Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Cullumber-Line Inc. (CLI) is a manufacturer that produces parts for residential telephones. Recent indications are that the market for this product is likely to

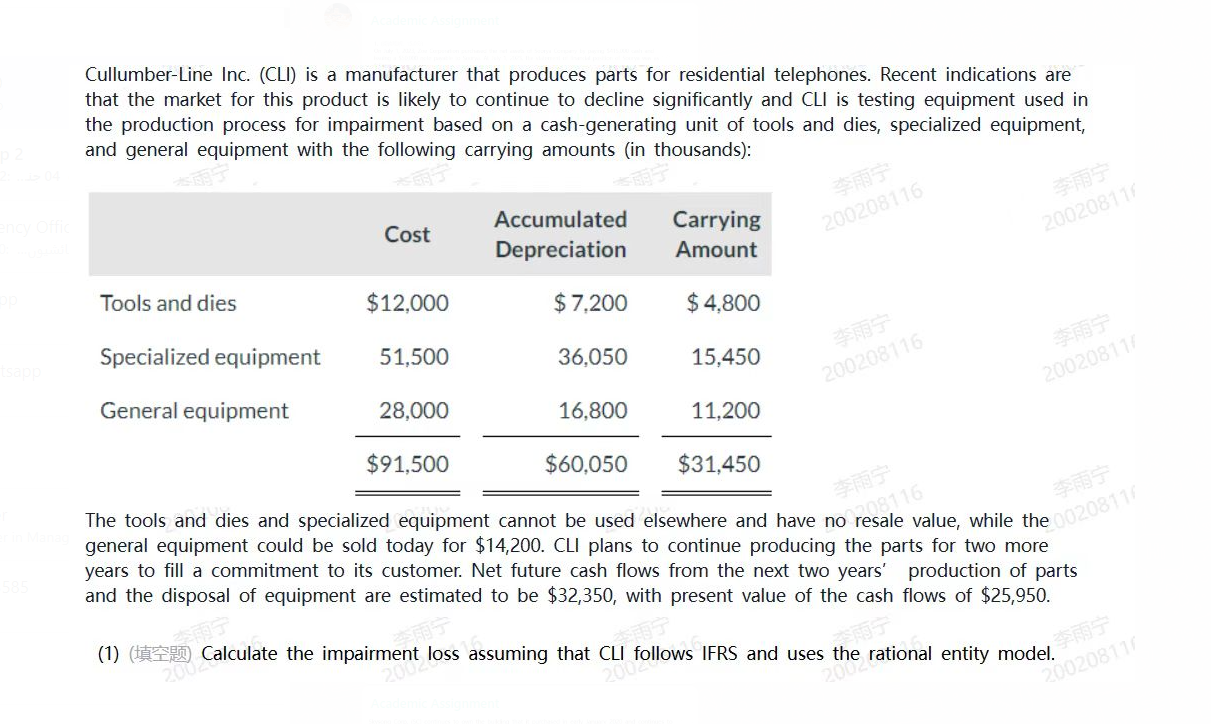

Cullumber-Line Inc. (CLI) is a manufacturer that produces parts for residential telephones. Recent indications are that the market for this product is likely to continue to decline significantly and CLI is testing equipment used in the production process for impairment based on a cash-generating unit of tools and dies, specialized equipment, and general equipment with the following carrying amounts (in thousands): ency Offic Cost Accumulated Depreciation Carrying 200208116 Tools and dies Amount 200208116 $12,000 $7,200 tsapp Specialized equipment $ 4,800 51,500 36,050 General equipment 15,450 28,000 200208116 16,800 20020811/ 11,200 $91,500 $60,050 $31,450 The tools and dies and specialized equipment cannot be used elsewhere and have no resale value, while the 020811 208116 general equipment could be sold today for $14,200. CLI plans to continue producing the parts for two more years to fill a commitment to its customer. Net future cash flows from the next two years' production of parts and the disposal of equipment are estimated to be $32,350, with present value of the cash flows of $25,950. 2002 2002 (1) (Calculate the impairment loss assuming that CLI follows IFRS and uses the rational entity model. 2002 the 2002 20020811

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the impairment loss for CullumberLine Inc CLI based on the rational entity model under ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started