Answered step by step

Verified Expert Solution

Question

1 Approved Answer

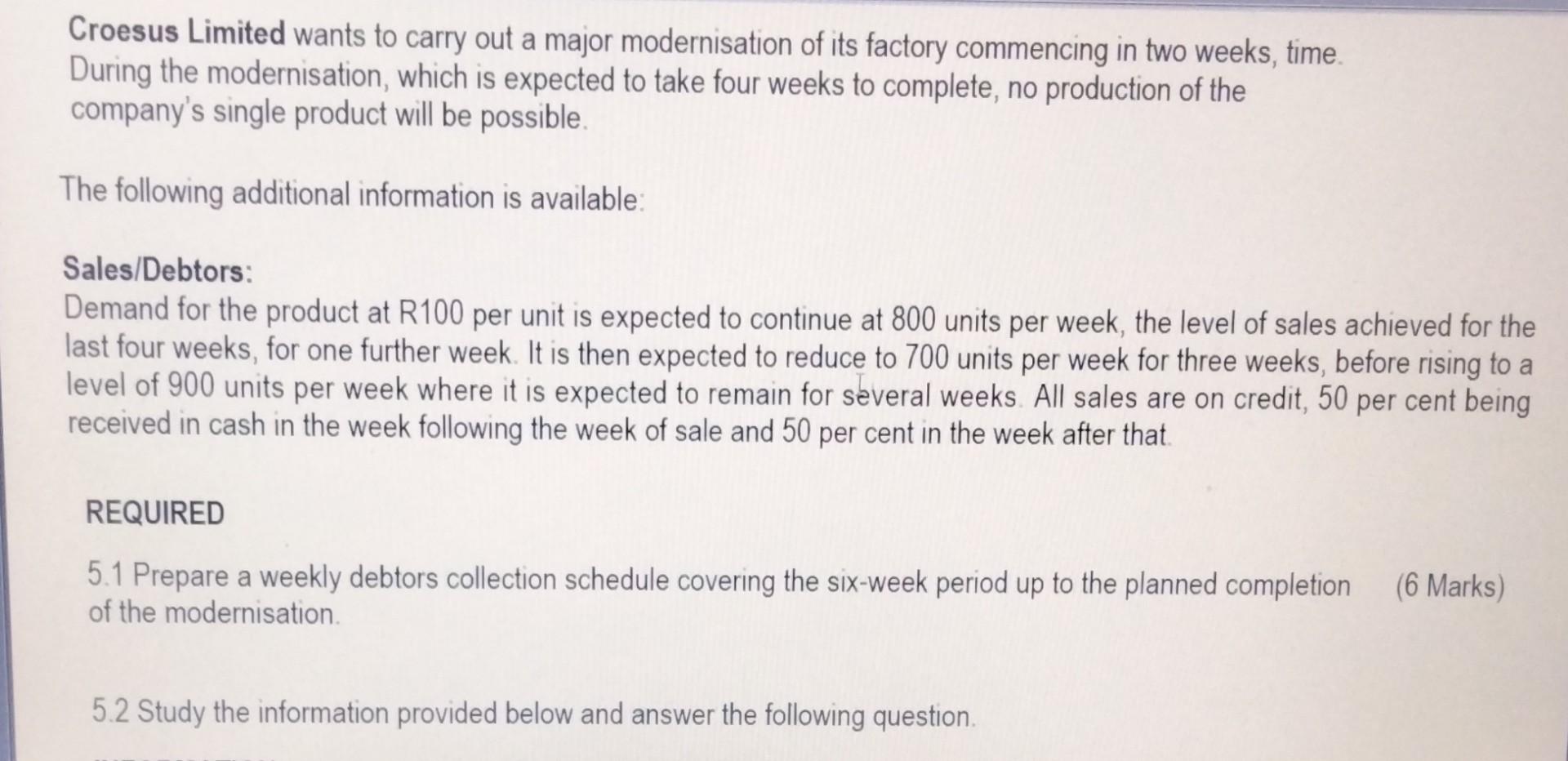

Croesus Limited wants to carry out a major modernisation of its factory commencing in two weeks, time. During the modernisation, which is expected to

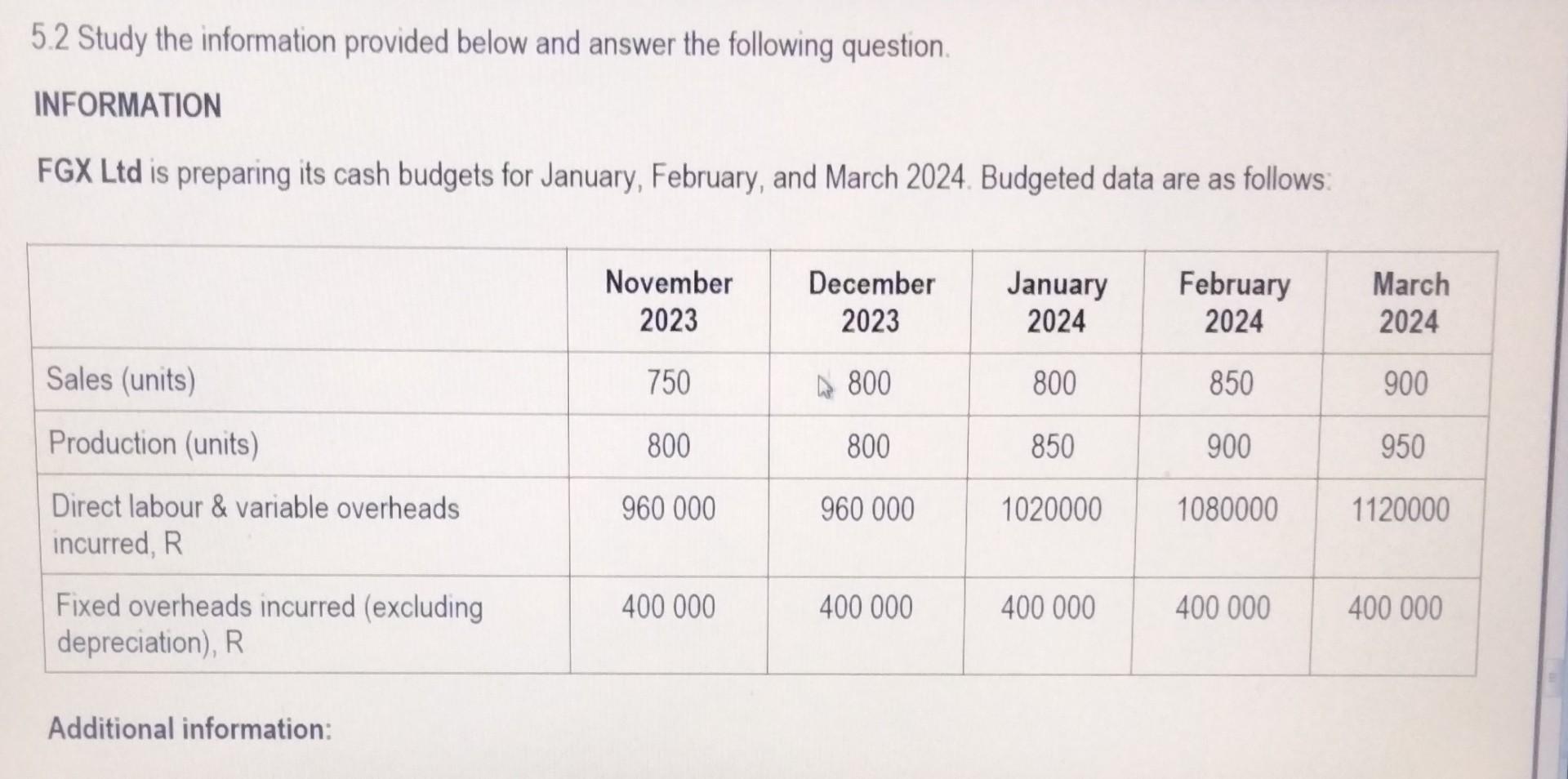

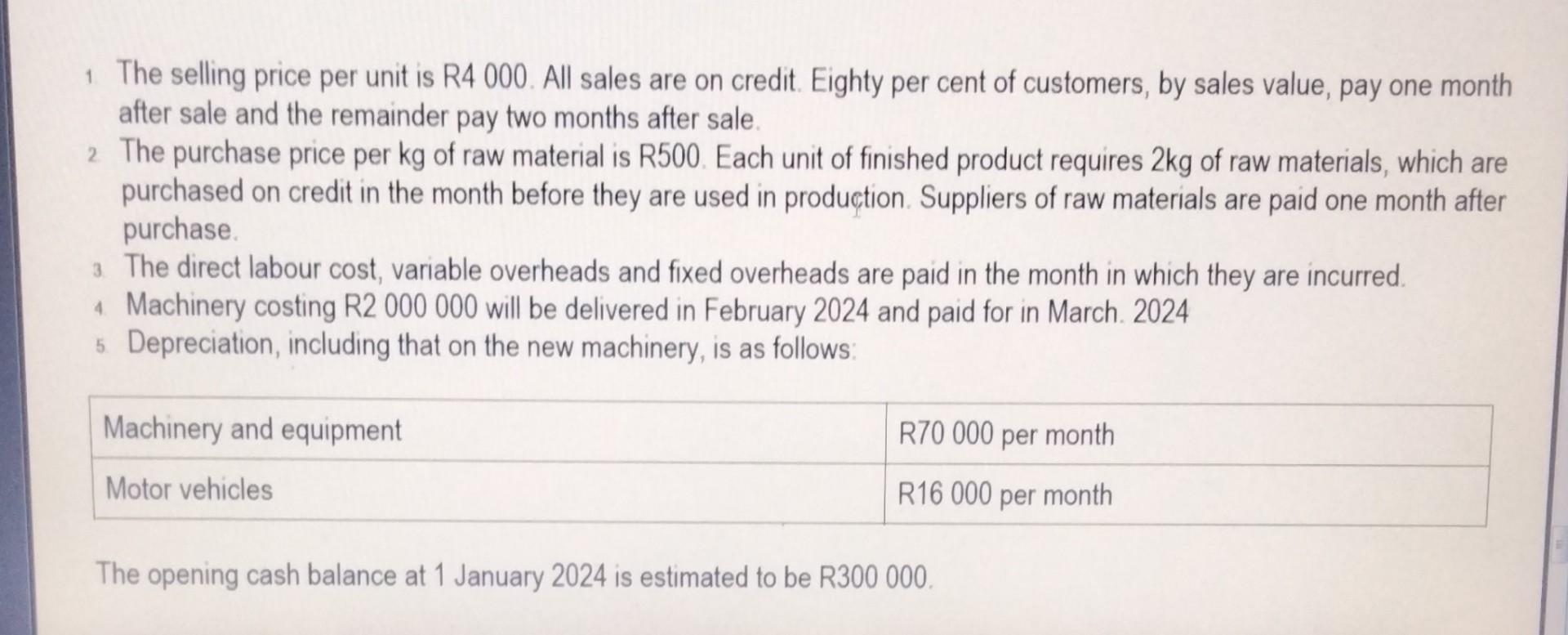

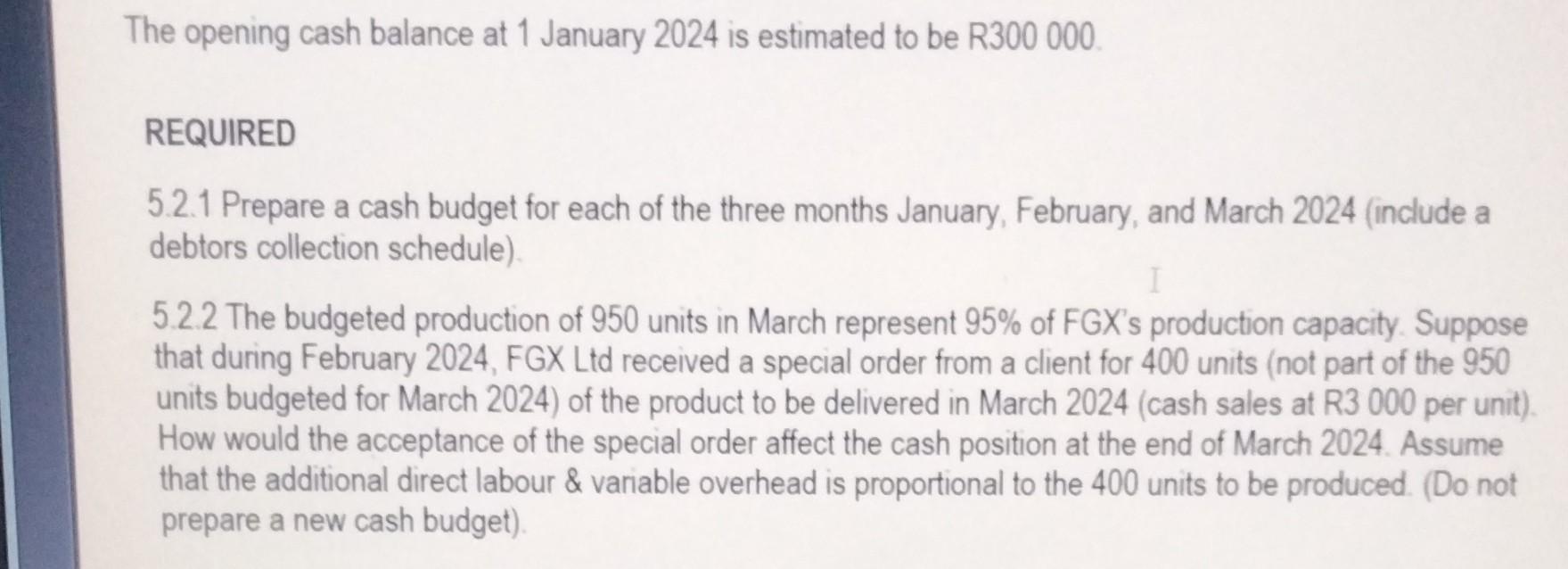

Croesus Limited wants to carry out a major modernisation of its factory commencing in two weeks, time. During the modernisation, which is expected to take four weeks to complete, no production of the company's single product will be possible. The following additional information is available: Sales/Debtors: Demand for the product at R100 per unit is expected to continue at 800 units per week, the level of sales achieved for the last four weeks, for one further week. It is then expected to reduce to 700 units per week for three weeks, before rising to a level of 900 units per week where it is expected to remain for several weeks. All sales are on credit, 50 per cent being received in cash in the week following the week of sale and 50 per cent in the week after that. REQUIRED 5.1 Prepare a weekly debtors collection schedule covering the six-week period up to the planned completion of the modernisation. 5.2 Study the information provided below and answer the following question. (6 Marks) 5.2 Study the information provided below and answer the following question. INFORMATION FGX Ltd is preparing its cash budgets for January, February, and March 2024. Budgeted data are as follows: November December January February March 2023 2023 2024 2024 2024 Sales (units) 750 800 800 850 900 Production (units) 800 800 850 900 950 Direct labour & variable overheads incurred, R 960 000 960 000 1020000 1080000 1120000 Fixed overheads incurred (excluding 400 000 400 000 400 000 400 000 400 000 depreciation), R Additional information: 1. The selling price per unit is R4 000. All sales are on credit. Eighty per cent of customers, by sales value, pay one month after sale and the remainder pay two months after sale. 2 The purchase price per kg of raw material is R500. Each unit of finished product requires 2kg of raw materials, which are purchased on credit in the month before they are used in production. Suppliers of raw materials are paid one month after purchase. 3. The direct labour cost, variable overheads and fixed overheads are paid in the month in which they are incurred. 4. Machinery costing R2 000 000 will be delivered in February 2024 and paid for in March. 2024 5. Depreciation, including that on the new machinery, is as follows: Machinery and equipment Motor vehicles R70 000 per month R16 000 per month The opening cash balance at 1 January 2024 is estimated to be R300 000. The opening cash balance at 1 January 2024 is estimated to be R300 000. REQUIRED 5.2.1 Prepare a cash budget for each of the three months January, February, and March 2024 (include a debtors collection schedule). I 5.2.2 The budgeted production of 950 units in March represent 95% of FGX's production capacity. Suppose that during February 2024, FGX Ltd received a special order from a client for 400 units (not part of the 950 units budgeted for March 2024) of the product to be delivered in March 2024 (cash sales at R3 000 per unit). How would the acceptance of the special order affect the cash position at the end of March 2024. Assume that the additional direct labour & variable overhead is proportional to the 400 units to be produced. (Do not prepare a new cash budget).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started