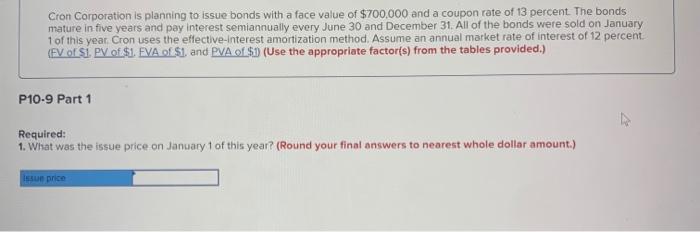

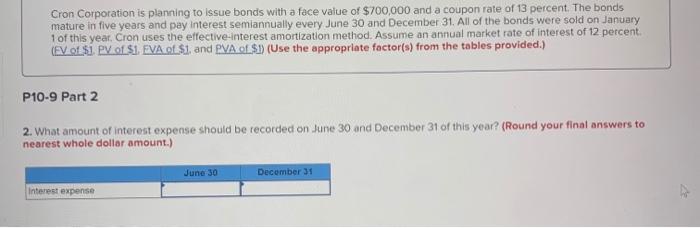

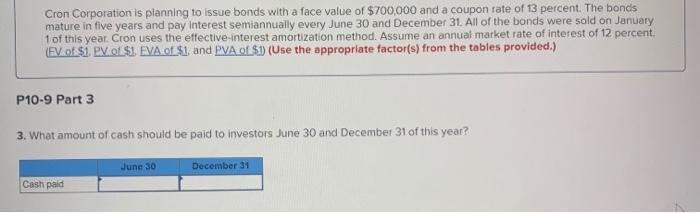

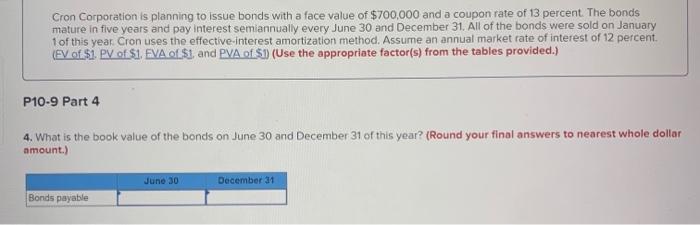

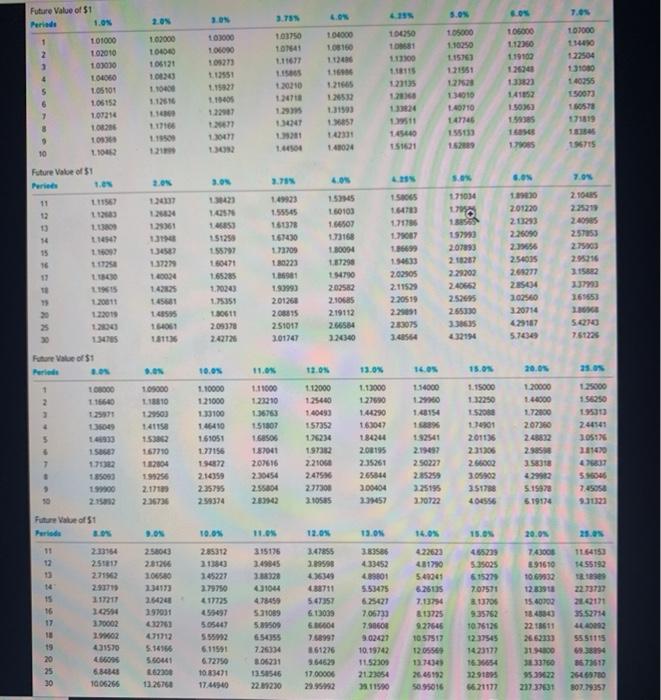

Cron Corporation is planning to issue bonds with a face value of $700,000 and a coupon rate of 13 percent. The bonds mature in five years and pay interest semiannually every June 30 and December 31. All of the bonds were sold on January 1 of this year Cron uses the effective interest amortization method. Assume an annual market rate of interest of 12 percent (FV of si. PV of $1. EVA of Si, and PVA of $) (Use the appropriate factor(s) from the tables provided.) P10-9 Part 1 Required: 1. What was the issue price on January 1 of this year? (Round your final answers to nearest whole dollar amount.) Issue price Cron Corporation is planning to issue bonds with a face value of $700,000 and a coupon rate of 13 percent. The bonds mature in five years and pay interest semiannually every June 30 and December 31. All of the bonds were sold on January 1 of this year, Cron uses the effective-interest amortization method. Assume an annual market rate of interest of 12 percent. (EV01 Si P of $1. FVA 0.51, and PVA of $.1) (Use the appropriate factor(s) from the tables provided.) P10-9 Part 2 2. What amount of interest expense should be recorded on June 30 and December 31 of this year? (Round your final answers to nearest whole dollar amount.) June 30 December 31 Interest expense Cron Corporation is planning to issue bonds with a face value of $700,000 and a coupon rate of 13 percent. The bonds mature in five years and pay interest semiannually every June 30 and December 31. All of the bonds were sold on January 1 of this year Cron uses the effective interest amortization method. Assume an annual market rate of interest of 12 percent (EV of $1. P of $1. EVA of $1, and PVA of $1) (Use the appropriate factor(s) from the tables provided.) P10-9 Part 4 4. What is the book value of the bonds on June 30 and December 31 of this year? (Round your final answers to nearest whole dollar amount.) June 30 December 31 Bonds payable Future Value of $1 3. NOS ON 100250 107000 1 2 03000 106000 104000 105160 24 105000 1.10250 102000 104040 106121 10120 105000 112050 1.19102 12551 101000 102010 101010 100 105101 1.05152 107214 10026 103 1.1002 12100 103750 10141 1167 LIB 20110 12 12 1.34 21 1.44504 113300 118115 121135 1.2000 121551 12120 310 140710 147746 31000 140255 150073 60578 171819 112510 13102 141852 1.50360 19385 16405 COICE SHKU 1910 117100 9 10 17 102 151621 1705 1575 Future Value of 1 Peres 1. G.ON Sos 7.09 205 2. SOS 171034 2.100 L11967 1.2427 11 12 13 160103 VO LU 129361 15 16 19 240905 257953 2.7903 2.9.15 3. 1.3421 10 1083 151258 155797 160471 165285 1.70243 1.75351 180611 2.05378 2.4212 1725 1970 20793 2.10267 2.29202 134587 13729 1004 14212 145661 143595 14051 1311 1.49923 1.59545 161378 167430 173709 130223 1981 130990 201204 208815 2.51017 3.01747 1717 1007 13669 194633 2.02305 2.11529 2. 20519 22051 2.63075 180004 187298 154790 202582 2.100 219112 2.66584 324340 1190 201220 21293 2.26090 2396 2.54015 261277 235034 3.02540 320714 425187 5.700 165553 95 120011 122019 2.5.2005 265330 3.38635 432194 5.410 7.51224 1.345 Future Value of $1 . ON 10. 11.0 110N 13.0% 20.05 16.0 1.20000 1.09000 1810 129503 10000 2 116640 25071 135049 5 143 . 150 7 17132 185090 9 100 2012 Future Value of 1 Periode 1.10000 121000 1.33100 1.46410 161051 177156 19672 2.16359 235795 2.59374 1.11000 122210 1.36753 151807 1685 187041 207616 2.30454 2.55804 150 167710 12804 199256 2171 2.36736 112000 1.25440 140493 157352 12234 19732 2.21066 2415 2.77301 2.1058 1.13000 1.27690 144290 163047 4244 200195 2.35261 2.65844 3.00404 201457 114000 120 1.68154 16 182541 2.1997 2.50227 125000 1.56250 1.500 2410 1051 2014 1.15000 132250 150 110901 201135 231706 2010 3.05902 351788 207300 24882 2985 35818 429972 5.1997 5.19174 5.06 325195 2.70722 TOON 12.05 13.0 20.0 15.03 46520 383586 11 12 3.47855 3.89598 4.36345 11.64153 1455192 7.07571 233164 2511 2.7192 2.971 117217 2004 3.70002 1. 431510 46609 684848 1006266 14 15 16 17 18 19 20 25 30 9.09 25000 2.024 106580 2.34173 2.6424 197031 20 01712 5.1997 5.50441 2300 13.26758 22.73737 20171 35.52714 285312 2130 145227 2.79750 417725 459497 505447 55592 6.11591 6.72750 1083471 17.400 315136 2.49845 388328 1044 478459 5 71089 5.500 654355 7.26334 8.06231 13.54546 22.19230 74308 3.91610 10632 1283910 15.40702 1840 22.18611 26.62333 4.89801 5.53475 6.25421 7.06733 7.90608 9.02427 10.19742 11.52309 21.23054 2911990 5.47357 6.13039 6.6004 760991 861276 9.64629 1700000 29.92 422623 431790 5.41941 8.250 7.13794 813725 927646 1057517 12.0556 1276343 26.45792 5095016 9.35752 10 76125 1237545 1423177 167654 12:91005 4621177 38 33750 9539422 227.37831 5551115 63.38394 8673517 256700 307.79357