Answered step by step

Verified Expert Solution

Question

1 Approved Answer

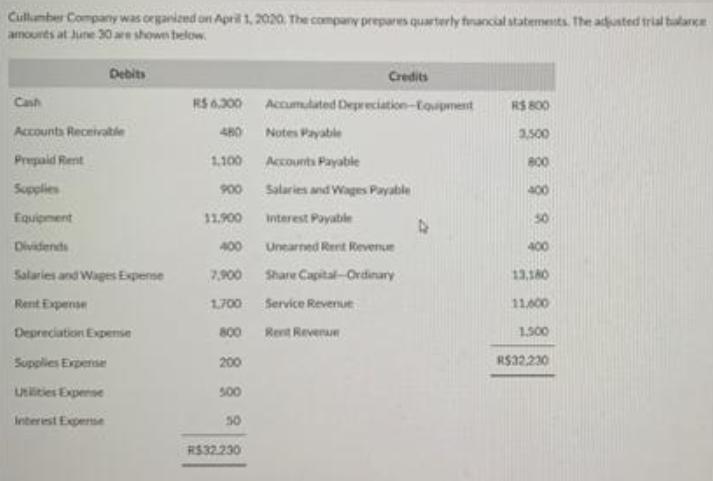

Cullumber Company was organieed on April 1, 2020. The company prepares quarterly francial statemests. The adusted trial balarc amounts at June 30 re showen

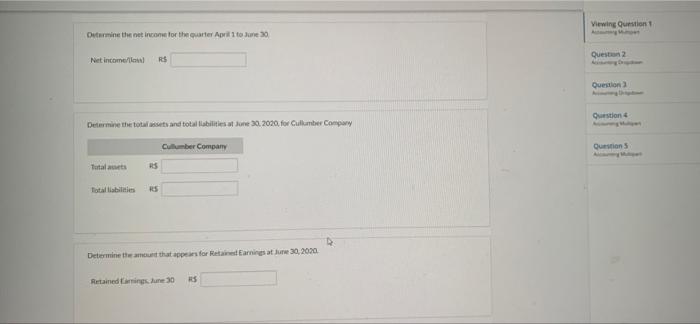

Cullumber Company was organieed on April 1, 2020. The company prepares quarterly francial statemests. The adusted trial balarc amounts at June 30 re showen below. Debits Credits Cash RS 6.300 Accumulated Depreciation-touipment RS 800 Accounts Receivatle 480 Notes Payable 3,500 Prepaid Rent 1,100 Accounts Payable 800 Supplies 900 Salaries and Wages Payable 400 Equipment 11.900 Interest Payable 50 Dividents 400 Unearned Rent Revenue Salaries and Wages Expense 7,900 Share Capital-Ordienary 13,180 Rent Expense 1.700 Service Revenue 11.600 Depreciation Expemie 800 Revt Reverue 1.500 Supplies Expense 200 R$32230 Uities Experse 500 Interest Experse 50 RS32.230 Viewing Question 1 Determine the net incone tor the quarter April 1 to June 30 Queston 2 Net income/lla) RS Question 3 Question 4 Determine the total assets and total labilities at June 30, 2020, for Cullumber Company Culumber Company Question S Tutal auets RS Total liabilnies RS Determine the amout that appears for Retained Earnings at June 30, 2020. Retained amings, June 30 RS

Step by Step Solution

There are 3 Steps involved in it

Step: 1

CALCULATION OF THE NET INCOME AND BALANCE TRANSFER TO RETAINED EARNINGS Service Revenue 11400 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started