Answered step by step

Verified Expert Solution

Question

1 Approved Answer

CSTUDY_Jan23_PGDFB_AFM8_Final_20221201102913.pdfFile (1).pdf - Adobe Acrobat Reader (32-bit) File Edit View Sign Window Help The mission of Orbit Limited is to achieve its vision by providing

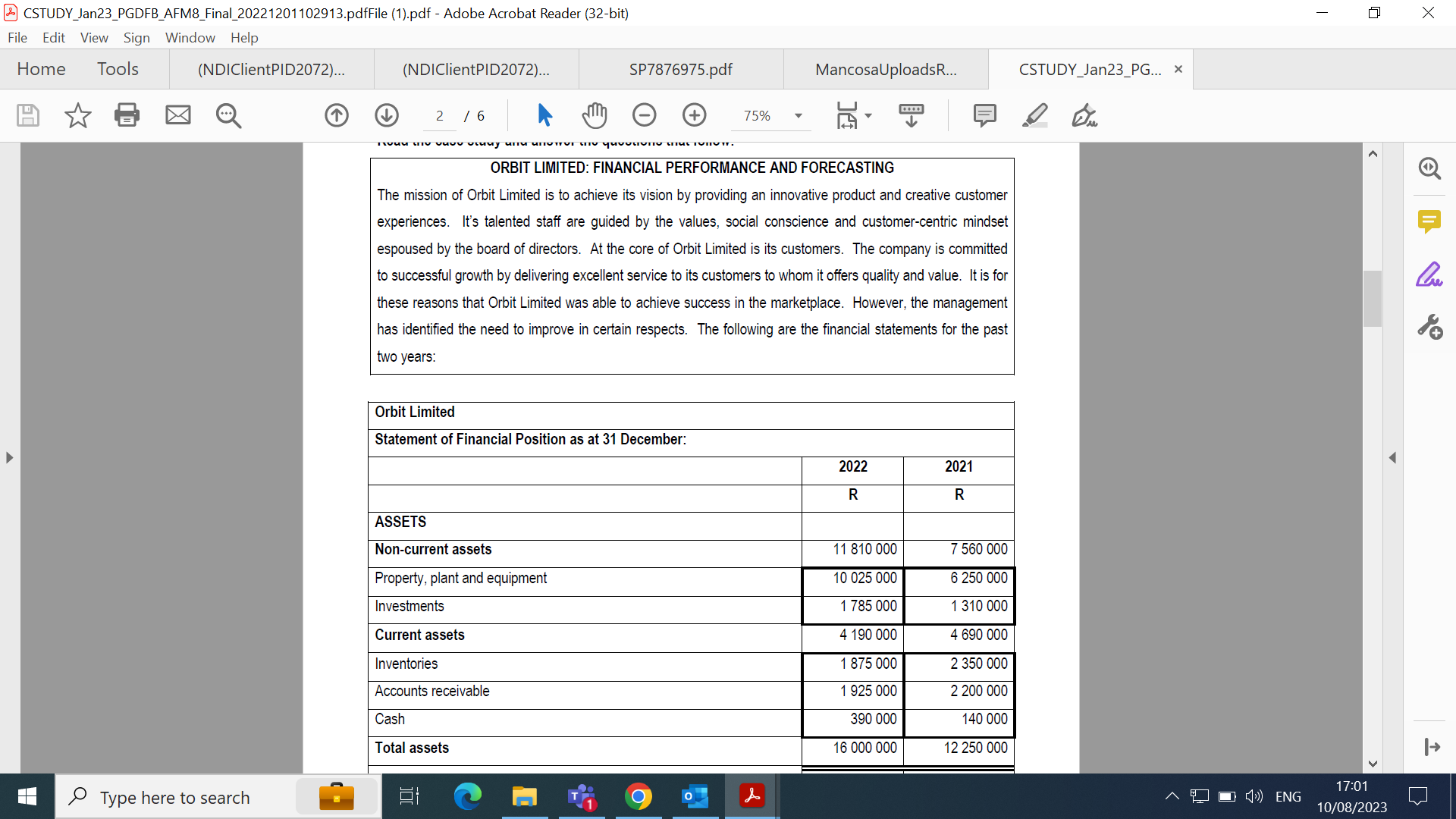

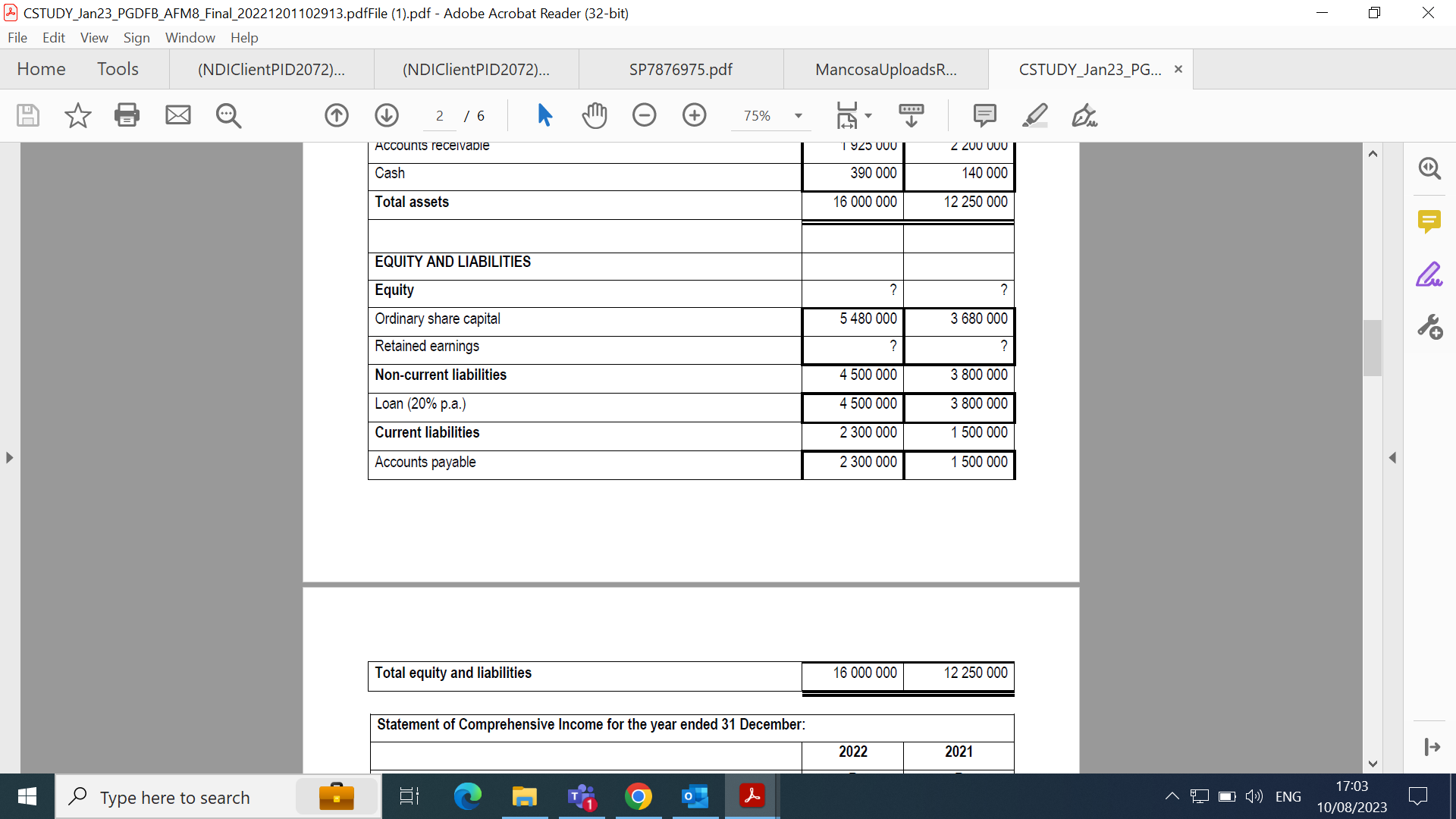

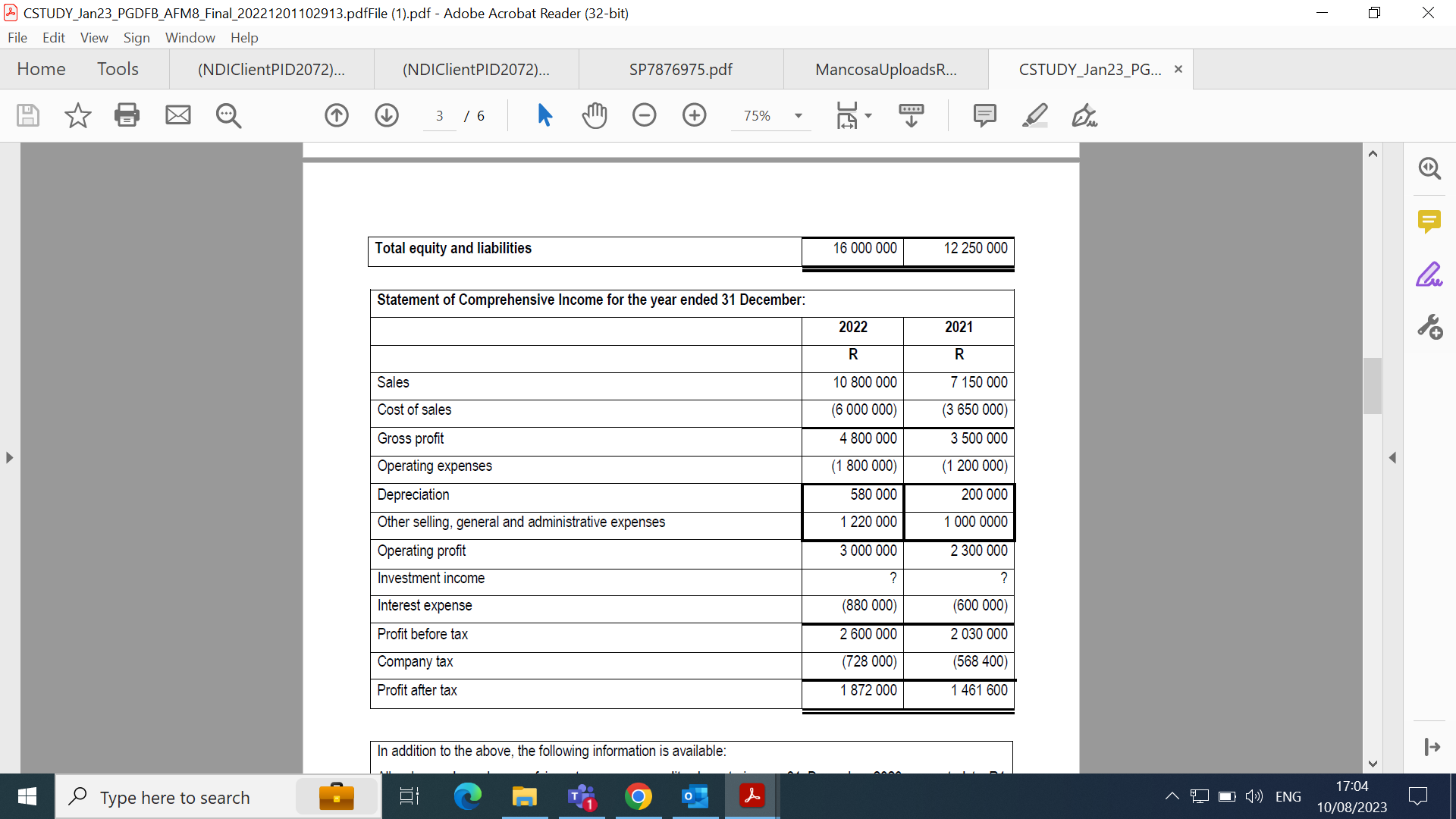

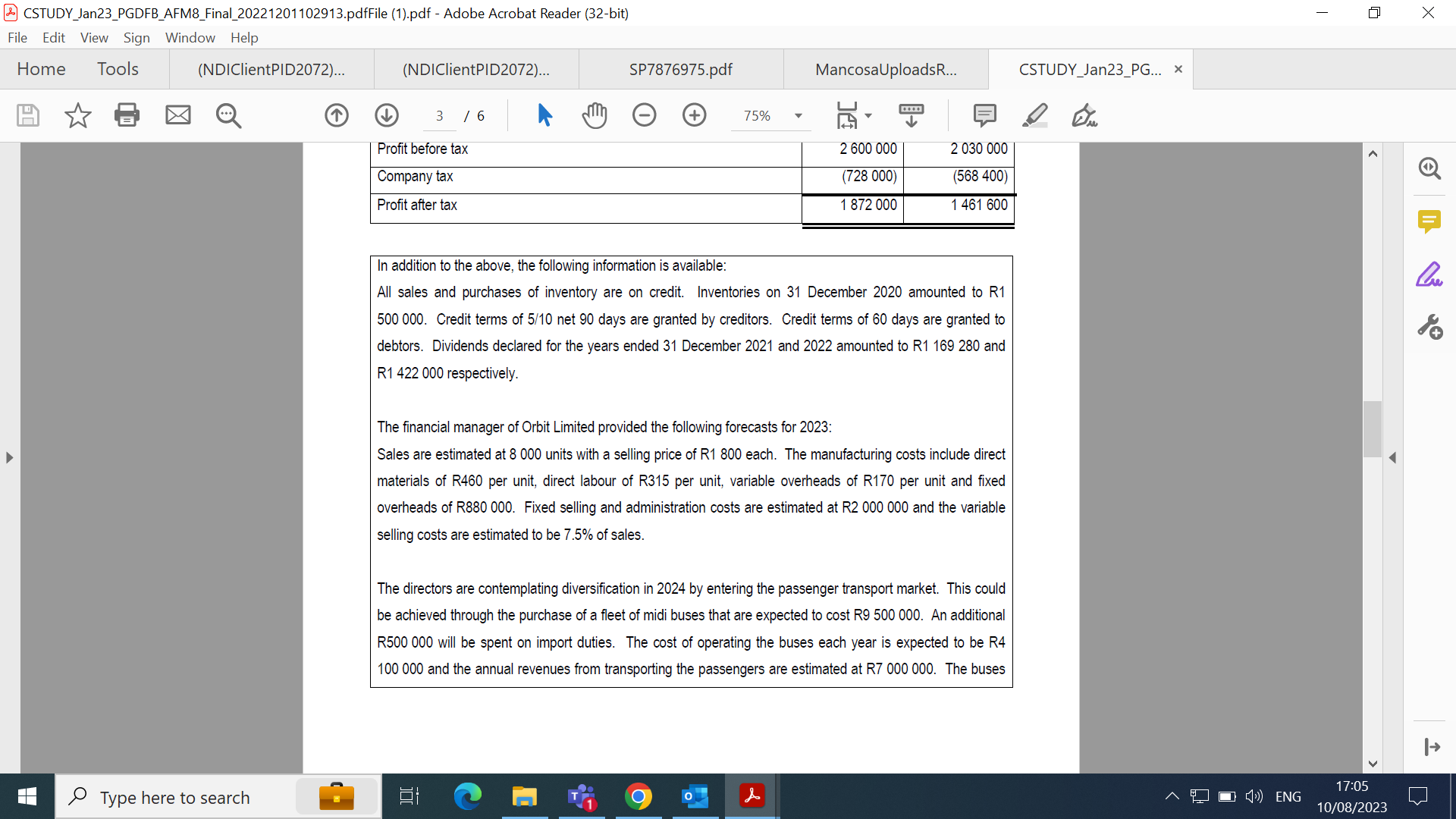

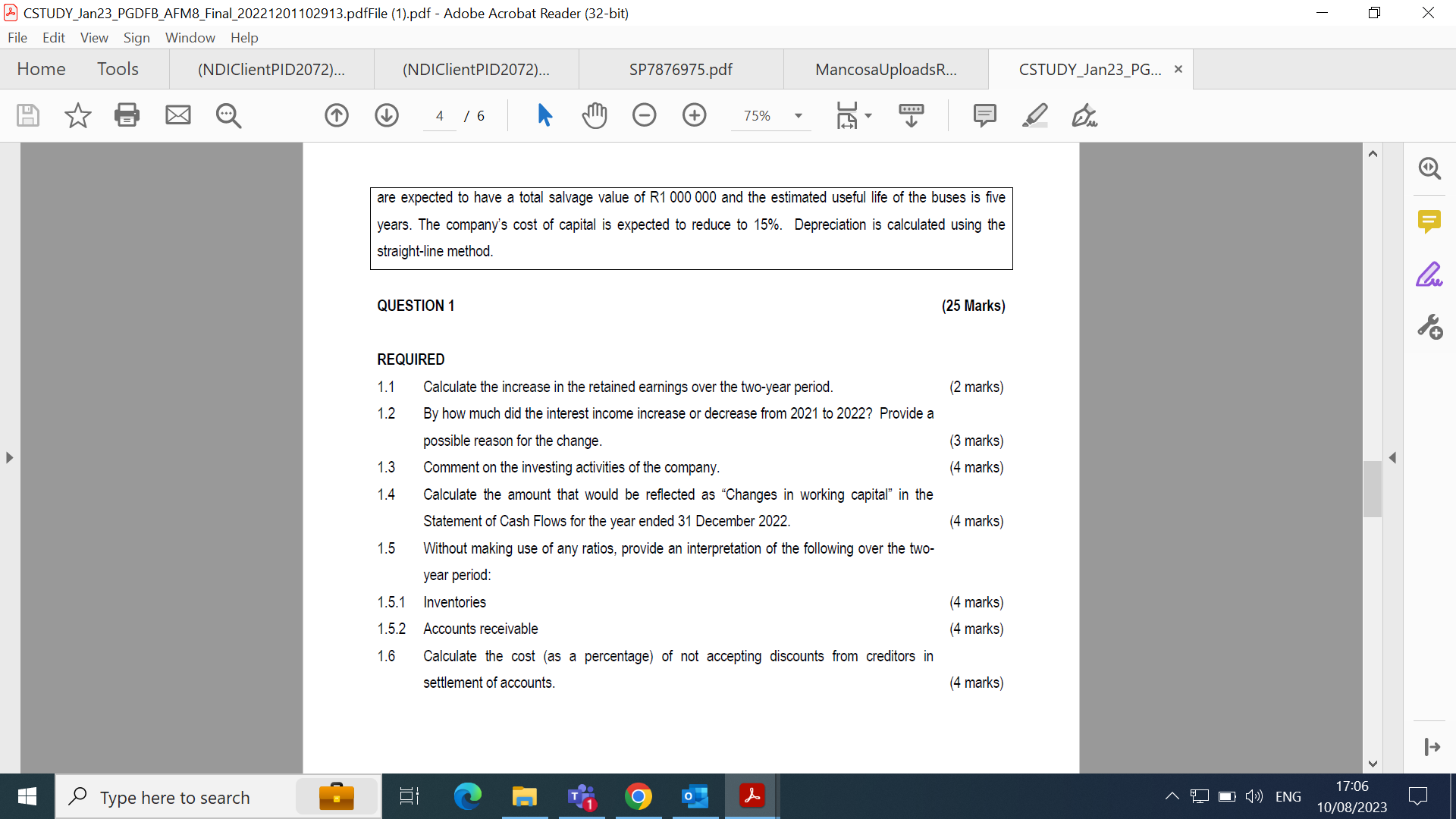

CSTUDY_Jan23_PGDFB_AFM8_Final_20221201102913.pdfFile (1).pdf - Adobe Acrobat Reader (32-bit) File Edit View Sign Window Help The mission of Orbit Limited is to achieve its vision by providing an innovative product and creative customer experiences. It's talented staff are guided by the values, social conscience and customer-centric mindset espoused by the board of directors. At the core of Orbit Limited is its customers. The company is committed to successful growth by delivering excellent service to its customers to whom it offers quality and value. It is for these reasons that Orbit Limited was able to achieve success in the marketplace. However, the management has identified the need to improve in certain respects. The following are the financial statements for the past two years: \\begin{tabular}{|l|} \\hline Orbit Limited \\\\ \\hline Statement of Financial Position as at 31 December: \\\\ \\hline \\end{tabular} D CSTUDY_Jan23_PGDFB_AFM8_Final_20221201102913.pdfFile (1).pdf - Adobe Acrobat Reader (32-bit) CSTUDY_Jan23_PGDFB_AFM8_Final_20221201102913.pdfFile (1).pdf - Adobe Acrobat Reader (32-bit) File Edit View Sign Window Help All sales and purchases of inventory are on credit. Inventories on 31 December 2020 amounted to R1 500000 . Credit terms of \\( 5 / 10 \\) net 90 days are granted by creditors. Credit terms of 60 days are granted to debtors. Dividends declared for the years ended 31 December 2021 and 2022 amounted to R1 169280 and R1 422000 respectively. The financial manager of Orbit Limited provided the following forecasts for 2023: Sales are estimated at 8000 units with a selling price of R1 800 each. The manufacturing costs include direct materials of R460 per unit, direct labour of R315 per unit, variable overheads of R170 per unit and fixed overheads of R880000. Fixed selling and administration costs are estimated at \\( R 2000000 \\) and the variable selling costs are estimated to be \7.5 of sales. The directors are contemplating diversification in 2024 by entering the passenger transport market. This could be achieved through the purchase of a fleet of midi buses that are expected to cost R9 500000 . An additional R500 000 will be spent on import duties. The cost of operating the buses each year is expected to be R4 100000 and the annual revenues from transporting the passengers are estimated at R7 000000 . The buses D CSTUDY_Jan23_PGDFB_AFM8_Final_20221201102913.pdfFile (1).pdf - Adobe Acrobat Reader (32-bit) File Edit View Sign Window Help Home Tools \\( \\quad \\) (NDIClientPID2072)... (NDIClientPID2072)... are expected to have a total salvage value of R1 000000 and the estimated useful life of the buses is five years. The company's cost of capital is expected to reduce to \15. Depreciation is calculated using the straight-line method. QUESTION 1 (25 Marks) REQUIRED 1.1 Calculate the increase in the retained earnings over the two-year period. (2 marks) 1.2 By how much did the interest income increase or decrease from 2021 to 2022? Provide a possible reason for the change. 1.3 Comment on the investing activities of the company. (3 marks) 1.4 Calculate the amount that would be reflected as \"Changes in working capital\" in the (4 marks) Statement of Cash Flows for the year ended 31 December 2022. (4 marks) 1.5 Without making use of any ratios, provide an interpretation of the following over the twoyear period: 1.5.1 Inventories (4 marks) 1.5.2 Accounts receivable (4 marks) 1.6 Calculate the cost (as a percentage) of not accepting discounts from creditors in settlement of accounts. (4 marks) D CSTUDY_Jan23_PGDFB_AFM8_Final_20221201102913.pdfFile (1).pdf - Adobe Acrobat Reader (32-bit) File Edit View Sign Window Help Total equity and liabilities In addition to the above, the following information is available

CSTUDY_Jan23_PGDFB_AFM8_Final_20221201102913.pdfFile (1).pdf - Adobe Acrobat Reader (32-bit) File Edit View Sign Window Help The mission of Orbit Limited is to achieve its vision by providing an innovative product and creative customer experiences. It's talented staff are guided by the values, social conscience and customer-centric mindset espoused by the board of directors. At the core of Orbit Limited is its customers. The company is committed to successful growth by delivering excellent service to its customers to whom it offers quality and value. It is for these reasons that Orbit Limited was able to achieve success in the marketplace. However, the management has identified the need to improve in certain respects. The following are the financial statements for the past two years: \\begin{tabular}{|l|} \\hline Orbit Limited \\\\ \\hline Statement of Financial Position as at 31 December: \\\\ \\hline \\end{tabular} D CSTUDY_Jan23_PGDFB_AFM8_Final_20221201102913.pdfFile (1).pdf - Adobe Acrobat Reader (32-bit) CSTUDY_Jan23_PGDFB_AFM8_Final_20221201102913.pdfFile (1).pdf - Adobe Acrobat Reader (32-bit) File Edit View Sign Window Help All sales and purchases of inventory are on credit. Inventories on 31 December 2020 amounted to R1 500000 . Credit terms of \\( 5 / 10 \\) net 90 days are granted by creditors. Credit terms of 60 days are granted to debtors. Dividends declared for the years ended 31 December 2021 and 2022 amounted to R1 169280 and R1 422000 respectively. The financial manager of Orbit Limited provided the following forecasts for 2023: Sales are estimated at 8000 units with a selling price of R1 800 each. The manufacturing costs include direct materials of R460 per unit, direct labour of R315 per unit, variable overheads of R170 per unit and fixed overheads of R880000. Fixed selling and administration costs are estimated at \\( R 2000000 \\) and the variable selling costs are estimated to be \7.5 of sales. The directors are contemplating diversification in 2024 by entering the passenger transport market. This could be achieved through the purchase of a fleet of midi buses that are expected to cost R9 500000 . An additional R500 000 will be spent on import duties. The cost of operating the buses each year is expected to be R4 100000 and the annual revenues from transporting the passengers are estimated at R7 000000 . The buses D CSTUDY_Jan23_PGDFB_AFM8_Final_20221201102913.pdfFile (1).pdf - Adobe Acrobat Reader (32-bit) File Edit View Sign Window Help Home Tools \\( \\quad \\) (NDIClientPID2072)... (NDIClientPID2072)... are expected to have a total salvage value of R1 000000 and the estimated useful life of the buses is five years. The company's cost of capital is expected to reduce to \15. Depreciation is calculated using the straight-line method. QUESTION 1 (25 Marks) REQUIRED 1.1 Calculate the increase in the retained earnings over the two-year period. (2 marks) 1.2 By how much did the interest income increase or decrease from 2021 to 2022? Provide a possible reason for the change. 1.3 Comment on the investing activities of the company. (3 marks) 1.4 Calculate the amount that would be reflected as \"Changes in working capital\" in the (4 marks) Statement of Cash Flows for the year ended 31 December 2022. (4 marks) 1.5 Without making use of any ratios, provide an interpretation of the following over the twoyear period: 1.5.1 Inventories (4 marks) 1.5.2 Accounts receivable (4 marks) 1.6 Calculate the cost (as a percentage) of not accepting discounts from creditors in settlement of accounts. (4 marks) D CSTUDY_Jan23_PGDFB_AFM8_Final_20221201102913.pdfFile (1).pdf - Adobe Acrobat Reader (32-bit) File Edit View Sign Window Help Total equity and liabilities In addition to the above, the following information is available Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started