Answered step by step

Verified Expert Solution

Question

1 Approved Answer

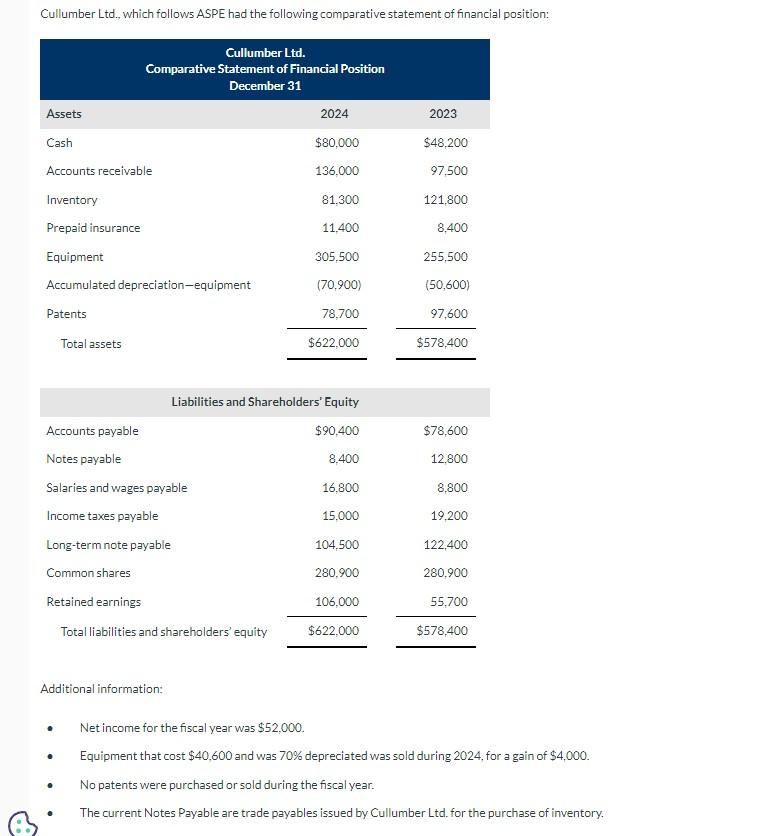

Cullumber Ltd., which follows ASPE had the following comparative statement of financial position: Assets Cash Accounts receivable Inventory Prepaid insurance Equipment Accumulated depreciation-equipment Patents

Cullumber Ltd., which follows ASPE had the following comparative statement of financial position: Assets Cash Accounts receivable Inventory Prepaid insurance Equipment Accumulated depreciation-equipment Patents Cullumber Ltd. Comparative Statement of Financial Position December 31 Total assets Accounts payable Notes payable Salaries and wages payable Income taxes payable Long-term note payable Common shares . Retained earnings Total liabilities and shareholders' equity Additional information: . Liabilities and Shareholders' Equity $90,400 8,400 16,800 15,000 2024 $80,000 136.000 81,300 11,400 305,500 (70,900) 78,700 $622,000 104,500 280,900 106,000 $622,000 2023 $48,200 97,500 121,800 8,400 255,500 (50,600) 97,600 $578,400 $78,600 12,800 8,800 19,200 122,400 280,900 55,700 $578,400 Net income for the fiscal year was $52,000. Equipment that cost $40,600 and was 70% depreciated was sold during 2024, for a gain of $4,000. No patents were purchased or sold during the fiscal year. The current Notes Payable are trade payables issued by Cullumber Ltd. for the purchase of inventory. Prepare the operating activities section of a statement of cash flows using the indirect format

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Net Income for the year 52000 Add back noncash expenses Depreciation expense Original cost of equipm...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started