Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Crowder Inc. is an American company considering a project in Hong Kong. The project has the expected cash flows in Hong Kong dollars (HK$) provided

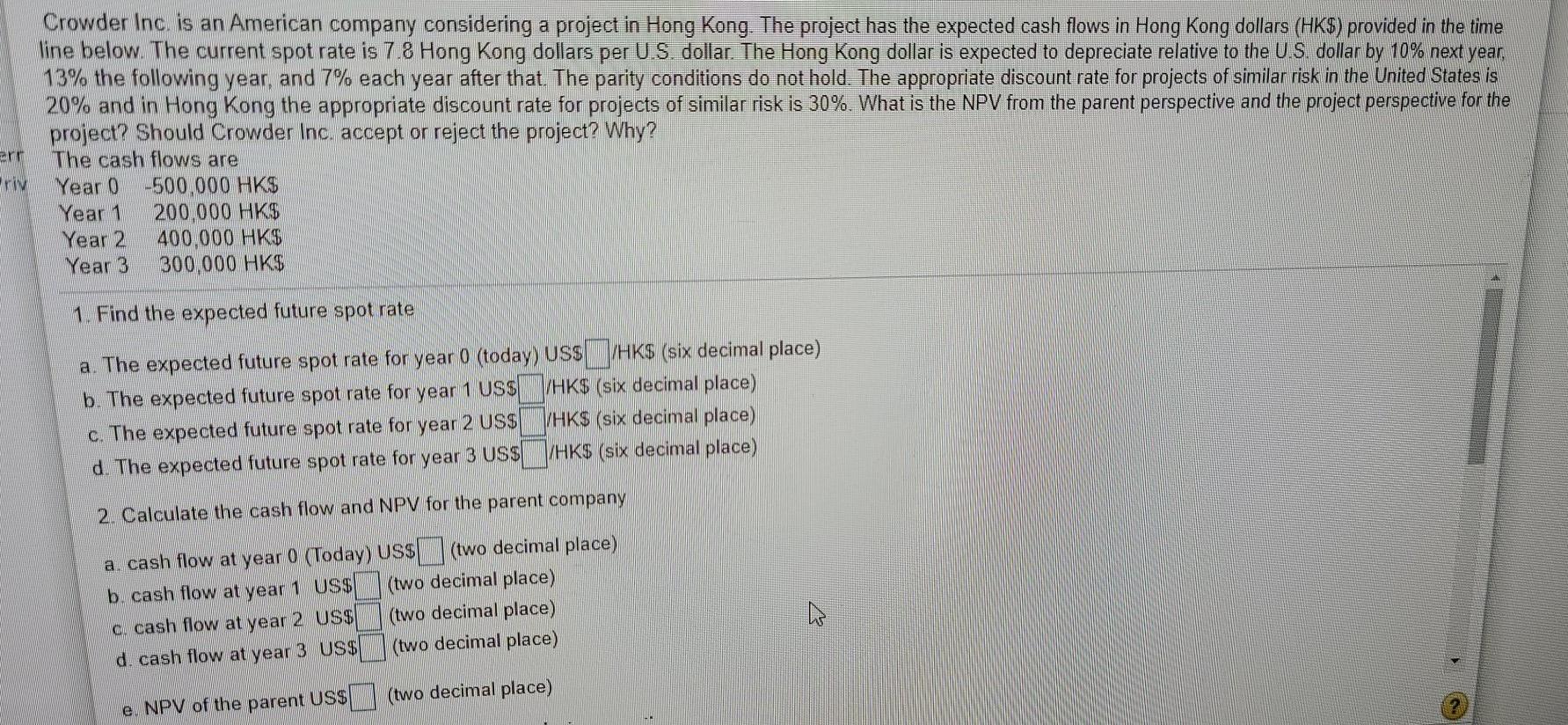

Crowder Inc. is an American company considering a project in Hong Kong. The project has the expected cash flows in Hong Kong dollars (HK$) provided in the time line below. The current spot rate is 7.8 Hong Kong dollars per U.S. dollar. The Hong Kong dollar is expected to depreciate relative to the U.S. dollar by 10% next year, 13% the following year, and 7% each year after that. The parity conditions do not hold. The appropriate discount rate for projects of similar risk in the United States is 20% and in Hong Kong the appropriate discount rate for projects of similar risk is 30%. What is the NPV from the parent perspective and the project perspective for the project? Should Crowder Inc. accept or reject the project? Why? The cash flows are Year 0 -500,000 HK$ Year 1 200,000 HK$ Year 2 400,000 HK$ Year 3 300,000 HK$ 1. Find the expected future spot rate a. The expected future spot rate for year 0 (today) USSHK$ (six decimal place) b. The expected future spot rate for year 1 USSHK$ (six decimal place) c. The expected future spot rate for year 2 USS HK$ (six decimal place) d. The expected future spot rate for year 3 US$ /HK$ (six decimal place) 2. Calculate the cash flow and NPV for the parent company a. cash flow at year 0 (Today) US$ (two decimal place) b. cash flow at year 1 US$ (two decimal place) e cash flow at year 2 US$ (two decimal place) d. cash flow at year 3 US$ (two decimal place) (two decimal place) e. NPV of the parent US$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started