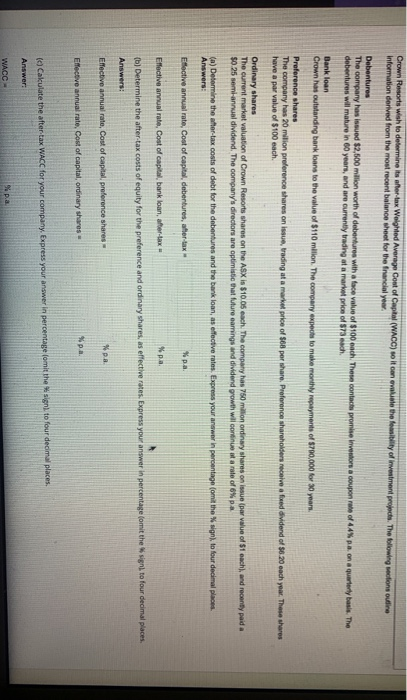

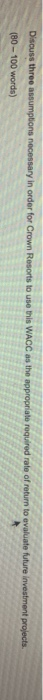

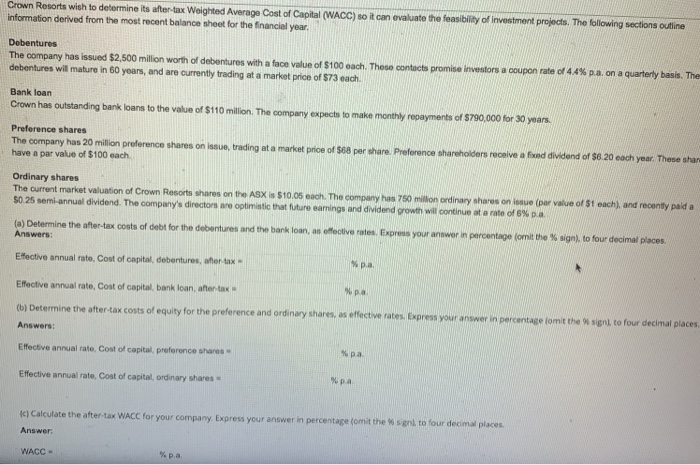

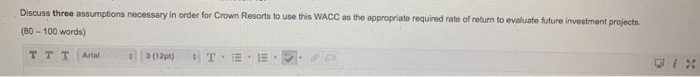

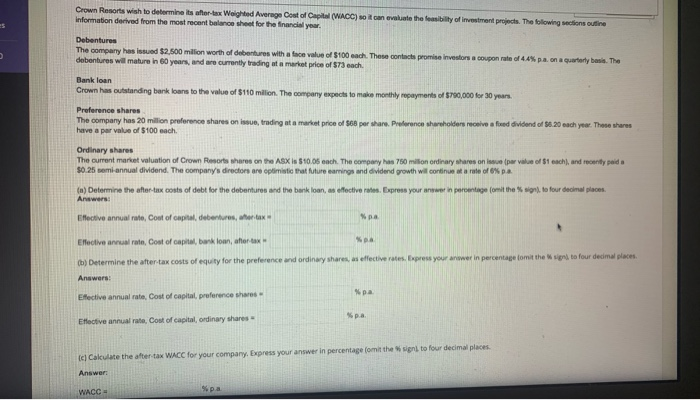

Crown Resorts wish to determine ts after-tax Weighted Average Cont of Captal (WACC) to it can avail the blity of investment projects. The following motions outline Information derived from the most recent balance sheet for the financial year Debentures The company has issued $2,500 milion worth of debertures with a face value of $100 each. These contacts promise Investor a coupon rate of 44% pa on a quarterly basis. The debentures will mature in 60 years, and are currently trading at a market price of 73 ch. Bank loan Crown has outstanding bank loans to the value of $110 milion. The company expects to make monthly payments of $700.000 for 30 year, Preference shares The company has 20 milion preference shares on bouw, vading at a market price of son per share. Protorance shareholders receive a feed avidend of $6:20 each year. These shares have a par value of $100 each Ordinary shares The current market valuation of Crown Resorts shares on the ASX is $10.05 each. The company has 750 million ordinary shares on issue (par value of Stach, and recently paida $0.25 semi-annual dividend. The company's directors are optimistic that future carings and dividend growth will contine at a rate of % pa (a) Determine the after-tax costs of debt for the debentures and the bank loan, as effective rates. Express your answer in percentage (omit the sign), to four decimal places Answers: Effective annual rate, Cost of capital debentures, after-tax- % pa Effective annual rate, Cost of capital,bank loan, after-tax *pa (b) Determine the after tax costs of equity for the preference and ordinary shares, as effective rates. Express your answer in percentage omit the sign to four decimal places Answers: Effective annual rate, Cost of capital, preference shares % pa Effective annual rate, cost of capital, ordinary shares %pa ( Cakulate the after tax WACC for your company, Express your answer in percentage lomit the sign to four decimal places. Answer: WACC - % pa Discuss three assumptions necessary in order for Crown Resorts to use this WACC as the appropriate required rate of return to evaluate future investment projects. (80-100 words) Discuss three assumptions necessary in order for Crown Resorts to use this WACC as the appropriate required rate of return to evaluate future investment projects. (80 - 100 words) Crown Resorts wish to determine its after-tax Weighted Average Cost of Capital (WACC) so it can evaluate the feasibility of investment projects. The following sections outline information derived from the most recent balance sheet for the financial year, Debentures The company has issued $2,500 million worth of debentures with a face value of S100 each. These contacts promise investors a coupon rate of 4.4%p.a. on a quarterly basis. The debentures will mature in 60 years, and are currently trading at a market price of 573 each. Bank loan Crown has outstanding bank loans to the value of $110 million. The company expects to make monthly repayments of $790,000 for 30 years. Preference shares The company has 20 million preference shares on issue, trading at a market price of $68 per share. Preference shareholders receive a fixed dividend of $8.20 each year. These share have a par value of $100 each Ordinary shares The current market valuation of Crown Resorts shares on the ASX is $10.05 each. The company has 750 million ordinary shares on issue (por value of 51 each), and recently paid a 50 25 semi-annual dividend. The company's directors are optimistic that future earnings and dividend growth will continue at a rate of 6% (a) Determine the after-tax costs of debt for the debentures and the bank loan, as effective rates Express your answer in percentage comit the sign to four decimal places Answers: Effective annual rate Cost of capital, debentures, ofertax % pa Effective annual rate, Cost of capital bank loan, after tax (b) Determine the after-tax costs of equity for the preference and ordinary shares, as effective rates. Express your answer in percentage lomit the sign to four decimal places Answers: Effective annual rate Cost of capital, preference shares pa Effective annual rate, Cost of capital, ordinary shares pa c) Calculate the after-tax WACC for your company Express your answer in percentage omit the sign to four decimal places. Answer: WACC - Discuss three assumptions necessary in order for Crown Resorts to use this WACC as the appropriate required rate of return to evaluate future investment projects. (80 - 100 words) TTT Arial 3 (12) T.EE Crown Resorts wish to determine its after-tax Weighted Average cost of Capital (WACC) so it on evaluate the feasibility of investment projects. The following sections outine information derived from the most recent balance sheet for the financial year es Debentures The company has issued $2,500 million worth of debentures with a face value of $100 each. These contacts promise investors a coupon rate of 4.4% pa. on a quarterly basis. The debentures will mature in 60 years, and are currently trading at a market price of 573 each. Bank loan Crown has outstanding bank loans to the value of $110 million. The company expects to make monthly payments of $700,000 for 30 years Preference shares The company has 20 milion preference shares on issue, trading at a market price of 568 per share. Preteranon shareholders receive a fixed vidend or 96.20 each year. These share have a par value of $100 each Ordinary shares The current market valuation of Crown Resorts shares on the ASX IN 510.06 orch. The company has 760 million ordinary shares on issue (perature of teach), and recently paida $0.25 semi-annual dividend. The company's directors are optimistic that future earnings and dividend growth will continue at a rate of 6% pa (a) Determine the after-tax costs of debt for the debertures and the bark loan, as effective rates. Express your answer in percentage (omit the sign to four decimal places Answers Effective annual rate, Coot of capital debertures, tax Effective arual rato, Cost of capital, bank town, after ex- (b) Determine the after-tax costs of equity for the preference and ordinary shares, as effective rates, Express your answer in percentage lomit the signs to four decimal places Answers Effective annual rate, Cost of capital, preference shares pa pa Effective annual rate, Cost of capital, ordinary shares Calculate the after tax WACC for your company, Express your answer in percentage omit the sign to four decimal places Answer: WACC - % pa Crown Resorts wish to determine ts after-tax Weighted Average Cont of Captal (WACC) to it can avail the blity of investment projects. The following motions outline Information derived from the most recent balance sheet for the financial year Debentures The company has issued $2,500 milion worth of debertures with a face value of $100 each. These contacts promise Investor a coupon rate of 44% pa on a quarterly basis. The debentures will mature in 60 years, and are currently trading at a market price of 73 ch. Bank loan Crown has outstanding bank loans to the value of $110 milion. The company expects to make monthly payments of $700.000 for 30 year, Preference shares The company has 20 milion preference shares on bouw, vading at a market price of son per share. Protorance shareholders receive a feed avidend of $6:20 each year. These shares have a par value of $100 each Ordinary shares The current market valuation of Crown Resorts shares on the ASX is $10.05 each. The company has 750 million ordinary shares on issue (par value of Stach, and recently paida $0.25 semi-annual dividend. The company's directors are optimistic that future carings and dividend growth will contine at a rate of % pa (a) Determine the after-tax costs of debt for the debentures and the bank loan, as effective rates. Express your answer in percentage (omit the sign), to four decimal places Answers: Effective annual rate, Cost of capital debentures, after-tax- % pa Effective annual rate, Cost of capital,bank loan, after-tax *pa (b) Determine the after tax costs of equity for the preference and ordinary shares, as effective rates. Express your answer in percentage omit the sign to four decimal places Answers: Effective annual rate, Cost of capital, preference shares % pa Effective annual rate, cost of capital, ordinary shares %pa ( Cakulate the after tax WACC for your company, Express your answer in percentage lomit the sign to four decimal places. Answer: WACC - % pa Discuss three assumptions necessary in order for Crown Resorts to use this WACC as the appropriate required rate of return to evaluate future investment projects. (80-100 words) Discuss three assumptions necessary in order for Crown Resorts to use this WACC as the appropriate required rate of return to evaluate future investment projects. (80 - 100 words) Crown Resorts wish to determine its after-tax Weighted Average Cost of Capital (WACC) so it can evaluate the feasibility of investment projects. The following sections outline information derived from the most recent balance sheet for the financial year, Debentures The company has issued $2,500 million worth of debentures with a face value of S100 each. These contacts promise investors a coupon rate of 4.4%p.a. on a quarterly basis. The debentures will mature in 60 years, and are currently trading at a market price of 573 each. Bank loan Crown has outstanding bank loans to the value of $110 million. The company expects to make monthly repayments of $790,000 for 30 years. Preference shares The company has 20 million preference shares on issue, trading at a market price of $68 per share. Preference shareholders receive a fixed dividend of $8.20 each year. These share have a par value of $100 each Ordinary shares The current market valuation of Crown Resorts shares on the ASX is $10.05 each. The company has 750 million ordinary shares on issue (por value of 51 each), and recently paid a 50 25 semi-annual dividend. The company's directors are optimistic that future earnings and dividend growth will continue at a rate of 6% (a) Determine the after-tax costs of debt for the debentures and the bank loan, as effective rates Express your answer in percentage comit the sign to four decimal places Answers: Effective annual rate Cost of capital, debentures, ofertax % pa Effective annual rate, Cost of capital bank loan, after tax (b) Determine the after-tax costs of equity for the preference and ordinary shares, as effective rates. Express your answer in percentage lomit the sign to four decimal places Answers: Effective annual rate Cost of capital, preference shares pa Effective annual rate, Cost of capital, ordinary shares pa c) Calculate the after-tax WACC for your company Express your answer in percentage omit the sign to four decimal places. Answer: WACC - Discuss three assumptions necessary in order for Crown Resorts to use this WACC as the appropriate required rate of return to evaluate future investment projects. (80 - 100 words) TTT Arial 3 (12) T.EE Crown Resorts wish to determine its after-tax Weighted Average cost of Capital (WACC) so it on evaluate the feasibility of investment projects. The following sections outine information derived from the most recent balance sheet for the financial year es Debentures The company has issued $2,500 million worth of debentures with a face value of $100 each. These contacts promise investors a coupon rate of 4.4% pa. on a quarterly basis. The debentures will mature in 60 years, and are currently trading at a market price of 573 each. Bank loan Crown has outstanding bank loans to the value of $110 million. The company expects to make monthly payments of $700,000 for 30 years Preference shares The company has 20 milion preference shares on issue, trading at a market price of 568 per share. Preteranon shareholders receive a fixed vidend or 96.20 each year. These share have a par value of $100 each Ordinary shares The current market valuation of Crown Resorts shares on the ASX IN 510.06 orch. The company has 760 million ordinary shares on issue (perature of teach), and recently paida $0.25 semi-annual dividend. The company's directors are optimistic that future earnings and dividend growth will continue at a rate of 6% pa (a) Determine the after-tax costs of debt for the debertures and the bark loan, as effective rates. Express your answer in percentage (omit the sign to four decimal places Answers Effective annual rate, Coot of capital debertures, tax Effective arual rato, Cost of capital, bank town, after ex- (b) Determine the after-tax costs of equity for the preference and ordinary shares, as effective rates, Express your answer in percentage lomit the signs to four decimal places Answers Effective annual rate, Cost of capital, preference shares pa pa Effective annual rate, Cost of capital, ordinary shares Calculate the after tax WACC for your company, Express your answer in percentage omit the sign to four decimal places Answer: WACC - % pa