Answered step by step

Verified Expert Solution

Question

1 Approved Answer

CSL Corporation is a mid-sized transportation firm with 10 million shares outstanding, trading at $ 25 per share and debt outstanding of $ 50

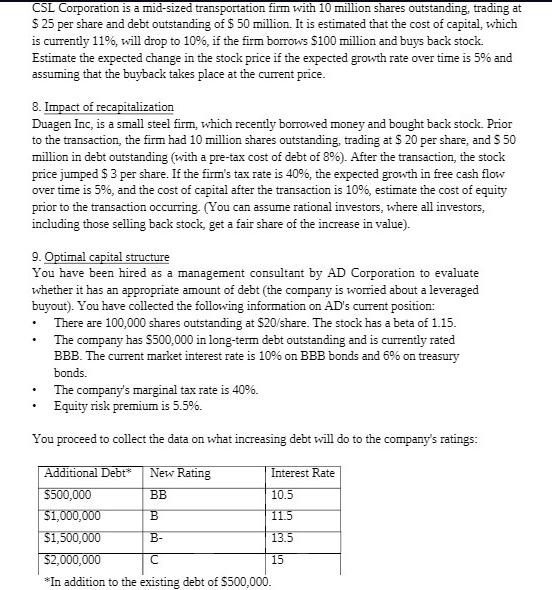

CSL Corporation is a mid-sized transportation firm with 10 million shares outstanding, trading at $ 25 per share and debt outstanding of $ 50 million. It is estimated that the cost of capital, which is currently 11%, will drop to 10%, if the firm borrows $100 million and buys back stock. Estimate the expected change in the stock price if the expected growth rate over time is 5% and assuming that the buyback takes place at the current price. 8. Impact of recapitalization Duagen Inc, is a small steel firm, which recently borrowed money and bought back stock. Prior to the transaction, the firm had 10 million shares outstanding, trading at $ 20 per share, and $ 50 million in debt outstanding (with a pre-tax cost of debt of 8%). After the transaction, the stock price jumped $ 3 per share. If the firm's tax rate is 40%, the expected growth in free cash flow over time is 5%, and the cost of capital after the transaction is 10%, estimate the cost of equity prior to the transaction occurring. (You can assume rational investors, where all investors, including those selling back stock, get a fair share of the increase in value). 9. Optimal capital structure You have been hired as a management consultant by AD Corporation to evaluate whether it has an appropriate amount of debt (the company is worried about a leveraged buyout). You have collected the following information on AD's current position: There are 100,000 shares outstanding at $20/share. The stock has a beta of 1.15. The company has $500,000 in long-term debt outstanding and is currently rated BBB. The current market interest rate is 10% on BBB bonds and 6% on treasury bonds. . The company's marginal tax rate is 40%. Equity risk premium is 5.5%. You proceed to collect the data on what increasing debt will do to the company's ratings: Additional Debt* New Rating $500,000 BB $1,000,000 B $1,500,000 B- $2,000,000 C *In addition to the existing debt of $500,000. Interest Rate 10.5 11.5 13.5 15

Step by Step Solution

★★★★★

3.32 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Calculate the components for the WACC E Market Value of Equity E Current Shares Outstanding Current Stock Price E 10000000 shares 25share E 250000000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started