Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Cullumber, Inc., has four-year bonds outstanding that pay a coupon rate of 6.9 percent and make coupon payments semiannually. If these bonds are currently selling

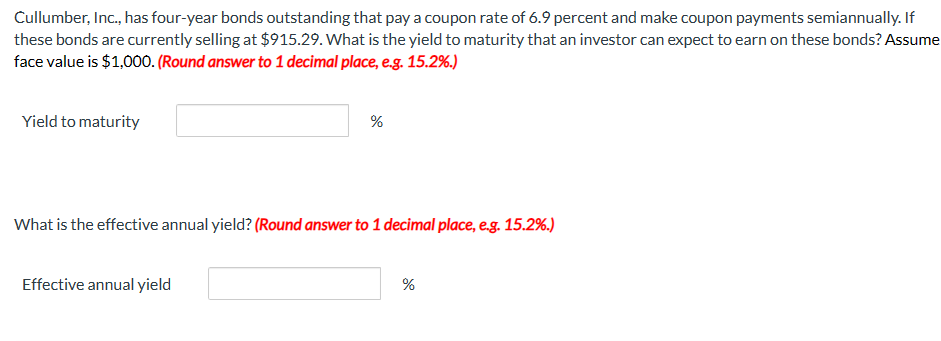

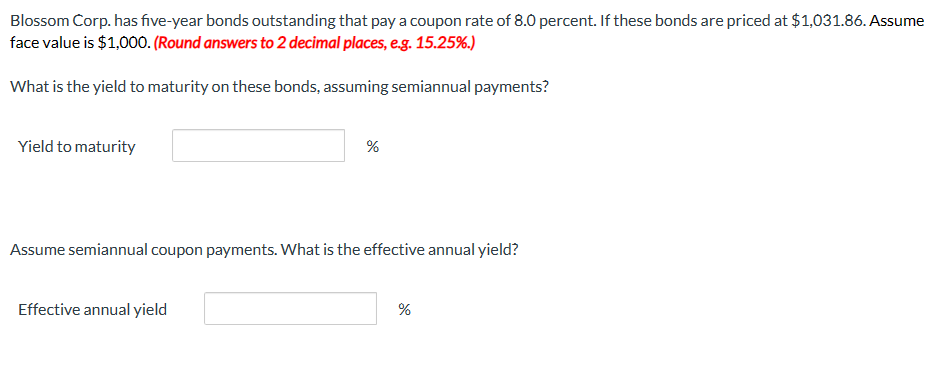

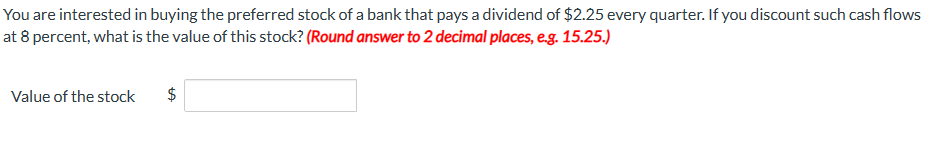

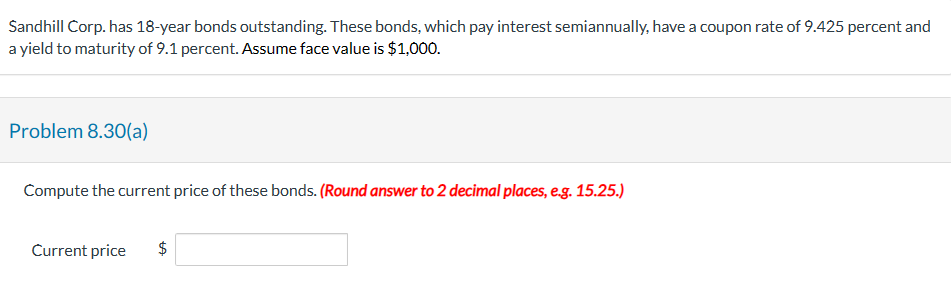

Cullumber, Inc., has four-year bonds outstanding that pay a coupon rate of 6.9 percent and make coupon payments semiannually. If these bonds are currently selling at $915.29. What is the yield to maturity that an investor can expect to earn on these bonds? Assume face value is $1,000. (Round answer to 1 decimal place, e.g. 15.2\%.) Yield to maturity % What is the effective annual yield? (Round answer to 1 decimal place, e.g. 15.2\%.) Effective annual yield % Sandhill Corp. has 18-year bonds outstanding. These bonds, which pay interest semiannually, have a coupon rate of 9.425 percent and a yield to maturity of 9.1 percent. Assume face value is $1,000. Problem 8.30(a) Compute the current price of these bonds. (Round answer to 2 decimal places, e.g. 15.25.) Blossom Corp. has five-year bonds outstanding that pay a coupon rate of 8.0 percent. If these bonds are priced at $1,031.86. Assume face value is $1,000. (Round answers to 2 decimal places, e.g. 15.25%.) What is the yield to maturity on these bonds, assuming semiannual payments? Yield to maturity % Assume semiannual coupon payments. What is the effective annual yield? Effective annual yield % You are interested in buying the preferred stock of a bank that pays a dividend of $2.25 every quarter. If you discount such cash flows at 8 percent, what is the value of this stock? (Round answer to 2 decimal places, e.g. 15.25.) Value of the stock $

Cullumber, Inc., has four-year bonds outstanding that pay a coupon rate of 6.9 percent and make coupon payments semiannually. If these bonds are currently selling at $915.29. What is the yield to maturity that an investor can expect to earn on these bonds? Assume face value is $1,000. (Round answer to 1 decimal place, e.g. 15.2\%.) Yield to maturity % What is the effective annual yield? (Round answer to 1 decimal place, e.g. 15.2\%.) Effective annual yield % Sandhill Corp. has 18-year bonds outstanding. These bonds, which pay interest semiannually, have a coupon rate of 9.425 percent and a yield to maturity of 9.1 percent. Assume face value is $1,000. Problem 8.30(a) Compute the current price of these bonds. (Round answer to 2 decimal places, e.g. 15.25.) Blossom Corp. has five-year bonds outstanding that pay a coupon rate of 8.0 percent. If these bonds are priced at $1,031.86. Assume face value is $1,000. (Round answers to 2 decimal places, e.g. 15.25%.) What is the yield to maturity on these bonds, assuming semiannual payments? Yield to maturity % Assume semiannual coupon payments. What is the effective annual yield? Effective annual yield % You are interested in buying the preferred stock of a bank that pays a dividend of $2.25 every quarter. If you discount such cash flows at 8 percent, what is the value of this stock? (Round answer to 2 decimal places, e.g. 15.25.) Value of the stock $ Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started