Question

Critically evaluate the loan request outlined below and recommend whether you would lend the requested amount. Your answer must indicate the relevant facts of the

Critically evaluate the loan request outlined below and recommend whether you would lend the requested amount. Your answer must indicate the relevant facts of the case; the appropriate concerns with this loan proposal and provide the relevant recommendations.

The Bank of Monash has just received a loan proposal from an established client seeking to buy a local mixed grocery store / convenience food store. John and Joan Jones have been customers with the Bank of Monash for the past seven years. Until two years ago they were the hard-working owners of the local dry cleaners and laundromat. Their business was well run and profitable, mainly servicing the needs of the local university staff and student population. As a result of the skills learned while cleaning graduation gowns, their business had also built up a profitable side line in cleaning wedding gowns and similar formal clothes. After working long hours for the previous five years John and Joan had sold their dry cleaners and took a long-overdue extended holiday. After their long holiday John and Joan have worked as managers in several other cleaning businesses specialising in formal wear. Now feeling refreshed and ready to meet the challenges of running a small business again, John and Joan seeking to borrow from the Bank of Monash to buy another small business serving the needs of the Monash community.

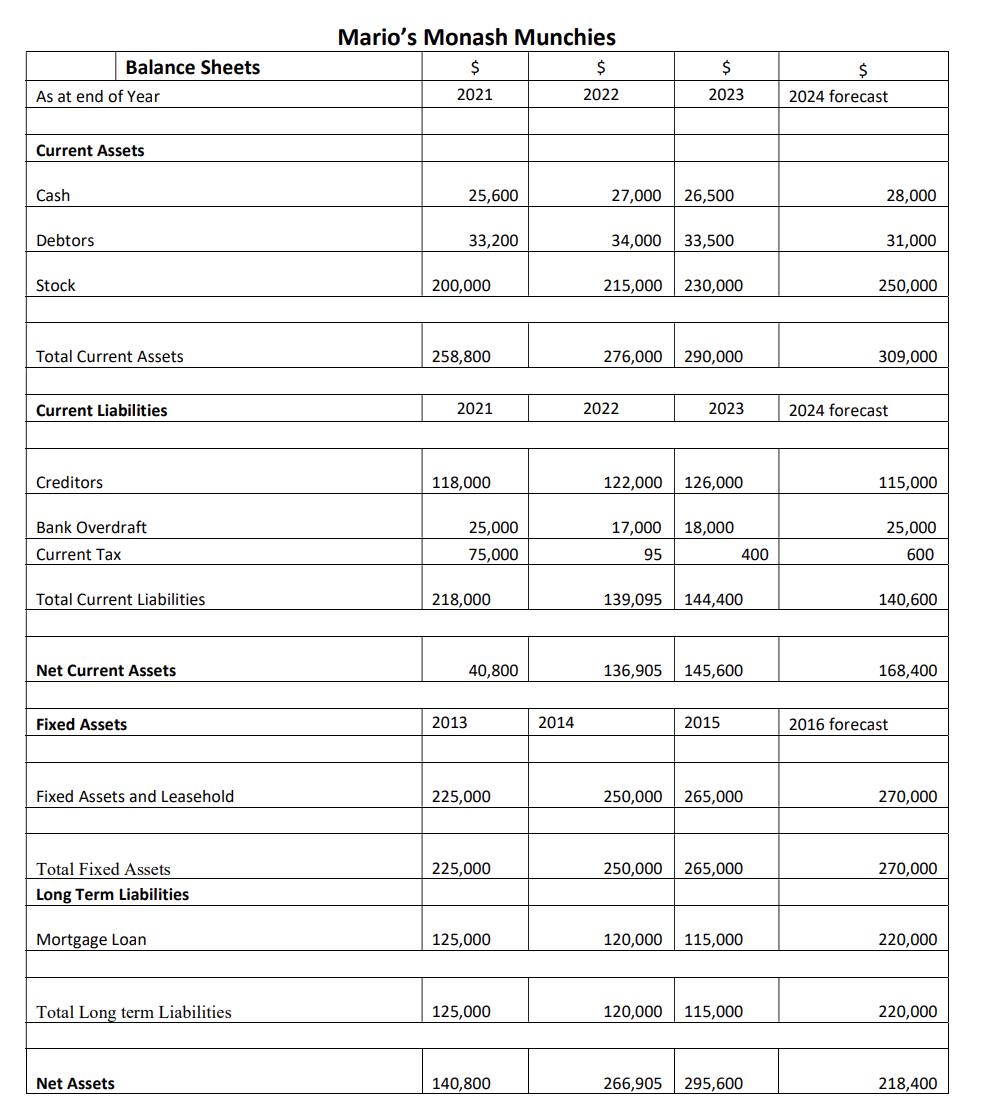

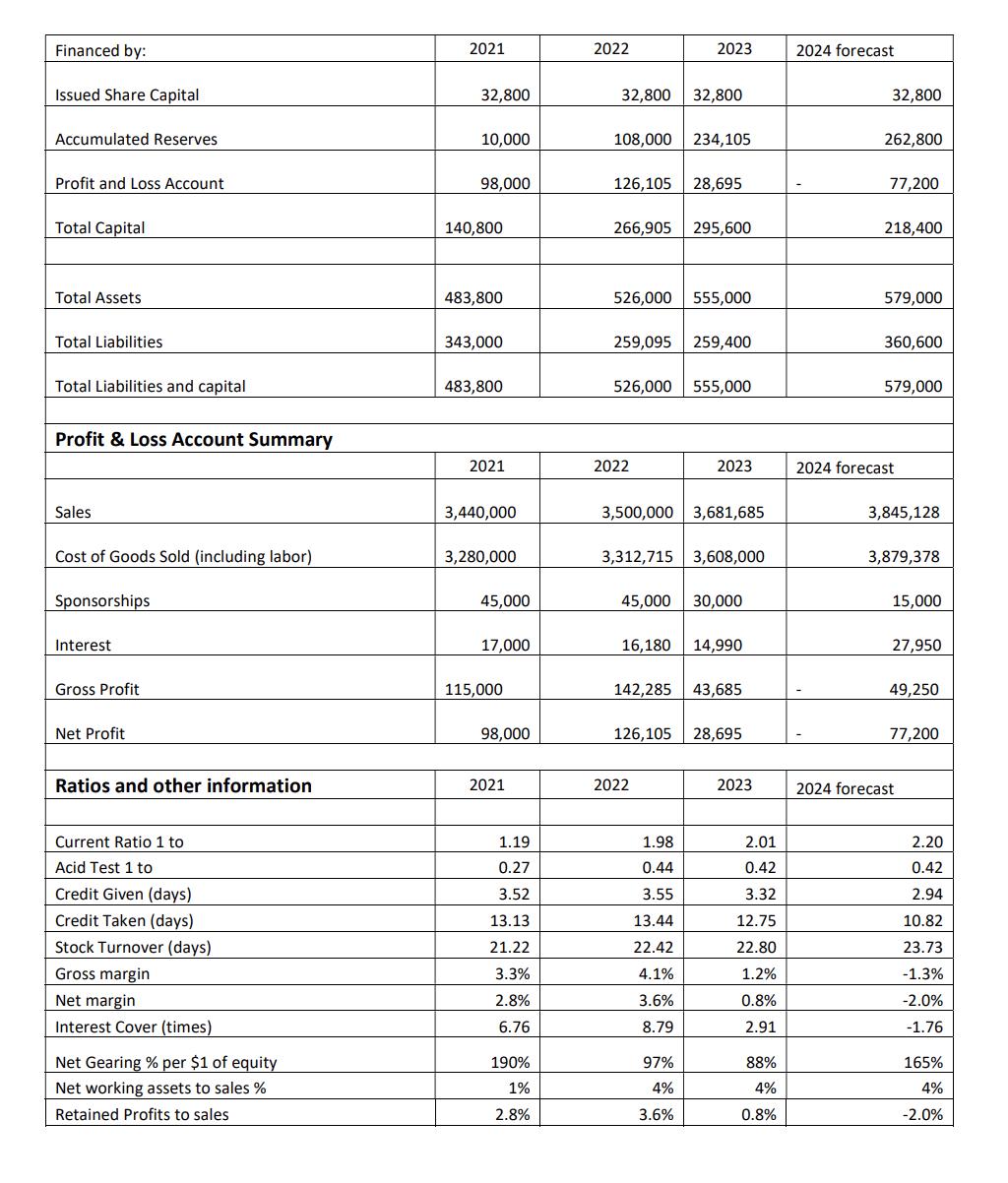

They are seeking to borrow $220,000 as a five-year term loan as well as an overdraft (line of credit) of $25,000 The business the John and Joan are seeking to buy is Mario's Monash Munchies (MMM). MMM has been part of the Monash community since 1958. The business has changed hands a number of times since it was established, the well-recognised name has stayed with the business. MMM is a small grocery and convenience store that provides a range of products to Monash community as well as a limited range of fast food items such as hot pies, coffee and soups. While the prices charged by MMM are a bit higher that the supermarket prices, MMM offers the advantage of being on campus and open for longer hours during semester (MMM has a long-term lease arrangement with the university student union). This has made MMM something of a Monash University institution, particularly with students dropping in after evening class to have a cup of soup to eat when catching the bus or train home. The most recent financial statements and balance sheet from MMM for the last three years together with a forecast for 2024 are provided below:

As at end of Year Current Assets Cash Debtors Stock Balance Sheets Total Current Assets Current Liabilities Creditors Bank Overdraft Current Tax Total Current Liabilities Net Current Assets Fixed Assets Fixed Assets and Leasehold Total Fixed Assets Long Term Liabilities Mortgage Loan Total Long term Liabilities Net Assets Mario's Monash Munchies $ 2021 25,600 33,200 200,000 258,800 2021 118,000 2013 25,000 75,000 218,000 40,800 225,000 225,000 125,000 125,000 140,800 2014 $ 2022 27,000 26,500 $ 2023 34,000 33,500 215,000 230,000 276,000 290,000 2022 17,000 95 2023 122,000 126,000 18,000 400 139,095 144,400 136,905 145,600 2015 250,000 265,000 250,000 265,000 120,000 115,000 120,000 115,000 266,905 295,600 2024 forecast 28,000 31,000 250,000 309,000 2024 forecast 115,000 25,000 600 140,600 168,400 2016 forecast 270,000 270,000 220,000 220,000 218,400

Step by Step Solution

3.49 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

To evaluate the loan request and determine whether to lend the requested amount lets analyze the relevant facts concerns and recommendations Relevant Facts Customers of the Bank of Monash for a signif...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started