Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Crown SB manufactures specialized equipment for use in the computer and communication industry. Each equipment manufactured is according to the specification set by the customer.

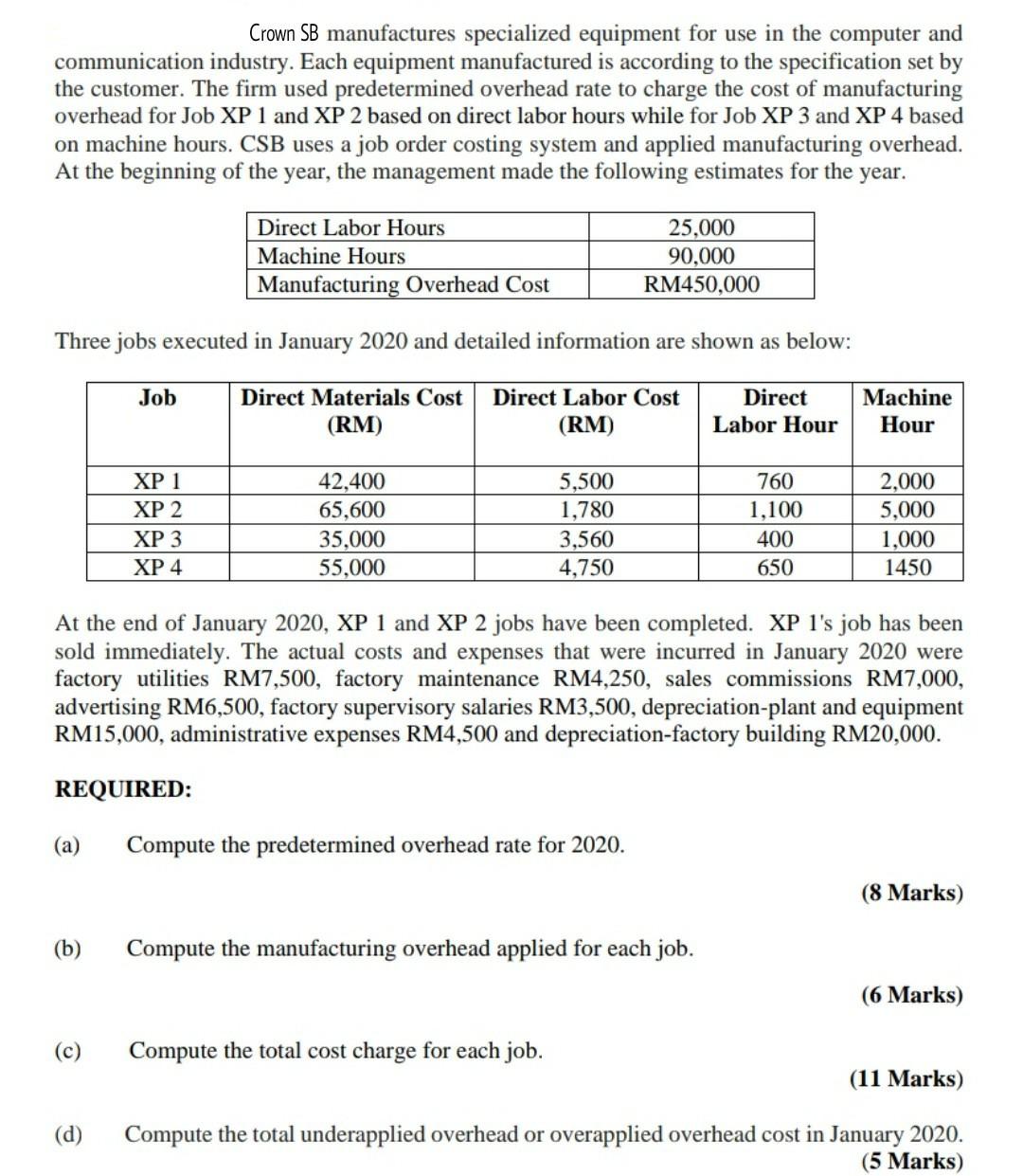

Crown SB manufactures specialized equipment for use in the computer and communication industry. Each equipment manufactured is according to the specification set by the customer. The firm used predetermined overhead rate to charge the cost of manufacturing overhead for Job XP 1 and XP 2 based on direct labor hours while for Job XP 3 and XP 4 based on machine hours. CSB uses a job order costing system and applied manufacturing overhead. At the beginning of the year, the management made the following estimates for the year. Direct Labor Hours Machine Hours Manufacturing Overhead Cost 25,000 90,000 RM450,000 Three jobs executed in January 2020 and detailed information are shown as below: Job Direct Materials Cost (RM) Direct Labor Cost (RM) Direct Labor Hour Machine Hour XP 1 XP 2 XP 3 XP 4 42,400 65,600 35,000 55,000 5,500 1,780 3,560 4,750 760 1,100 400 650 2,000 5,000 1.000 1450 At the end of January 2020, XP 1 and XP 2 jobs have been completed. XP 1's job has been sold immediately. The actual costs and expenses that were incurred in January 2020 were factory utilities RM7,500, factory maintenance RM4,250, sales commissions RM7,000, advertising RM6,500, factory supervisory salaries RM3,500, depreciation-plant and equipment RM15,000, administrative expenses RM4,500 and depreciation-factory building RM20,000. REQUIRED: (a) Compute the predetermined overhead rate for 2020. (8 Marks) (b) Compute the manufacturing overhead applied for each job. (6 Marks) (c) Compute the total cost charge for each job. (11 Marks) (d) Compute the total underapplied overhead or overapplied overhead cost in January 2020

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started