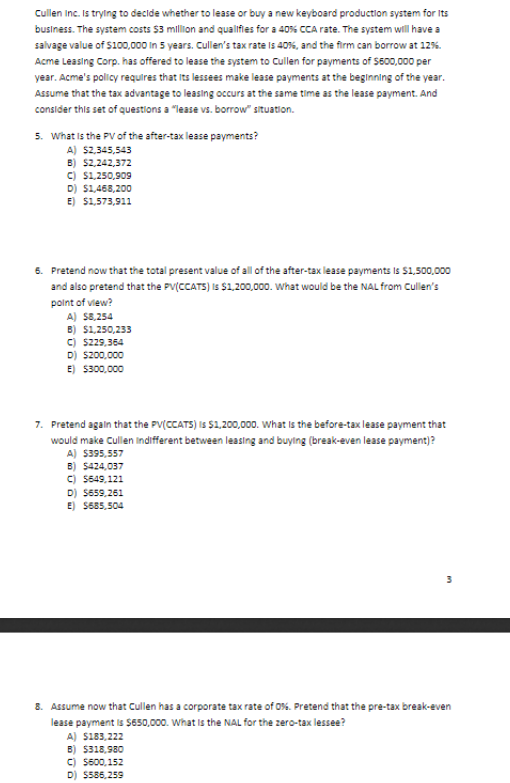

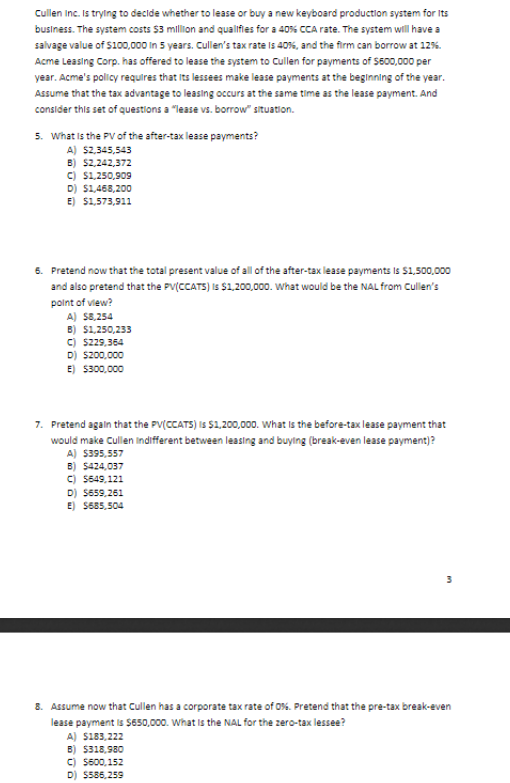

Cullen Inc. is trying to decide whether to lease or buy a new keyboard production system for its business. The system costs $3 million and qualifles for a 40%. CCA rate. The system will have a salvage value of $100,000 in 5 years. Cullen's tax rate is 40%, and the firm can borrow at 12% Acme Leasing Corp. has offered to lease the system to Cullen for payments of $500,000 per year. Acme's policy requires that its lessees make lease payments at the beginning of the year. Assume that the tax advantage to leasing occurs at the same time as the lease payment. And consider this set of questions a "lease vs. borrow situation 5. What is the PV of the after-tax lease payments? A) $2.345,543 B) $2,242,372 C) 51.250,909 D) 51.463,200 E) $1.573,921 6. Pretend now that the total present value of all of the after-tax lease payments is 51,500,000 and also pretend that the PV(CCATS) is $1,200,000. What would be the NAL from Cullen's point of view? A) S8,254 B) $1,250,233 C) $229,364 D) $200,000 E) $300,000 7. Pretend again that the PV(CCATS) is $1,200,000. What is the before-tax lease payment that would make Cullen Indifferent between leasing and buying (break-even lease payment)? A $395.557 B) $424,037 C) 5549,121 D) $659,261 E) 5685,504 8. Assume now that Cullen has a corporate tax rate of %. Pretend that the pre-tax break-even lease payment is $650,000. What is the NAL for the zero-tax lessee? A) $183,222 B) 5318.580 C) $600.152 D) 5586,259 Cullen Inc. is trying to decide whether to lease or buy a new keyboard production system for its business. The system costs $3 million and qualifles for a 40%. CCA rate. The system will have a salvage value of $100,000 in 5 years. Cullen's tax rate is 40%, and the firm can borrow at 12% Acme Leasing Corp. has offered to lease the system to Cullen for payments of $500,000 per year. Acme's policy requires that its lessees make lease payments at the beginning of the year. Assume that the tax advantage to leasing occurs at the same time as the lease payment. And consider this set of questions a "lease vs. borrow situation 5. What is the PV of the after-tax lease payments? A) $2.345,543 B) $2,242,372 C) 51.250,909 D) 51.463,200 E) $1.573,921 6. Pretend now that the total present value of all of the after-tax lease payments is 51,500,000 and also pretend that the PV(CCATS) is $1,200,000. What would be the NAL from Cullen's point of view? A) S8,254 B) $1,250,233 C) $229,364 D) $200,000 E) $300,000 7. Pretend again that the PV(CCATS) is $1,200,000. What is the before-tax lease payment that would make Cullen Indifferent between leasing and buying (break-even lease payment)? A $395.557 B) $424,037 C) 5549,121 D) $659,261 E) 5685,504 8. Assume now that Cullen has a corporate tax rate of %. Pretend that the pre-tax break-even lease payment is $650,000. What is the NAL for the zero-tax lessee? A) $183,222 B) 5318.580 C) $600.152 D) 5586,259