Answered step by step

Verified Expert Solution

Question

1 Approved Answer

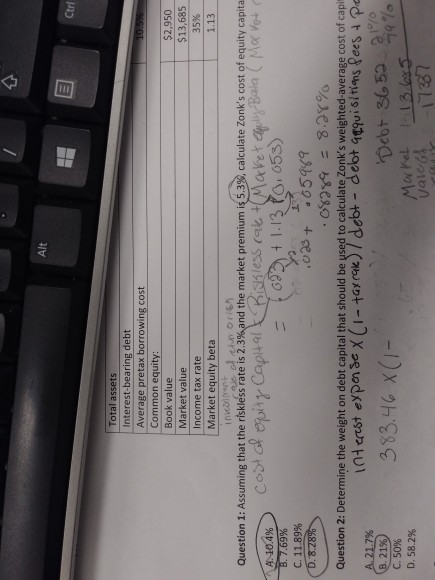

Ctrl Total assets Interest-bearing debt Average pretax borrowing cost Common equity: Book value $2,950 Market value $13,685 Income tax rate 35% Market equity beta 1.13

Ctrl Total assets Interest-bearing debt Average pretax borrowing cost Common equity: Book value $2,950 Market value $13,685 Income tax rate 35% Market equity beta 1.13 inv o r16 Question 1: Assuming that the riskless rate is 2.3% and the market premium is 5.3%, calculate Zonk's cost of equity capita cost of equity Capital & Biskless cake + Market eguity Bata ( Market 1073) + 1.13 PO. 053) B. 7.69% C. 11.89% 1000+ 05989 0.8.28% 08289 = 8:28% Question 2: Determine the weight on debt capital that should be used to calculate Zonk's weighted average cost of capir interest expense X (1- tax rate), debt - debot aequisitions fees a pre A. 21.7% B. 21% 383.46 X(1- Debt 365928 C. 50% Market 113.6x5 D.58.2% vale 7387 Ctrl Total assets Interest-bearing debt Average pretax borrowing cost Common equity: Book value $2,950 Market value $13,685 Income tax rate 35% Market equity beta 1.13 inv o r16 Question 1: Assuming that the riskless rate is 2.3% and the market premium is 5.3%, calculate Zonk's cost of equity capita cost of equity Capital & Biskless cake + Market eguity Bata ( Market 1073) + 1.13 PO. 053) B. 7.69% C. 11.89% 1000+ 05989 0.8.28% 08289 = 8:28% Question 2: Determine the weight on debt capital that should be used to calculate Zonk's weighted average cost of capir interest expense X (1- tax rate), debt - debot aequisitions fees a pre A. 21.7% B. 21% 383.46 X(1- Debt 365928 C. 50% Market 113.6x5 D.58.2% vale 7387

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started