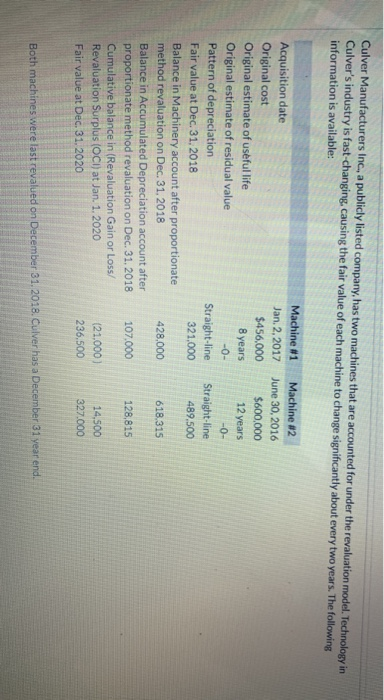

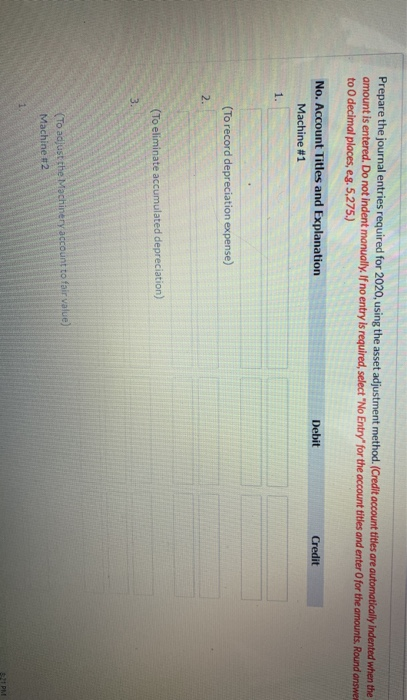

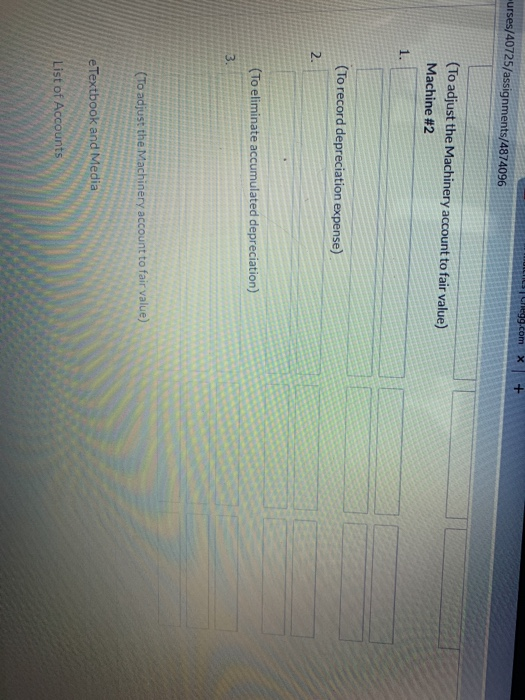

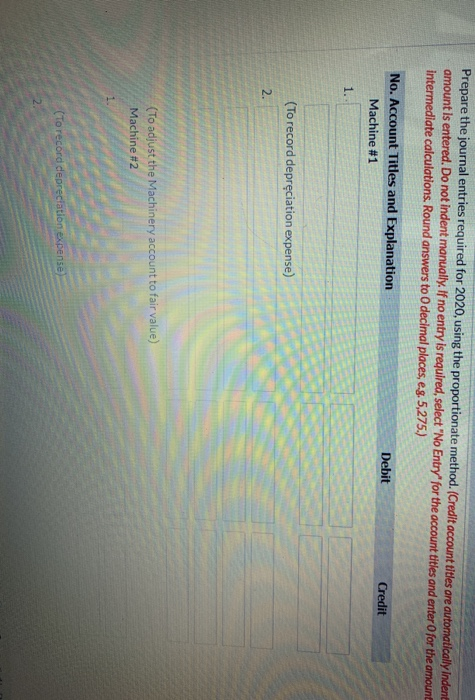

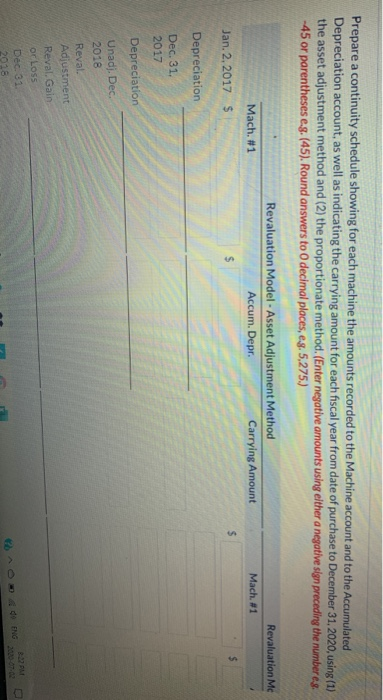

Culver Manufacturers Inc, a publicly listed company, has two machines that are accounted for under the revaluation model. Technology in Culver's industry is fast-changing, causing the fair value of each machine to change significantly about every two years. The following information is available: Machine #1 Jan. 2. 2017 $456,000 8 years -0- Straight-line 321.000 Machine #2 June 30, 2016 $600,000 12 years -0- Straight-line 489.500 Acquisition date Original cost Original estimate of useful life Original estimate of residual value Pattern of depreciation Fair value at Dec 31, 2018 Balance in Machinery account after proportionate method revaluation on Dec. 31, 2018 Balance in Accumulated Depreciation account after proportionate method revaluation on Dec. 31. 2018 Cumulative balance in (Revaluation Gain or Loss/ Revaluation Surplus (CI) at Jan. 1. 2020 Fair value at Dec 31, 2020 428,000 618.315 107.000 128,815 (21.000) 236.500 14,500 327.000 Both machines were last revalued on December 31, 2018. Culver has a December 31 year end. Prepare the journal entries required for 2020, using the asset adjustment method. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts. Round answer to O decimal places, e.g. 5,275.) No. Account Titles and Explanation Machine #1 Debit Credit 1. (To record depreciation expense) 2. (To eliminate accumulated depreciation) 3. (To adjust the Machinery account to fair value) Machine 2 21 PM Chegg.com X + -urses/40725/assignments/4874096 (To adjust the Machinery account to fair value) Machine #2 1. (To record depreciation expense) 2. (To eliminate accumulated depreciation) 3. (To adjust the Machinery account to fair value) e Textbook and Media List of Accounts Prepare the journal entries required for 2020, using the proportionate method. (Credit account titles are automatically Inden amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter for the amount intermediate calculations. Round answers to decimal places, e.g. 5,275.) No. Account Titles and Explanation Machine #1 Debit Credit 1. (To record depreciation expense) 2. (To adjust the Machinery account to fair value) Machine #2 (To record depreciation expense) Prepare a continuity schedule showing for each machine the amounts recorded to the Machine account and to the Accumulated Depreciation account, as well as indicating the carrying amount for each fiscal year from date of purchase to December 31, 2020, using (1) the asset adjustment method and (2) the proportionate method. (Enter negative amounts using either a negative sign preceding the numberes. -45 or parentheses e.g. (45). Round answers to decimal places, e.g. 5,275.) Revaluation Mc Revaluation Model - Asset Adjustment Method Accum. Depr. Carrying Amount Mach. #1 Mach #1 Jan. 2. 2017 $ $ $ $ Depreciation Dec. 31. 2017 Depreciation Unadj. Dec 2018 Reval. Adjustment Reval. Gain Or Loss Dec 31 2018 de ENG Culver Manufacturers Inc, a publicly listed company, has two machines that are accounted for under the revaluation model. Technology in Culver's industry is fast-changing, causing the fair value of each machine to change significantly about every two years. The following information is available: Machine #1 Jan. 2. 2017 $456,000 8 years -0- Straight-line 321.000 Machine #2 June 30, 2016 $600,000 12 years -0- Straight-line 489.500 Acquisition date Original cost Original estimate of useful life Original estimate of residual value Pattern of depreciation Fair value at Dec 31, 2018 Balance in Machinery account after proportionate method revaluation on Dec. 31, 2018 Balance in Accumulated Depreciation account after proportionate method revaluation on Dec. 31. 2018 Cumulative balance in (Revaluation Gain or Loss/ Revaluation Surplus (CI) at Jan. 1. 2020 Fair value at Dec 31, 2020 428,000 618.315 107.000 128,815 (21.000) 236.500 14,500 327.000 Both machines were last revalued on December 31, 2018. Culver has a December 31 year end. Prepare the journal entries required for 2020, using the asset adjustment method. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts. Round answer to O decimal places, e.g. 5,275.) No. Account Titles and Explanation Machine #1 Debit Credit 1. (To record depreciation expense) 2. (To eliminate accumulated depreciation) 3. (To adjust the Machinery account to fair value) Machine 2 21 PM Chegg.com X + -urses/40725/assignments/4874096 (To adjust the Machinery account to fair value) Machine #2 1. (To record depreciation expense) 2. (To eliminate accumulated depreciation) 3. (To adjust the Machinery account to fair value) e Textbook and Media List of Accounts Prepare the journal entries required for 2020, using the proportionate method. (Credit account titles are automatically Inden amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter for the amount intermediate calculations. Round answers to decimal places, e.g. 5,275.) No. Account Titles and Explanation Machine #1 Debit Credit 1. (To record depreciation expense) 2. (To adjust the Machinery account to fair value) Machine #2 (To record depreciation expense) Prepare a continuity schedule showing for each machine the amounts recorded to the Machine account and to the Accumulated Depreciation account, as well as indicating the carrying amount for each fiscal year from date of purchase to December 31, 2020, using (1) the asset adjustment method and (2) the proportionate method. (Enter negative amounts using either a negative sign preceding the numberes. -45 or parentheses e.g. (45). Round answers to decimal places, e.g. 5,275.) Revaluation Mc Revaluation Model - Asset Adjustment Method Accum. Depr. Carrying Amount Mach. #1 Mach #1 Jan. 2. 2017 $ $ $ $ Depreciation Dec. 31. 2017 Depreciation Unadj. Dec 2018 Reval. Adjustment Reval. Gain Or Loss Dec 31 2018 de ENG