Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Crocs Proprietary Limited Crocs is part of a group of companies. The holding company is Old Mac Proprietary Limited Old Mac. The year-end of

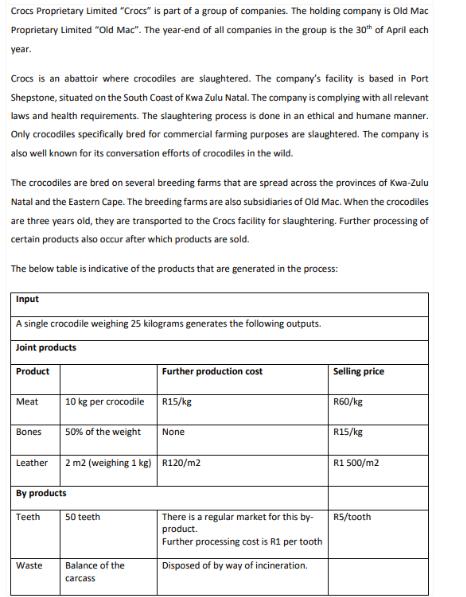

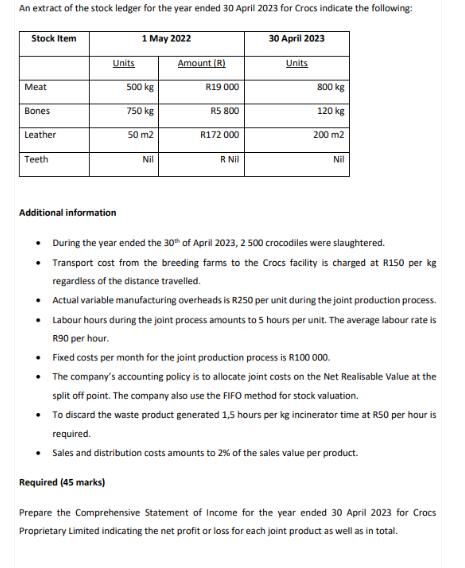

Crocs Proprietary Limited "Crocs" is part of a group of companies. The holding company is Old Mac Proprietary Limited "Old Mac". The year-end of all companies in the group is the 30th of April each year. Crocs is an abattoir where crocodiles are slaughtered. The company's facility is based in Port Shepstone, situated on the South Coast of Kwa Zulu Natal. The company is complying with all relevant laws and health requirements. The slaughtering process is done in an ethical and humane manner. Only crocodiles specifically bred for commercial farming purposes are slaughtered. The company is also well known for its conversation efforts of crocodiles in the wild. The crocodiles are bred on several breeding farms that are spread across the provinces of Kwa-Zulu Natal and the Eastern Cape. The breeding farms are also subsidiaries of Old Mac. When the crocodiles are three years old, they are transported to the Crocs facility for slaughtering. Further processing of certain products also occur after which products are sold. The below table is indicative of the products that are generated in the process: Input A single crocodile weighing 25 kilograms generates the following outputs. Joint products Product Meat Bones 10 kg per crocodile 50% of the weight Waste By products Teeth Leather 2 m2 (weighing 1 kg) R120/m2 50 teeth Further production cost Balance of the carcass R15/kg None There is a regular market for this by- product. Further processing cost is R1 per tooth Disposed of by way of incineration. Selling price R60/kg R15/kg R1 500/m2 R5/tooth An extract of the stock ledger for the year ended 30 April 2023 for Crocs indicate the following: 1 May 2022 Stock Item Meat Bones Leather Teeth Units 500 kg 750 kg 50 m2 Nil Amount (R) R19 000 R5 800 R172 000 R Nil 30 April 2023 Units 800 kg 120 kg 200 m2 Nil Additional information During the year ended the 30th of April 2023, 2 500 crocodiles were slaughtered. Transport cost from the breeding farms to the Crocs facility is charged at R150 per kg regardless of the distance travelled. Actual variable manufacturing overheads is R250 per unit during the joint production process. . Labour hours during the joint process amounts to 5 hours per unit. The average labour rate is R90 per hour. Fixed costs per month for the joint production process is R100 000. The company's accounting policy is to allocate joint costs on the Net Realisable Value at the split off point. The company also use the FIFO method for stock valuation. To discard the waste product generated 1,5 hours per kg incinerator time at R50 per hour is required. Sales and distribution costs amounts to 2% of the sales value per product. Required (45 marks) Prepare the Comprehensive Statement of Income for the year ended 30 April 2023 for Crocs Proprietary Limited indicating the net profit or loss for each joint product as well as in total.

Step by Step Solution

★★★★★

3.46 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Income Statement Revenue Meat 800 kg R25kg R20 000 Bones 120 kg R5kg R600 Leather ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started