Question

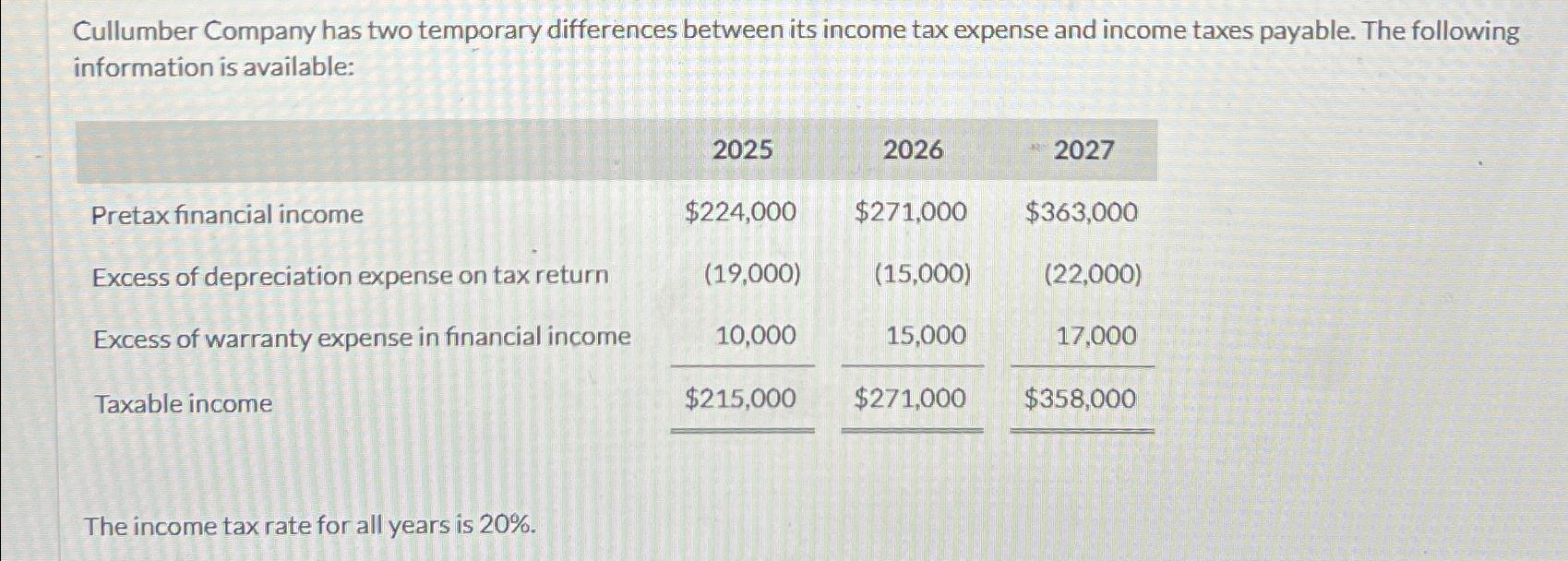

Cullumber Company has two temporary differences between its income tax expense and income taxes payable. The following information is available: 2025 2026 2027 Pretax

Cullumber Company has two temporary differences between its income tax expense and income taxes payable. The following information is available: 2025 2026 2027 Pretax financial income $224,000 $271,000 $363,000 Excess of depreciation expense on tax return (19,000) (15,000) (22,000) Excess of warranty expense in financial income 10,000 15,000 17,000 Taxable income $215,000 $271,000 $358,000 The income tax rate for all years is 20%.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the income tax expense and income taxes payable for each year we need to consider the t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting principles and analysis

Authors: Terry d. Warfield, jerry j. weygandt, Donald e. kieso

2nd Edition

471737933, 978-0471737933

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App