Answered step by step

Verified Expert Solution

Question

1 Approved Answer

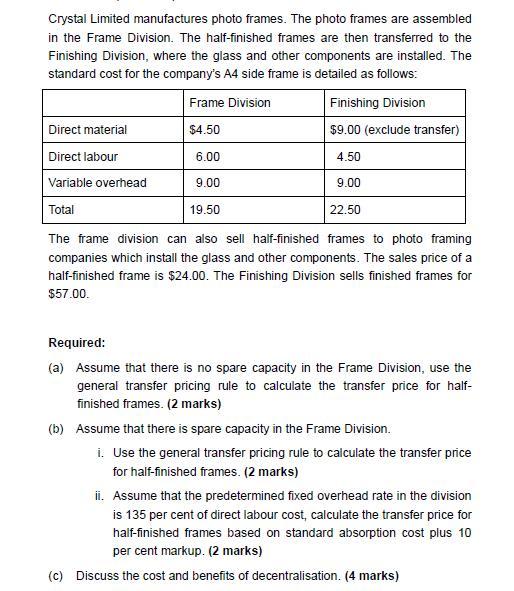

Crystal Limited manufactures photo frames. The photo frames are assembled in the Frame Division. The half-finished frames are then transferred to the Finishing Division,

Crystal Limited manufactures photo frames. The photo frames are assembled in the Frame Division. The half-finished frames are then transferred to the Finishing Division, where the glass and other components are installed. The standard cost for the company's A4 side frame is detailed as follows: Frame Division Finishing Division $4.50 $9.00 (exclude transfer) 6.00 4.50 9.00 9.00 Direct material Direct labour Variable overhead Total The frame division can also sell half-finished frames to photo framing companies which install the glass and other components. The sales price of a half-finished frame is $24.00. The Finishing Division sells finished frames for $57.00. 19.50 22.50 Required: (a) Assume that there is no spare capacity in the Frame Division, use the general transfer pricing rule to calculate the transfer price for half- finished frames. (2 marks) (b) Assume that there is spare capacity in the Frame Division. i. Use the general transfer pricing rule to calculate the transfer price for half-finished frames. (2 marks) ii. Assume that the predetermined fixed overhead rate in the division is 135 per cent of direct labour cost, calculate the transfer price for half-finished frames based on standard absorption cost plus 10 per cent markup. (2 marks) (c) Discuss the cost and benefits of decentralisation. (4 marks)

Step by Step Solution

★★★★★

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

a Assuming no spare capacity in the Frame Division the general transfer pricing rule suggests setting the transfer price for halffinished frames at th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started