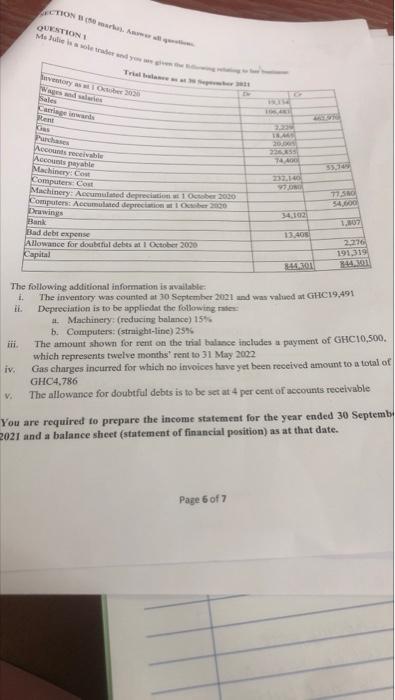

CTION B (50 marka). Answer all quations QUESTION 1 Ms Julie is a sole trader and you given the ingretting to the be Trial balance as at 30 Sep 11 Inventory as at October 2020 Wages and salaries BUR Sales Carriage 106. AKT inwands Rent Kius Purchases Accounts receivable Accounts payable Machinery: Cost Computers Cost 77,580 54,600 Machinery: Accumulated depreciation at 1 October 2020 Computers: Accumulated depreciation at 1 October 2020 Drawings 1,807 Bank 13,408 Bad debt expense 2,276 191,319 Allowance for doubtfal debts at 1 October 2020 Capital 844.301 844.301 The following additional information is available. i. The inventory was counted at 30 September 2021 and was valued at GHC19,491 Depreciation is to be appliedat the following rates ik. # Machinery: (reducing balance) 15% b. Computers: (straight-line) 25% iii. The amount shown for rent on the trial balance includes a payment of GHC10,500. which represents twelve months' rent to 31 May 2022 iv. Gas charges incurred for which no invoices have yet been received amount to a total of GHC4,786 V. The allowance for doubtful debts is to be set at 4 per cent of accounts receivable You are required to prepare the income statement for the year ended 30 Septemb 2021 and a balance sheet (statement of financial position) as at that date. Page 6 of 7 G 2,239 18.441 20,00 226,855 74,400 232,140 97 UND 34,102 55,349 CTION B (50 marka). Answer all quations QUESTION 1 Ms Julie is a sole trader and you given the ingretting to the be Trial balance as at 30 Sep 11 Inventory as at October 2020 Wages and salaries BUR Sales Carriage 106. AKT inwands Rent Kius Purchases Accounts receivable Accounts payable Machinery: Cost Computers Cost 77,580 54,600 Machinery: Accumulated depreciation at 1 October 2020 Computers: Accumulated depreciation at 1 October 2020 Drawings 1,807 Bank 13,408 Bad debt expense 2,276 191,319 Allowance for doubtfal debts at 1 October 2020 Capital 844.301 844.301 The following additional information is available. i. The inventory was counted at 30 September 2021 and was valued at GHC19,491 Depreciation is to be appliedat the following rates ik. # Machinery: (reducing balance) 15% b. Computers: (straight-line) 25% iii. The amount shown for rent on the trial balance includes a payment of GHC10,500. which represents twelve months' rent to 31 May 2022 iv. Gas charges incurred for which no invoices have yet been received amount to a total of GHC4,786 V. The allowance for doubtful debts is to be set at 4 per cent of accounts receivable You are required to prepare the income statement for the year ended 30 Septemb 2021 and a balance sheet (statement of financial position) as at that date. Page 6 of 7 G 2,239 18.441 20,00 226,855 74,400 232,140 97 UND 34,102 55,349