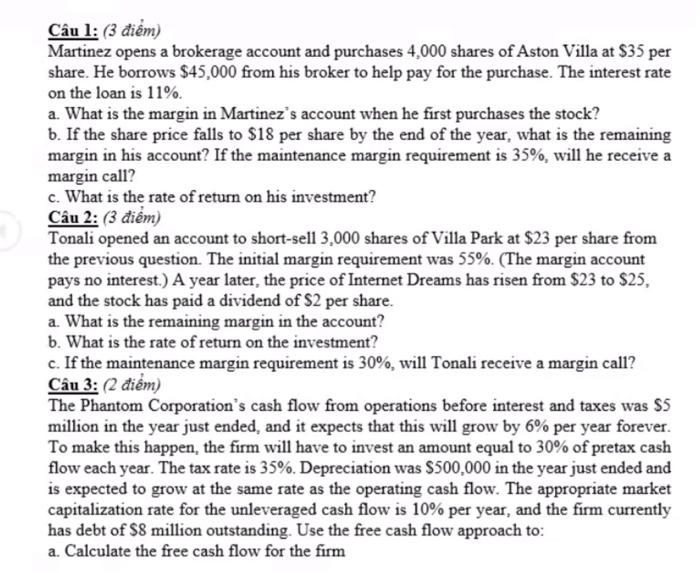

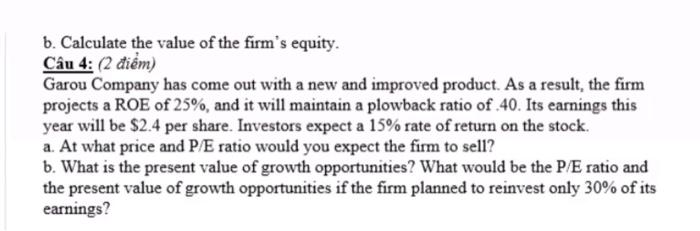

Cu 1: (3 im) Martinez opens a brokerage account and purchases 4,000 shares of Aston Villa at $35 per share. He borrows $45,000 from his broker to help pay for the purchase. The interest rate on the loan is 11%. a. What is the margin in Martinez's account when he first purchases the stock? b. If the share price falls to $18 per share by the end of the year, what is the remaining margin in his account? If the maintenance margin requirement is 35%, will he receive a margin call? c. What is the rate of return on his investment? Cu 2: (3 im) Tonali opened an account to short-sell 3,000 shares of Villa Park at $23 per share from the previous question. The initial margin requirement was 55%. (The margin account pays no interest.) A year later, the price of Internet Dreams has risen from $23 to $25, and the stock has paid a dividend of $2 per share. a. What is the remaining margin in the account? b. What is the rate of return on the investment? c. If the maintenance margin requirement is 30%, will Tonali receive a margin call? Cu 3: (2 im) The Phantom Corporation's cash flow from operations before interest and taxes was $5 million in the year just ended, and it expects that this will grow by 6% per year forever. To make this happen, the firm will have to invest an amount equal to 30% of pretax cash flow each year. The tax rate is 35%. Depreciation was $500,000 in the year just ended and is expected to grow at the same rate as the operating cash flow. The appropriate market capitalization rate for the unleveraged cash flow is 10% per year, and the firm currently has debt of $8 million outstanding. Use the free cash flow approach to: a. Calculate the free cash flow for the firm b. Calculate the value of the firm's equity. Cu 4: (2 im) Garou Company has come out with a new and improved product. As a result, the firm projects a ROE of 25%, and it will maintain a plowback ratio of 40. Its earnings this year will be $2.4 per share. Investors expect a 15% rate of return on the stock. a. At what price and P/E ratio would you expect the firm to sell? b. What is the present value of growth opportunities? What would be the P/E ratio and the present value of growth opportunities if the firm planned to reinvest only 30% of its earnings