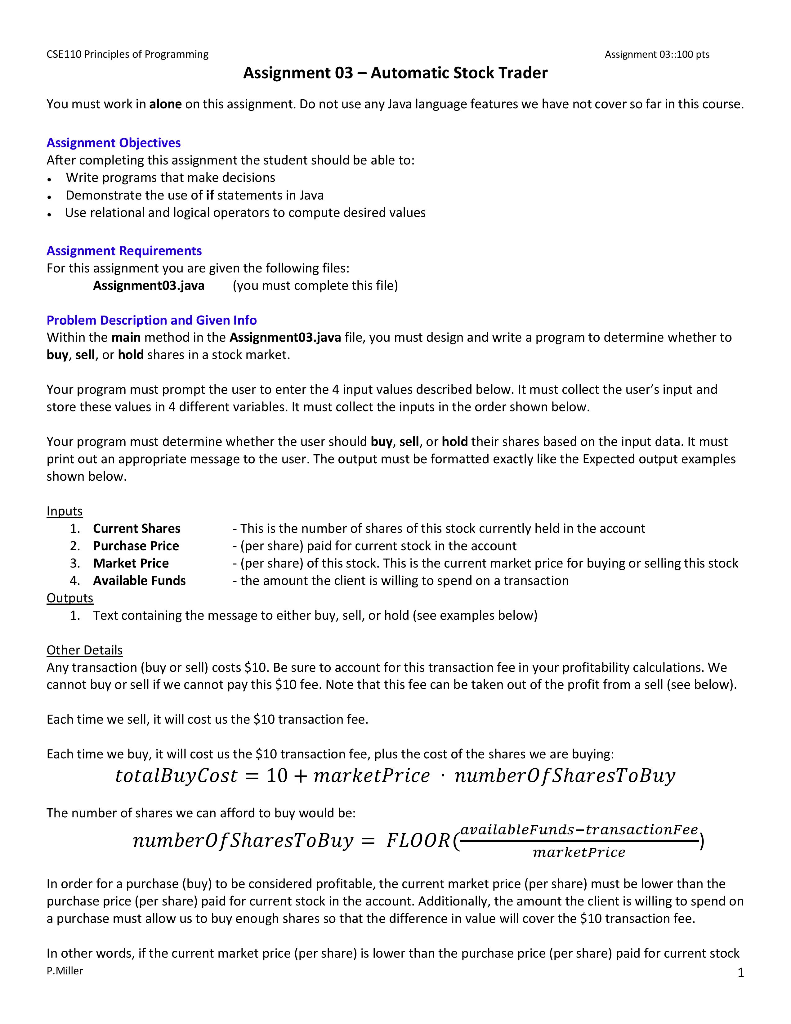

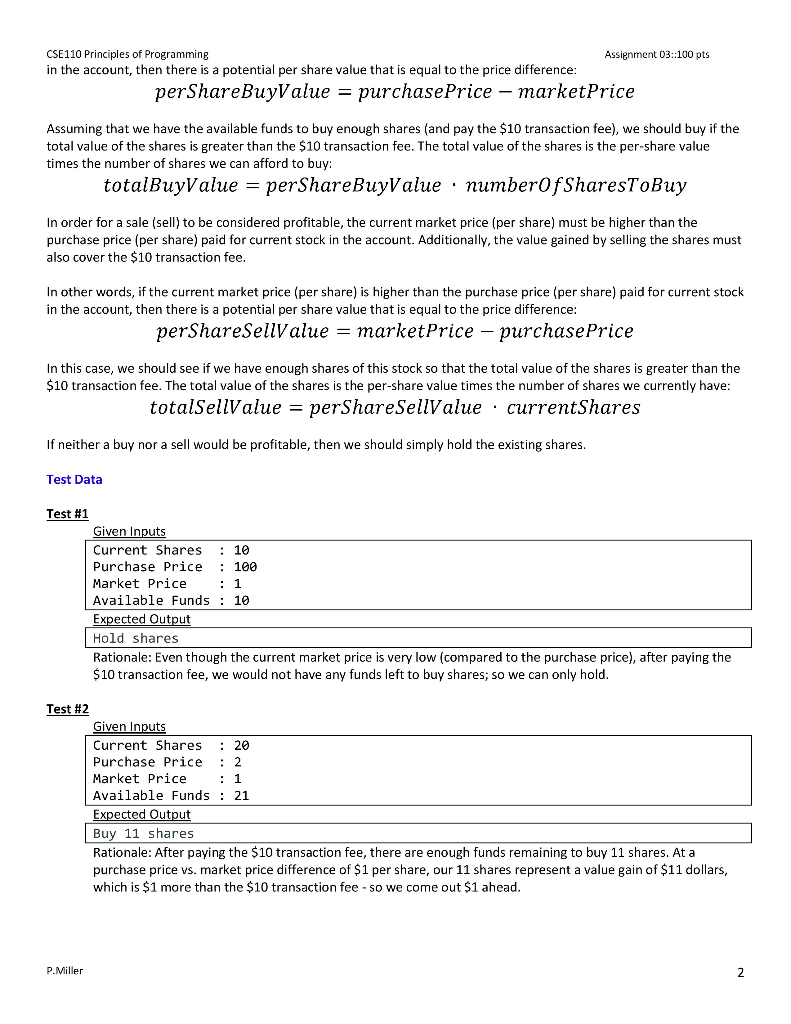

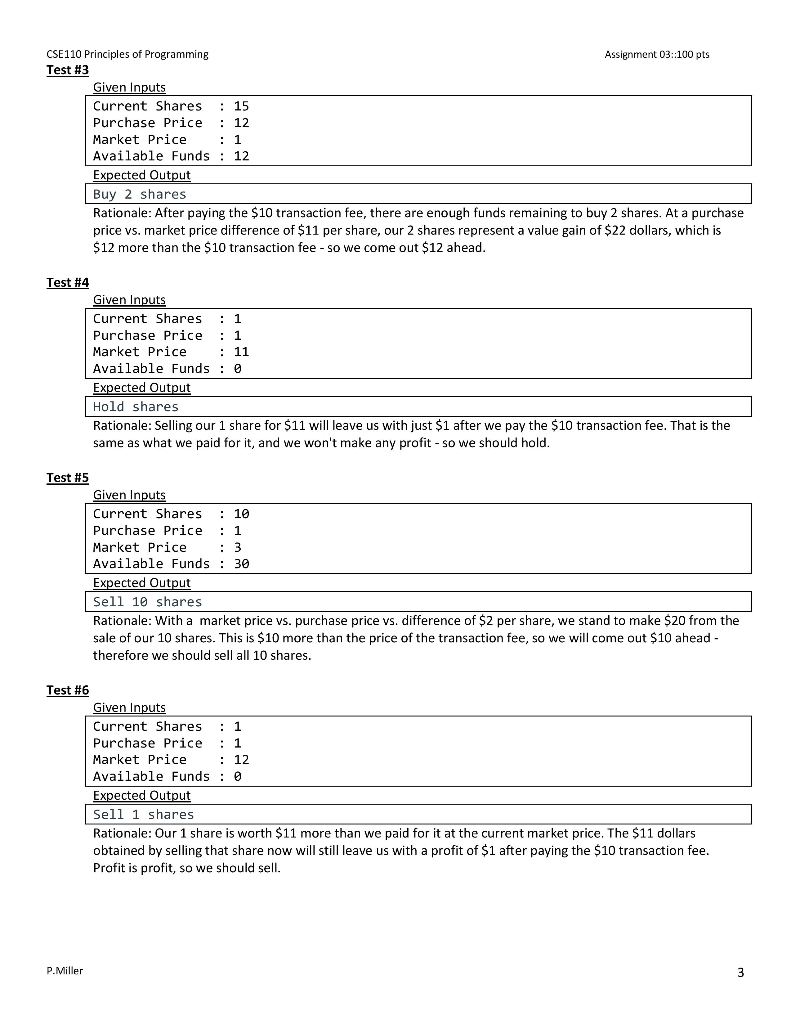

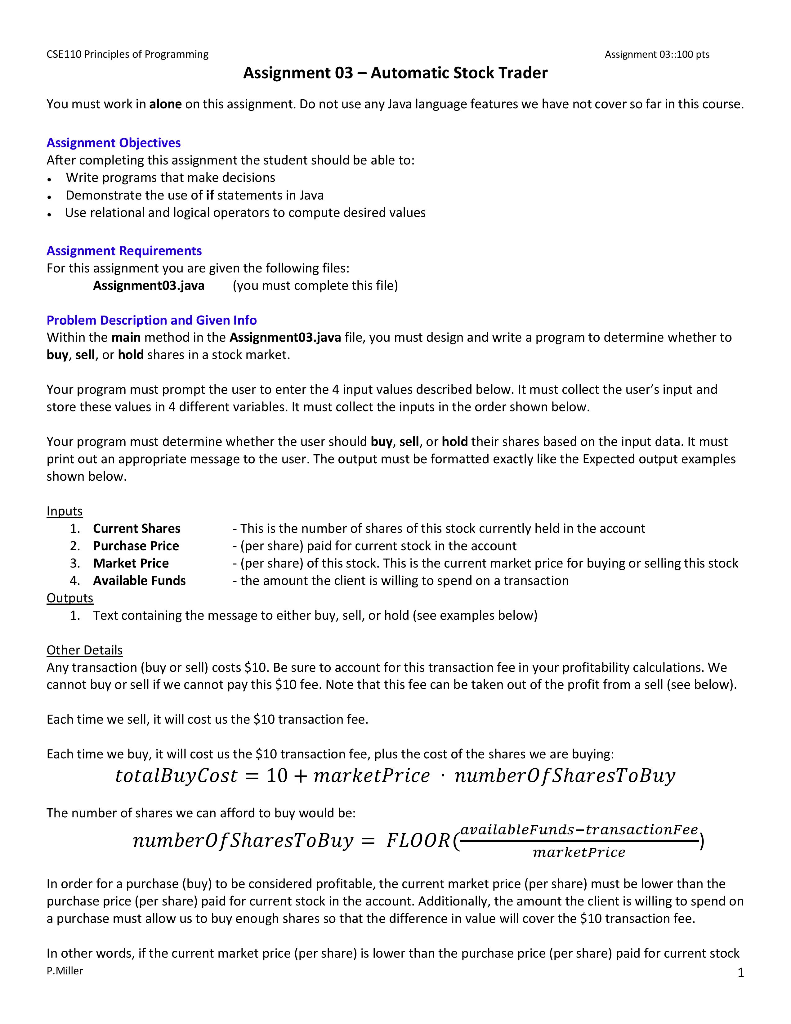

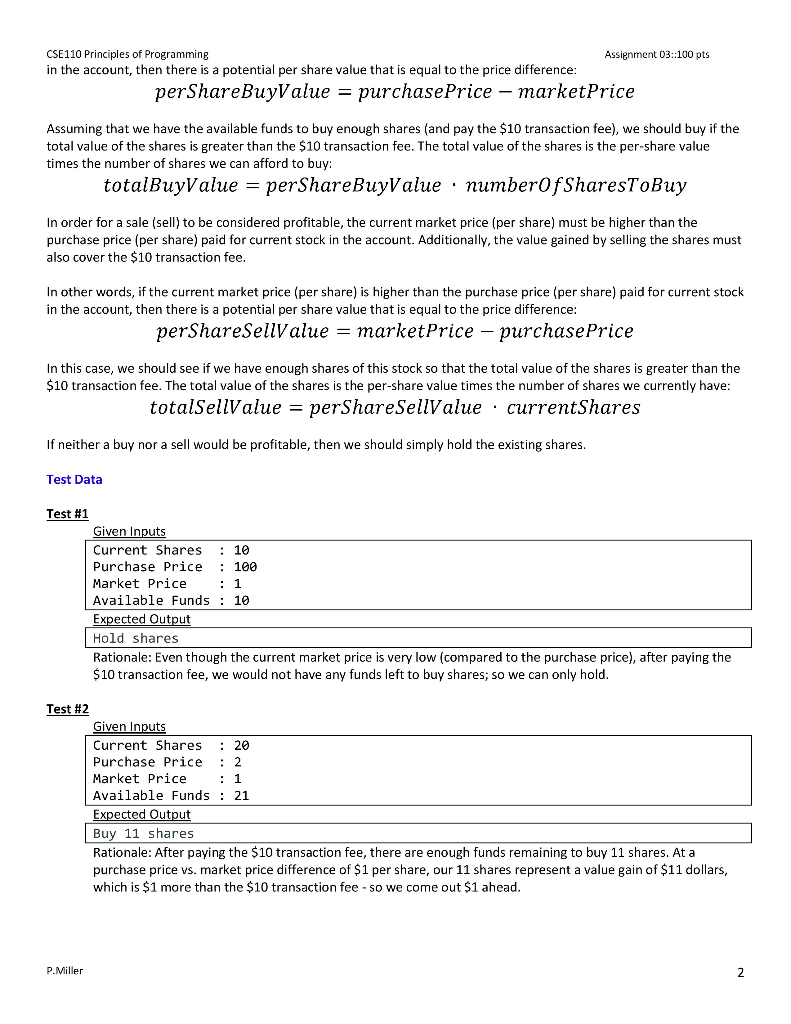

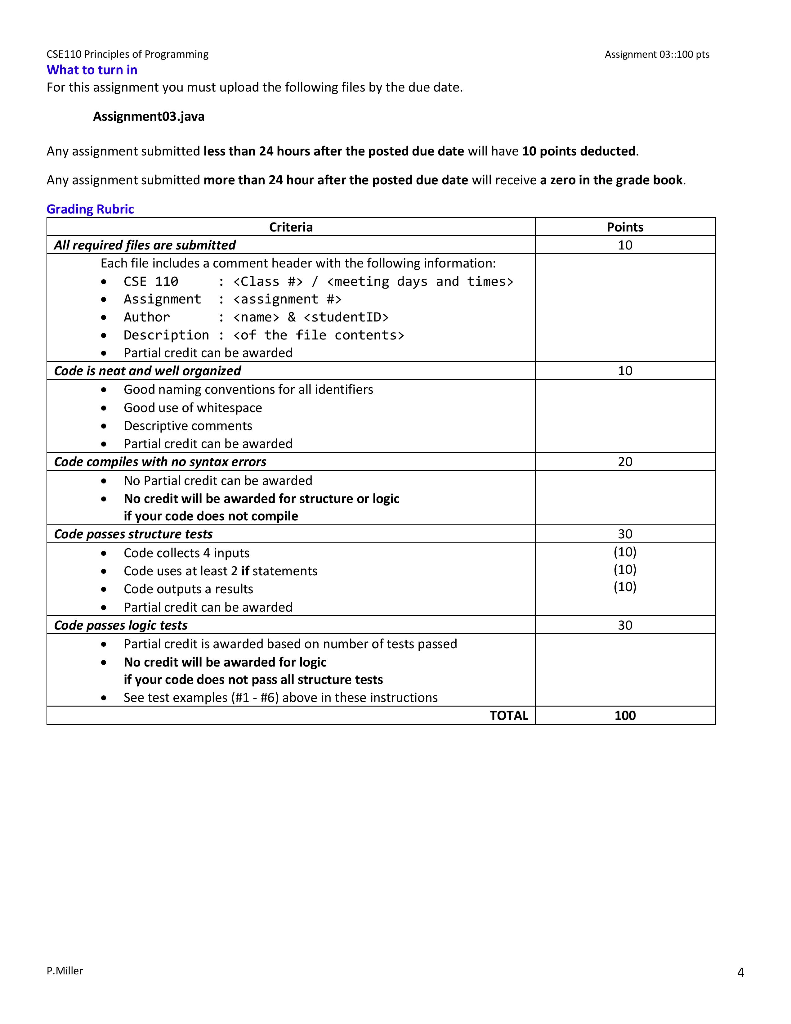

CSE110 Principles of Programming Assignment 03::100 pts Assignment 03 - Automatic Stock Trader You must work in alone on this assignment. Do not use any Java language features we have not cover so far in this course. Assignment Objectives After completing this assignment the student should be able to: Write programs that make decisions Demonstrate the use of if statements in Java Use relational and logical operators to compute desired values Assignment Requirements For this assignment you are given the following files: Assignment03.java (you must complete this file) Problem Description and Given Info Within the main method in the Assignment03.java file, you must design and write a program to determine whether to buy, sell, or hold shares in a stock market. Your program must prompt the user to enter the 4 input values described below. It must collect the user's input and store these values in 4 different variables. It must collect the inputs in the order shown below. Your program must determine whether the user should buy, sell, or hold their shares based on the input data. It must print out an appropriate message to the user. The output must be formatted exactly like the Expected output examples shown below. Inputs 1. Current Shares - This is the number of shares of this stock currently held in the account 2. Purchase Price - (per share) paid for current stock in the account 3. Market Price - (per share) of this stock. This is the current market price for buying or selling this stock 4. Available Funds - the amount the client is willing to spend on a transaction Outputs 1. Text containing the message to either buy, sell, or hold (see examples below) Other Details Any transaction (buy or sell) costs $10. Be sure to account for this transaction fee in your profitability calculations. We cannot buy or sell if we cannot pay this $10 fee. Note that this fee can be taken out of the profit from a sell (see below). Each time we sell, it will cost us the $10 transaction fee. Each time we buy, it will cost us the $10 transaction fee, plus the cost of the shares we are buying: totalBuy Cost = 10 + marketPrice numberOfSharesToBuy The number of shares we can afford to buy would be: number Of SharesToBuy = FLOOD availableFunds-transaction Fee. marketPrice In order for a purchase (buy) to be considered profitable, the current market price (per share) must be lower than the purchase price (per share) paid for current stock in the account. Additionally, the amount the client is willing to spend on a purchase must allow us to buy enough shares so that the difference in value will cover the $10 transaction fee. In other words, if the current market price (per share) is lower than the purchase price (per share) paid for current stock P. Miller CSE110 Principles of Programming Assignment 03::100 pts in the account, then there is a potential per share value that is equal to the price difference: perShareBuyValue = purchasePrice - market Price Assuming that we have the available funds to buy enough shares (and pay the $10 transaction fee), we should buy if the total value of the shares is greater than the $10 transaction fee. The total value of the shares is the per-share value times the number of shares we can afford to buy: totalBuyValue = perShareBuyValue numberOfSharesToBuy In order for a sale (sell) to be considered profitable, the current market price (per share) must be higher than the purchase price (per share) paid for current stock in the account. Additionally, the value gained by selling the shares must also cover the $10 transaction fee. In other words, if the current market price (per share) is higher than the purchase price (per share) paid for current stock in the account, then there is a potential per share value that is equal to the price difference: perShareSellValue = marketPrice purchase Price In this case, we should see if we have enough shares of this stock so that the total value of the shares is greater than the $10 transaction fee. The total value of the shares is the per-share value times the number of shares we currently have: totalSellValue = perShareSellValue currentShares If neither a buy nor a sell would be profitable, then we should simply hold the existing shares. Test Data Test #1 Given Inputs Current Shares 10 Purchase Price 100 Market Price : 1 Available Funds : 10 Expected Output Hold shares Rationale: Even though the current market price is very low (compared to the purchase price), after paying the $10 transaction fee, we would not have any funds left to buy shares; so we can only hold. Test #2 Given Inputs Current Shares : 20 Purchase Price : 2 Market Price : 1 Available Funds : 21 Expected Output Buy 11 shares Rationale: After paying the $10 transaction fee, there are enough funds remaining to buy 11 shares. At a purchase price vs. market price difference of $1 per share, our 11 shares represent a value gain of $11 dollars, which is $1 more than the $10 transaction fee - so we come out $1 ahead. P. Miller CSE110 Principles of Programming Assignment 03::100 pts Test #3 Given Inputs Current Shares 15 Purchase Price : 12 Market Price : 1 Available Funds : 12 Expected Output Buy 2 shares Rationale: After paying the $10 transaction fee, there are enough funds remaining to buy 2 shares. At a purchase price vs. market price difference of $11 per share, our 2 shares represent a value gain of $22 dollars, which is $12 more than the $10 transaction fee - so we come out $12 ahead. Test #4 Given Inputs Current Shares : 1 Purchase Price : 1 Market Price 11 Available Funds: 0 Expected Output Hold shares Rationale: Selling our 1 share for $11 will leave us with just $1 after we pay the $10 transaction fee. That is the same as what we paid for it, and we won't make any profit - so we should hold. Test #5 Given Inputs Current Shares 10 Purchase Price : 1 Market Price : 3 Available Funds : 30 Expected Output Sell 10 shares Rationale: With a market price vs. purchase price vs. difference of $2 per share, we stand to make $20 from the sale of our 10 shares. This is $10 more than the price of the transaction fee, so we will come out $10 ahead - therefore we should sell all 10 shares. Test #6 Given Inputs Current Shares : 1 Purchase Price : 1 Market Price 12 Available Funds : 0 Expected Output Sell 1 shares Rationale: Our 1 share is worth $11 more than we paid for it at the current market price. The $11 dollars obtained by selling that share now will still leave us with a profit of $1 after paying the $10 transaction fee. Profit is profit, so we should sell. P. Miller Assignment 03::100 pts CSE110 Principles of Programming What to turn in For this assignment you must upload the following files by the due date. Assignment03.java Any assignment submitted less than 24 hours after the posted due date will have 10 points deducted. Any assignment submitted more than 24 hour after the posted due date will receive a zero in the grade book. Points 10 Grading Rubric Criteria | All required files are submitted Each file includes a comment header with the following information: CSE 110 ;

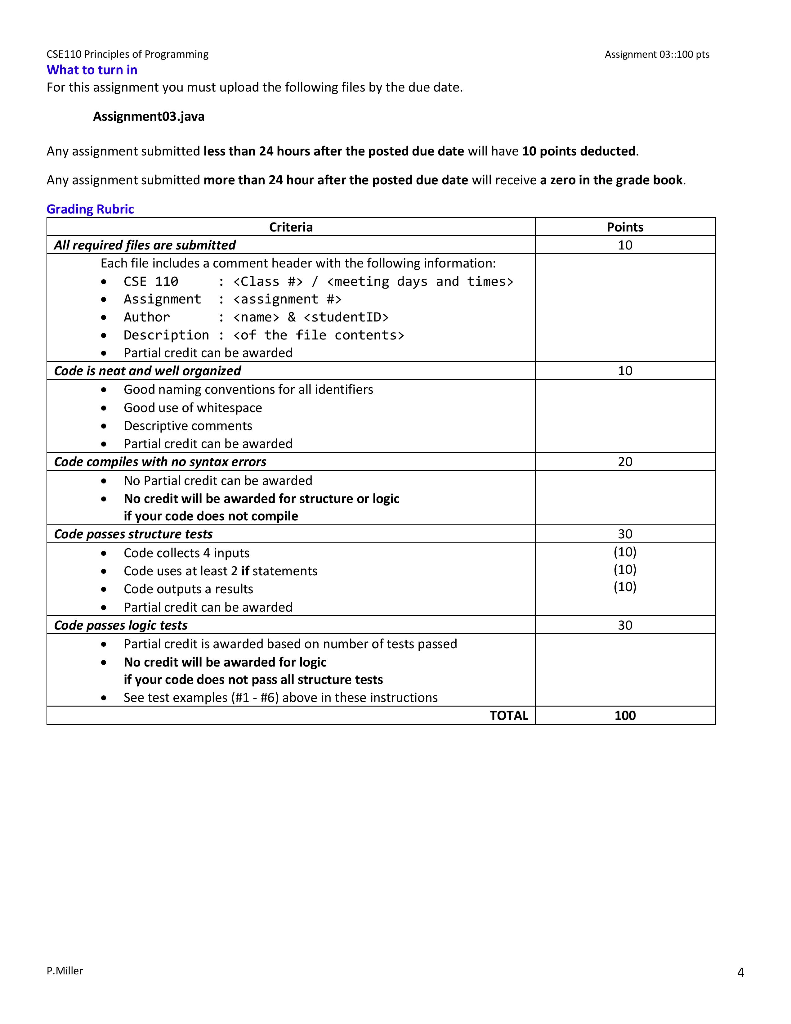

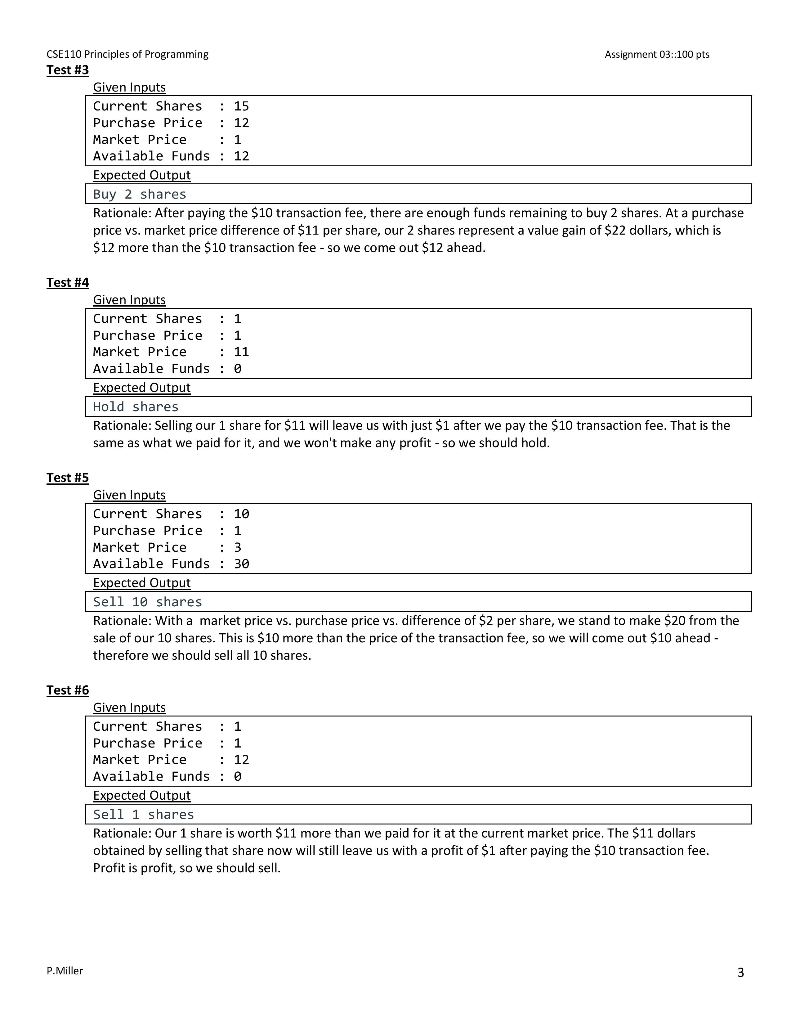

| Assignment Author & Description: Partial credit can be awarded Code is neat and well organized Good naming conventions for all identifiers Good use of whitespace Descriptive comments Partial credit can be awarded Code compiles with no syntax errors No Partial credit can be awarded No credit will be awarded for structure or logic if your code does not compile Code passes structure tests Code collects 4 inputs Code uses at least 2 if statements Code outputs a results Partial credit can be awarded Code passes logic tests Partial credit is awarded based on number of tests passed No credit will be awarded for logic if your code does not pass all structure tests See test examples (#1 - #6) above in these instructions TOTAL 30 100 P. Miller