Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Cullumber Company leased equipment from Ayayai Company on July 1, 2025, for an eight-year period expiring June 30, 2033. Equal annual payments under the

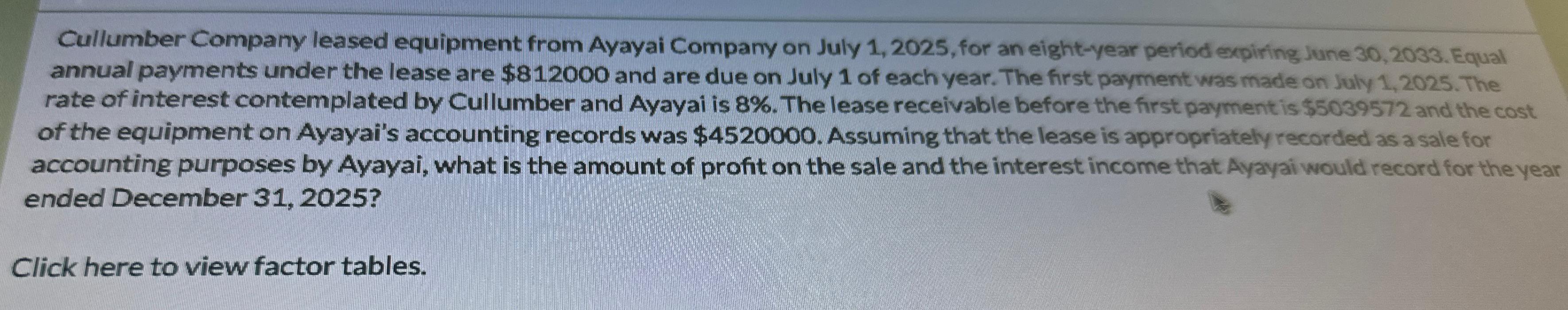

Cullumber Company leased equipment from Ayayai Company on July 1, 2025, for an eight-year period expiring June 30, 2033. Equal annual payments under the lease are $812000 and are due on July 1 of each year. The first payment was made on July 1, 2025. The rate of interest contemplated by Cullumber and Ayayai is 8%. The lease receivable before the first payment is $5039572 and the cost of the equipment on Ayayai's accounting records was $4520000. Assuming that the lease is appropriately recorded as a sale for accounting purposes by Ayayai, what is the amount of profit on the sale and the interest income that Ayayai would record for the year ended December 31, 2025? Click here to view factor tables.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started