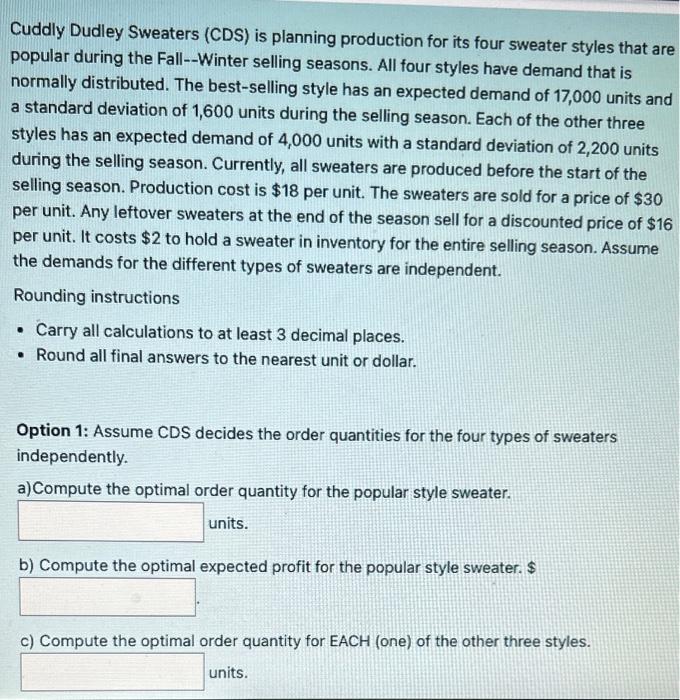

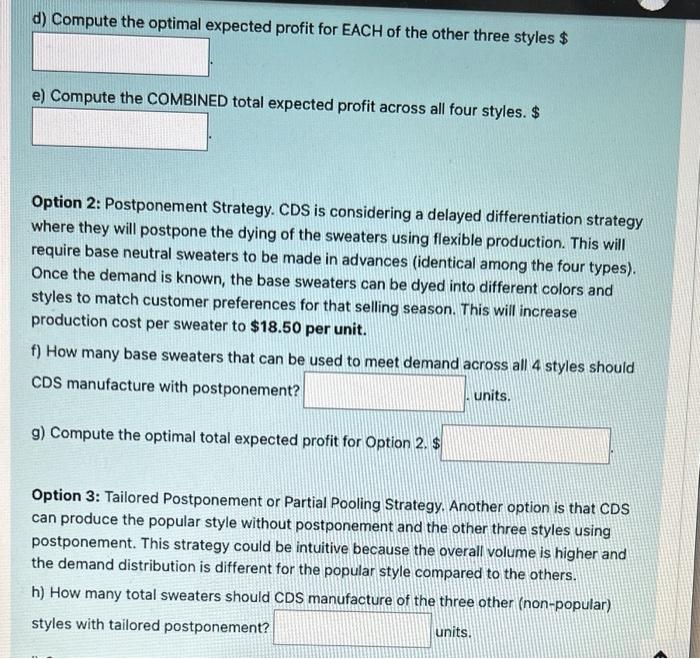

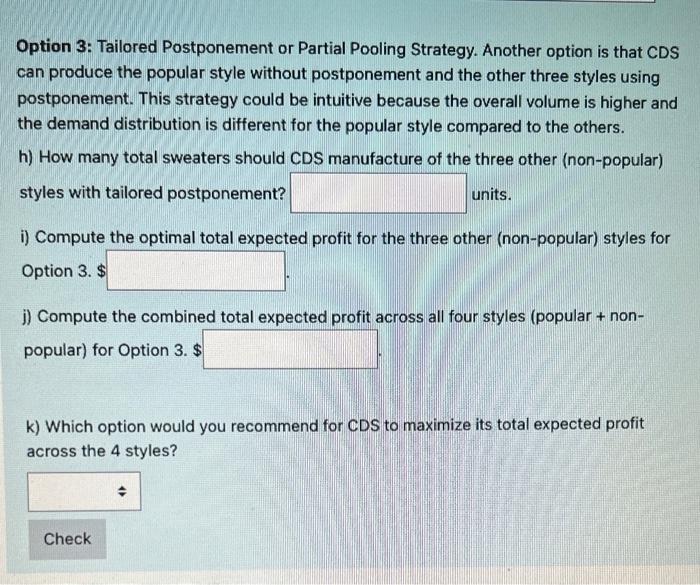

Cuddly Dudley Sweaters (CDS) is planning production for its four sweater styles that a popular during the Fall--Winter selling seasons. All four styles have demand that is normally distributed. The best-selling style has an expected demand of 17,000 units ar a standard deviation of 1,600 units during the selling season. Each of the other three styles has an expected demand of 4,000 units with a standard deviation of 2,200 units during the selling season. Currently, all sweaters are produced before the start of the selling season. Production cost is $18 per unit. The sweaters are sold for a price of $30 per unit. Any leftover sweaters at the end of the season sell for a discounted price of $ per unit. It costs $2 to hold a sweater in inventory for the entire selling season. Assume the demands for the different types of sweaters are independent. Rounding instructions - Carry all calculations to at least 3 decimal places. - Round all final answers to the nearest unit or dollar. Option 1: Assume CDS decides the order quantities for the four types of sweaters independently. a)Compute the optimal order quantity for the popular style sweater. units. b) Compute the optimal expected profit for the popular style sweater. $ c) Compute the optimal order quantity for EACH (one) of the other three styles. units. d) Compute the optimal expected profit for EACH of the other three styles $ e) Compute the COMBINED total expected profit across all four styles. $ Option 2: Postponement Strategy. CDS is considering a delayed differentiation strategy where they will postpone the dying of the sweaters using flexible production. This will require base neutral sweaters to be made in advances (identical among the four types). Once the demand is known, the base sweaters can be dyed into different colors and styles to match customer preferences for that selling season. This will increase production cost per sweater to $18.50 per unit. f) How many base sweaters that can be used to meet demand across all 4 styles should CDS manufacture with postponement? units. g) Compute the optimal total expected profit for Option 2.$ Option 3: Tailored Postponement or Partial Pooling Strategy. Another option is that CDS can produce the popular style without postponement and the other three styles using postponement. This strategy could be intuitive because the overall volume is higher and the demand distribution is different for the popular style compared to the others. h) How many total sweaters should CDS manufacture of the three other (non-popular) styles with tailored postponement? units. Option 3: Tailored Postponement or Partial Pooling Strategy. Another option is that CDS can produce the popular style without postponement and the other three styles using postponement. This strategy could be intuitive because the overall volume is higher and the demand distribution is different for the popular style compared to the others. h) How many total sweaters should CDS manufacture of the three other (non-popular) styles with tailored postponement? units. i) Compute the optimal total expected profit for the three other (non-popular) styles for Option 3.$ j) Compute the combined total expected profit across all four styles (popular + nonpopular) for Option 3.$ k) Which option would you recommend for CDS to maximize its total expected profit across the 4 styles