Answered step by step

Verified Expert Solution

Question

1 Approved Answer

CTU Inc., a U.S. firm, is considering an investment project in England. The current exchange rate is $1.2=$1. The firm assumes that the exchange rate

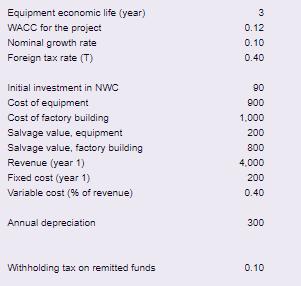

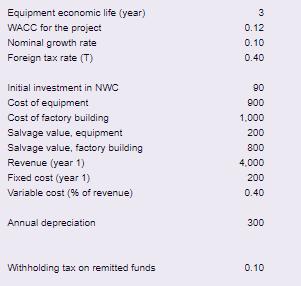

CTU Inc., a U.S. firm, is considering an investment project in England. The current exchange rate is $1.2=$1. The firm assumes that the exchange rate will remain the same for the next 3 years. Based on the agreement with the U.K. government, the firm will be able to remit 100% of the cash flow generated from the project. The government will levy a 10% withholding tax on the remittance. The monetary amounts in the following tables are denominated in the pound.

Equipment economic life (year) WACC for the project Nominal growth rate Foreign tax rate (T) Initial investment in NWC Cost of equipment Cost of factory building Salvage value, equipment Salvage value, factory building Revenue (year 1) Fixed cost (year 1) Variable cost (% of revenue) Annual depreciation Withholding tax on remitted funds 3 0.12 0.10 0.40 90 900 1,000 200 800 4,000 200 0.40 300 0.10

Step by Step Solution

★★★★★

3.45 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the operating cash flow for year 3 we need to consider the revenue cost...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started