Question

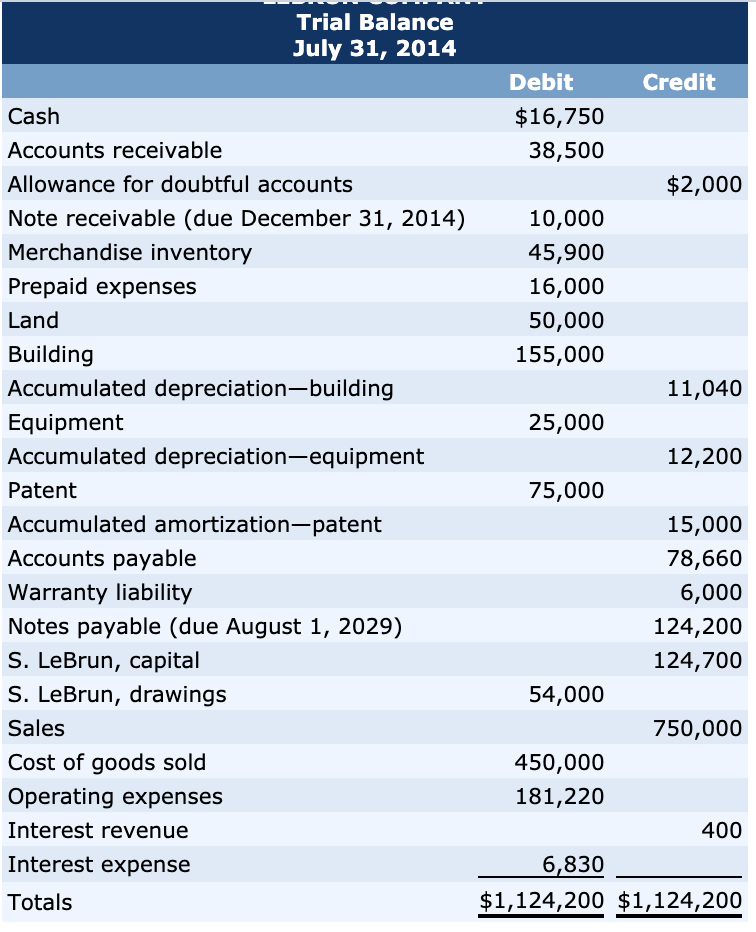

Cumulative Coverage - Chapters 3 to 10 The unadjusted trial balance of LeBrun Company at its year end, July 31, 2014, is as follows: Adjustment

Cumulative Coverage - Chapters 3 to 10

The unadjusted trial balance of LeBrun Company at its year end, July 31, 2014, is as follows:

Adjustment data:

- Estimated uncollectible accounts receivable at July 31 are $3,850.

- The note receivable bears interest of 8% and was issued on December 31, 2013. Interest is payable the first of each month.

- A physical count of inventory determined that $39,220 of inventory was actually on hand.

- Prepaid expenses of $5,540 expired in the year. (use the account Operating Expenses.)

- Depreciation is calculated on the long-lived assets using the following methods and useful lives:

Building: straight-line, 25 years, $12,000 residual value Equipment: double diminishing-balance, five years, $2,500 residual value Patent: straight-line, five years, no residual value - The 6% note payable was issued on August 1, 2004. Interest is paid monthly at the beginning of each month for the previous months interest. Of the note principal, $1,680 is currently due.

- Estimated warranty costs for July are $2,035. (Use the account Operating Expenses.)

a) Prepare the adjusting journal entries required at July 31.

b) Prepare an adjusted trial balance at July 31.

c) Prepare a multiple-step income statement for the year at July 31.

d) Prepare a statement of owners equity for the year at July 31.

e) Prepare a balance sheet for the year at July 31. (List Current Assets in order of liquidity. List Property, Plant and Equipment in order of Land, Buildings and Equipment.)

Trial Balance July 31, 2014 Credit Debit $16,750 38,500 $2,000 10,000 45,900 16,000 50,000 155,000 11,040 25,000 12,200 75,000 Cash Accounts receivable Allowance for doubtful accounts Note receivable (due December 31, 2014) Merchandise inventory Prepaid expenses Land Building Accumulated depreciation-building Equipment Accumulated depreciation equipment Patent Accumulated amortization-patent Accounts payable Warranty liability Notes payable (due August 1, 2029) S. LeBrun, capital S. LeBrun, drawings Sales Cost of goods sold Operating expenses Interest revenue Interest expense Totals 15,000 78,660 6,000 124,200 124,700 54,000 750,000 450,000 181,220 400 6,830 $1,124,200 $1,124,200

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started