Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Cullumber Company owns delivery equipment that cost $53,800 and has accumulated depreciation of $27,300 as of July 30, 2020. On that date, Cullumber disposes

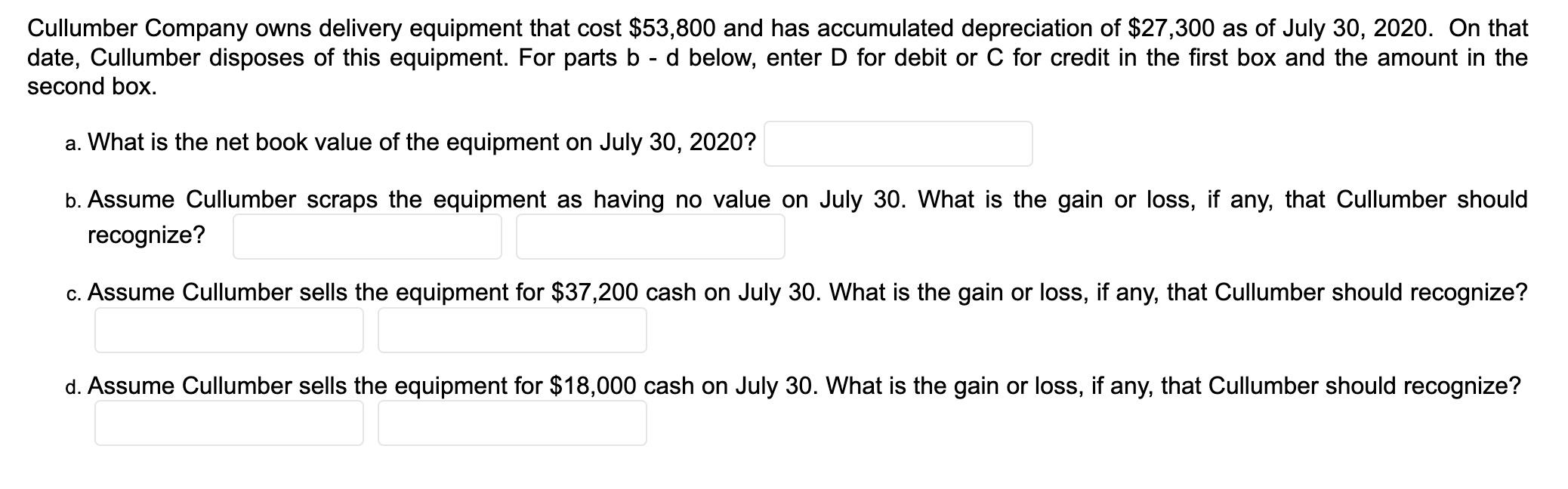

Cullumber Company owns delivery equipment that cost $53,800 and has accumulated depreciation of $27,300 as of July 30, 2020. On that date, Cullumber disposes of this equipment. For parts b - d below, enter D for debit or C for credit in the first box and the amount in the second box. a. What is the net book value of the equipment on July 30, 2020? b. Assume Cullumber scraps the equipment as having no value on July 30. What is the gain or loss, if any, that Cullumber should recognize? c. Assume Cullumber sells the equipment for $37,200 cash on July 30. What is the gain or loss, if any, that Cullumber should recognize? d. Assume Cullumber sells the equipment for $18,000 cash on July 30. What is the gain or loss, if any, that Cullumber should recognize?

Step by Step Solution

★★★★★

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

General Info Equipment Cost 49700 Accumulated Depreciation as of July 30 2020 24800 Sol...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started