Answered step by step

Verified Expert Solution

Question

1 Approved Answer

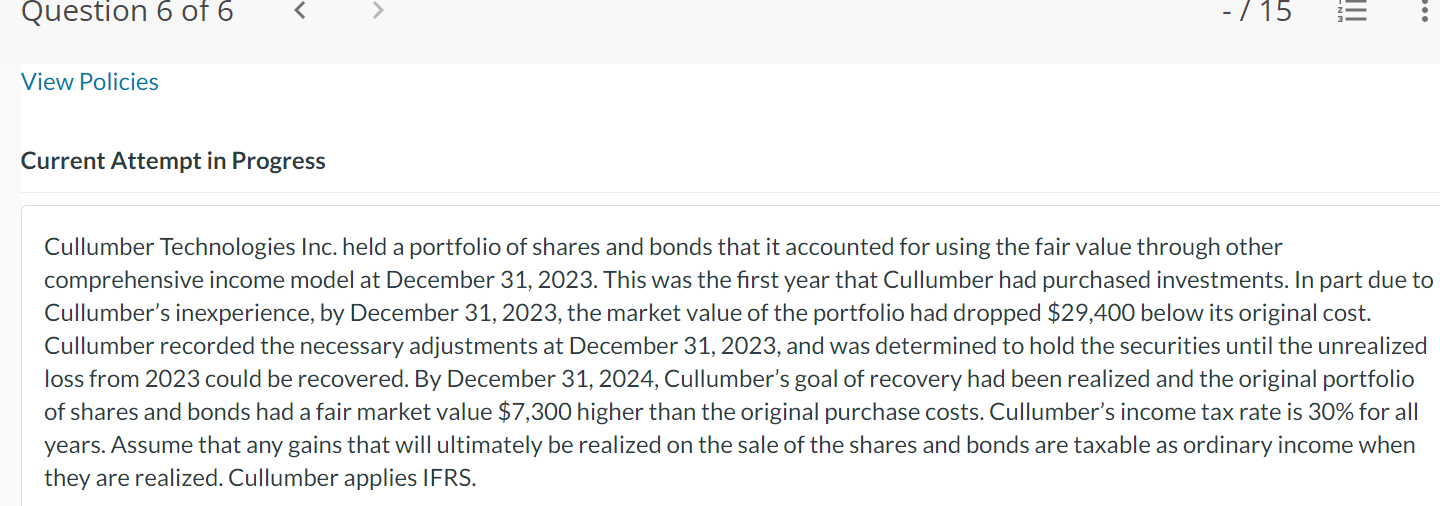

Cullumber Technologies Inc. held a portfolio of shares and bonds that it accounted for using the fair value through other comprehensive income model at December

Cullumber Technologies Inc. held a portfolio of shares and bonds that it accounted for using the fair value through other

comprehensive income model at December This was the first year that Cullumber had purchased investments. In part due to

Cullumber's inexperience, by December the market value of the portfolio had dropped $ below its original cost.

Cullumber recorded the necessary adjustments at December and was determined to hold the securities until the unrealized

Ioss from could be recovered. By December Cullumber's goal of recovery had been realized and the original portfolio

of shares and bonds had a fair market value $ higher than the original purchase costs. Cullumber's income tax rate is for all

years. Assume that any gains that will ultimately be realized on the sale of the shares and bonds are taxable as ordinary income when

they are realized. Cullumber applies IFRS.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started