Answered step by step

Verified Expert Solution

Question

1 Approved Answer

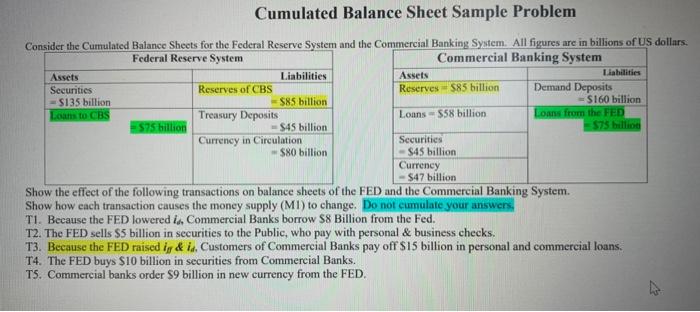

Cumulated Balance Sheet Sample Problem Consider the Cumulated Balance Sheets for the Federal Reserve System and the Commercial Banking System. All figures are in

Cumulated Balance Sheet Sample Problem Consider the Cumulated Balance Sheets for the Federal Reserve System and the Commercial Banking System. All figures are in billions of US dollars. Federal Reserve System Commercial Banking System Assets Liabilities Liabilities Assets Securities Reserves of CBS Reserves $85 billion Demand Deposits -$135 billion Loans to CBS -$85 billion - $160 billion Treasury Deposits Loans $58 billion $75 billion -$45 billion Currency in Circulation -$80 billion Loans from the FED $75 billion Securities $45 billion Currency -$47 billion Show the effect of the following transactions on balance sheets of the FED and the Commercial Banking System. Show how each transaction causes the money supply (M1) to change. Do not cumulate your answers, T1. Because the FED lowered is, Commercial Banks borrow $8 Billion from the Fed. T2. The FED sells $5 billion in securities to the Public, who pay with personal & business checks. T3. Because the FED raised in & ia, Customers of Commercial Banks pay off $15 billion in personal and commercial loans. T4. The FED buys $10 billion in securities from Commercial Banks. T5. Commercial banks order $9 billion in new currency from the FED.

Step by Step Solution

★★★★★

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

To analyze the effect of the transactions on the balance sheets of the Federal Reserve System FED and the Commercial Banking System CBS as well as the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started