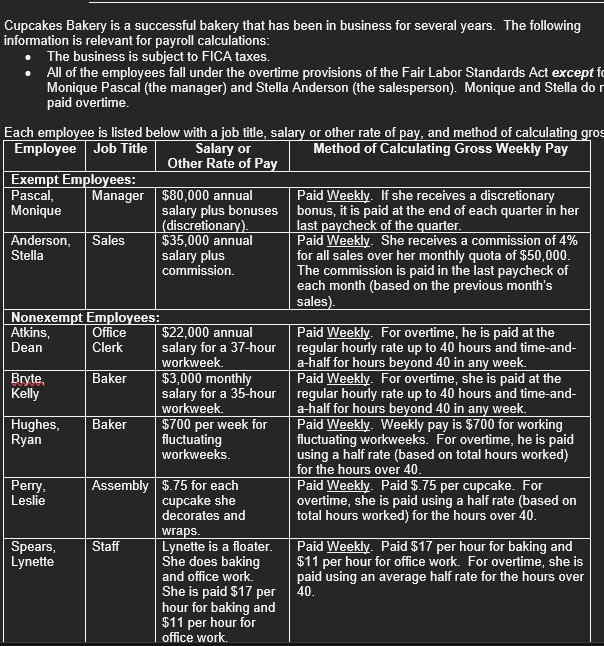

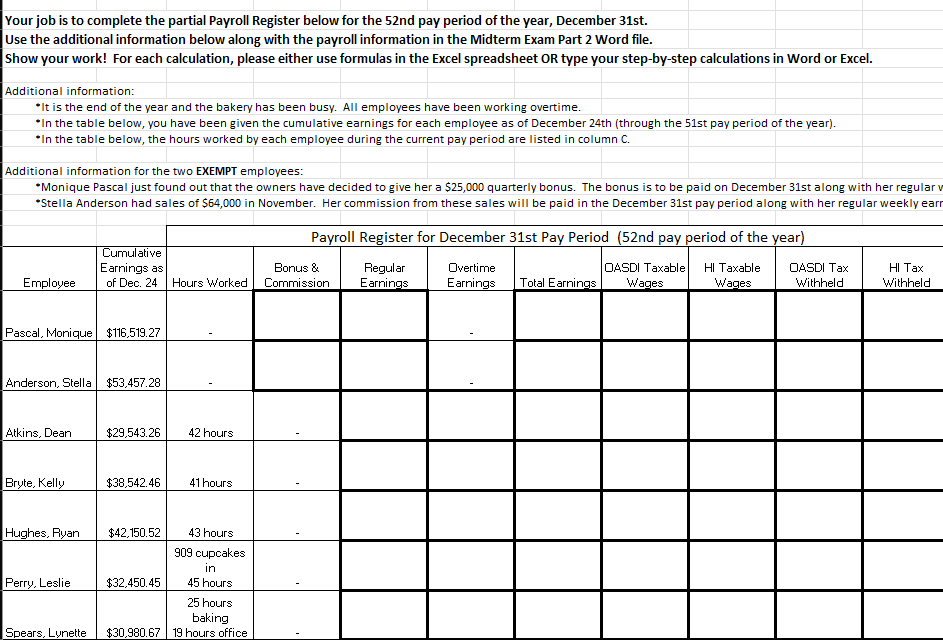

Cupcakes Bakery is a successful bakery that has been in business for several years. The following nformation is relevant for payroll calculations: Your job is to complete the partial Payroll Register below for the 52nd pay period of the year, December 31st. Use the additional information below along with the payroll information in the Midterm Exam Part 2 Word file. Show your work! For each calculation, please either use formulas in the Excel spreadsheet OR type your step-by-step calculations in Word or Excel. Additional information: -It is the end of the year and the bakery has been busy. All employees have been working overtime. -In the table below, you have been given the cumulative earnings for each employee as of December 24th (through the 51st pay period of the year). - In the table below, the hours worked by each employee during the current pay period are listed in column C. Additional information for the two EXEMPT employees: -Monique Pascal just found out that the owners have decided to give her a $25,000 quarterly bonus. The bonus is to be paid on December 31 st along with her regular v - Stella Anderson had sales of $64,000 in November. Her commission from these sales will be paid in the December 31 st pay period along with her regular weekly earr Cupcakes Bakery is a successful bakery that has been in business for several years. The following nformation is relevant for payroll calculations: Your job is to complete the partial Payroll Register below for the 52nd pay period of the year, December 31st. Use the additional information below along with the payroll information in the Midterm Exam Part 2 Word file. Show your work! For each calculation, please either use formulas in the Excel spreadsheet OR type your step-by-step calculations in Word or Excel. Additional information: -It is the end of the year and the bakery has been busy. All employees have been working overtime. -In the table below, you have been given the cumulative earnings for each employee as of December 24th (through the 51st pay period of the year). - In the table below, the hours worked by each employee during the current pay period are listed in column C. Additional information for the two EXEMPT employees: -Monique Pascal just found out that the owners have decided to give her a $25,000 quarterly bonus. The bonus is to be paid on December 31 st along with her regular v - Stella Anderson had sales of $64,000 in November. Her commission from these sales will be paid in the December 31 st pay period along with her regular weekly earr