Answered step by step

Verified Expert Solution

Question

1 Approved Answer

CU Corporation has a fixed-for-fixed currency swap signed at an exchange rate of JPY/USD 111 with a notional principal of USD 100 million. The

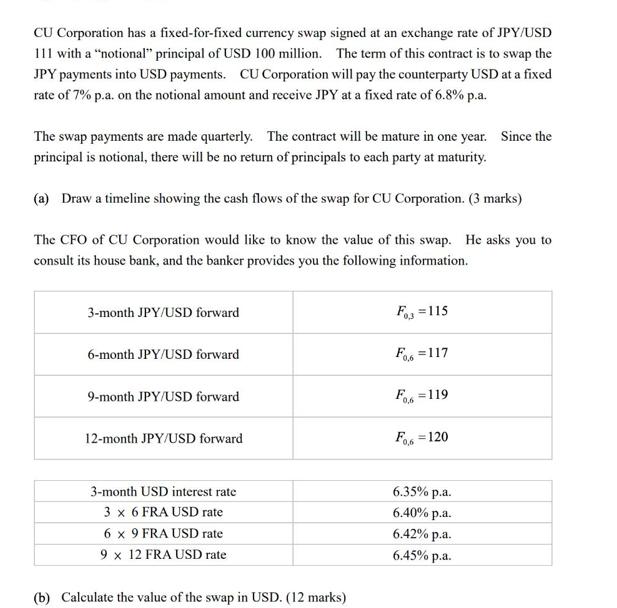

CU Corporation has a fixed-for-fixed currency swap signed at an exchange rate of JPY/USD 111 with a "notional" principal of USD 100 million. The term of this contract is to swap the JPY payments into USD payments. CU Corporation will pay the counterparty USD at a fixed rate of 7% p.a. on the notional amount and receive JPY at a fixed rate of 6.8% p.a. The swap payments are made quarterly. The contract will be mature in one year. Since the principal is notional, there will be no return of principals to each party at maturity. (a) Draw a timeline showing the cash flows of the swap for CU Corporation. (3 marks) The CFO of CU Corporation would like to know the value of this swap. He asks you to consult its house bank, and the banker provides you the following information. 3-month JPY/USD forward 6-month JPY/USD forward 9-month JPY/USD forward 12-month JPY/USD forward 3-month USD interest rate 3 x 6 FRA USD rate 6 x 9 FRA USD rate 9 x 12 FRA USD rate (b) Calculate the value of the swap in USD. (12 marks) F3=115 F0,6 =117 For =119 Fo6-120 = 6.35% p.a. 6.40% p.a. 6.42% p.a. 6.45% p.a.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started