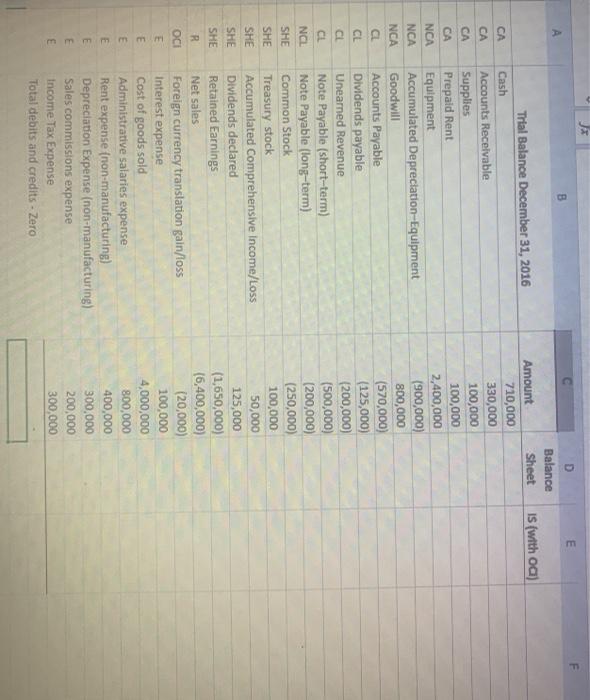

cture 4 A B C D E F G H 1 . Using the Trial Balance (in Excel) create a set of articulating financial statements - balance sheet, Income statement (with appended Other Comprehensive Income), and statement of changes in stockholder's equity (columnar format). Additional Common Stock facts/transactions that you need to consider are as follows: In 2016, Brennan issued $50,000 of additional common stock. To simplify the problem, I did not split the proceeds between Par and APIC it is just all common stock. In 2016, Brennan bought back (with cash) $20,000 of stock, increasing the Treasury stock account. Both common stock transactions are already properly reflected in the 12/31/16 balances, but you need to back these out to determine the 1/1/16 account balances in order to prepare the statement of stockholders' equity. 5 B 0 Other relevant additional facts: Regis declared a $125,000 dividend that was unpaid at 12/31/16. The dividend (not the dividend payable) was properly reported in a separate ledger account Dividend declared", a temporary account that needs to be closed out to RE. The Statement of Comprehensive Income contains of Foreign currency translation gain/loss". Brennan accumulates OCI In stockholders' equity as Accumulated Other Comprehensive Income in the same manner that regular net income gets accumulated in retained earnings. The statement of changes in stockholder's equity must be in a columnar format displaying changes in, Retained Earnings, Common Stock, Treasury Stock and Accumulated Other Comprehensive Income and Total Stockholders Equity. The trial balance uses positive numbers for debits and negative numbers as credits. Use of negative numbers in financials is reserved for a limited number of items. For example we do not show sales revenue as a minus. Negative numbers are reserved for losses, deficits and other special circumstances like contra assets and contra liabilities. For this exercise a negative will be used for but not limited to: Dividends declared (not the payable) Treasury stock o Accumulated depreciation Any Loss items associated with Accumulated Other Comprehensive Income Some beginning and ending control totals to check your work: Total assets - $3,540,000 Total comprehensive income $320,000. (Regular Ni and OCI must be displayed) Total endine stockholder's equity is $1.945,000 E D f B Balance Sheet IS (with oa) CA CA CA CA NCA NCA NCA CL CL CL CL NCL SHE SHE SHE SHE SHE R Trial Balance December 31, 2016 Cash Accounts Receivable Supplies Prepaid Rent Equipment Accumulated Depreciation Equipment Goodwill Accounts Payable Dividends payable Unearned Revenue Note Payable (short-term) Note Payable (long-term) Common Stock Treasury stock Accumulated Comprehensive Income/Loss Dividends declared Retained Earnings Net sales Foreign currency translation gain/loss Interest expense Cost of goods sold Administrative salaries expense Rent expense (non-manufacturing) Depreciation Expense (non-manufacturing) Sales commissions expense Income Tax Expense Total debits and credits - Zero Amount 710,000 330,000 100,000 100,000 2,400,000 (900,000) 800,000 (570,000) (125,000) (200,000) (500,000) (200,000) (250,000) 100,000 50,000 125,000 (1,650,000) (6,400,000) (20,000) 100,000 4,000,000 800,000 400,000 300,000 200,000 300,000 E E m m m m m. cture 4 A B C D E F G H 1 . Using the Trial Balance (in Excel) create a set of articulating financial statements - balance sheet, Income statement (with appended Other Comprehensive Income), and statement of changes in stockholder's equity (columnar format). Additional Common Stock facts/transactions that you need to consider are as follows: In 2016, Brennan issued $50,000 of additional common stock. To simplify the problem, I did not split the proceeds between Par and APIC it is just all common stock. In 2016, Brennan bought back (with cash) $20,000 of stock, increasing the Treasury stock account. Both common stock transactions are already properly reflected in the 12/31/16 balances, but you need to back these out to determine the 1/1/16 account balances in order to prepare the statement of stockholders' equity. 5 B 0 Other relevant additional facts: Regis declared a $125,000 dividend that was unpaid at 12/31/16. The dividend (not the dividend payable) was properly reported in a separate ledger account Dividend declared", a temporary account that needs to be closed out to RE. The Statement of Comprehensive Income contains of Foreign currency translation gain/loss". Brennan accumulates OCI In stockholders' equity as Accumulated Other Comprehensive Income in the same manner that regular net income gets accumulated in retained earnings. The statement of changes in stockholder's equity must be in a columnar format displaying changes in, Retained Earnings, Common Stock, Treasury Stock and Accumulated Other Comprehensive Income and Total Stockholders Equity. The trial balance uses positive numbers for debits and negative numbers as credits. Use of negative numbers in financials is reserved for a limited number of items. For example we do not show sales revenue as a minus. Negative numbers are reserved for losses, deficits and other special circumstances like contra assets and contra liabilities. For this exercise a negative will be used for but not limited to: Dividends declared (not the payable) Treasury stock o Accumulated depreciation Any Loss items associated with Accumulated Other Comprehensive Income Some beginning and ending control totals to check your work: Total assets - $3,540,000 Total comprehensive income $320,000. (Regular Ni and OCI must be displayed) Total endine stockholder's equity is $1.945,000 E D f B Balance Sheet IS (with oa) CA CA CA CA NCA NCA NCA CL CL CL CL NCL SHE SHE SHE SHE SHE R Trial Balance December 31, 2016 Cash Accounts Receivable Supplies Prepaid Rent Equipment Accumulated Depreciation Equipment Goodwill Accounts Payable Dividends payable Unearned Revenue Note Payable (short-term) Note Payable (long-term) Common Stock Treasury stock Accumulated Comprehensive Income/Loss Dividends declared Retained Earnings Net sales Foreign currency translation gain/loss Interest expense Cost of goods sold Administrative salaries expense Rent expense (non-manufacturing) Depreciation Expense (non-manufacturing) Sales commissions expense Income Tax Expense Total debits and credits - Zero Amount 710,000 330,000 100,000 100,000 2,400,000 (900,000) 800,000 (570,000) (125,000) (200,000) (500,000) (200,000) (250,000) 100,000 50,000 125,000 (1,650,000) (6,400,000) (20,000) 100,000 4,000,000 800,000 400,000 300,000 200,000 300,000 E E m m m m m