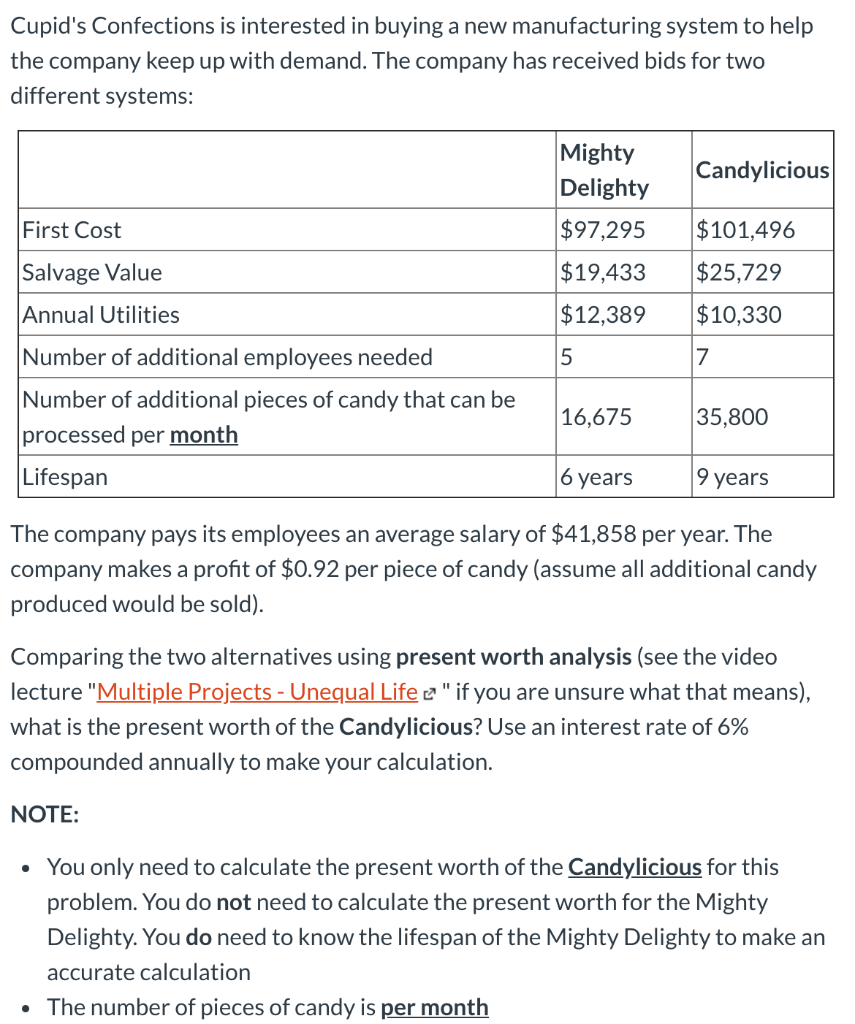

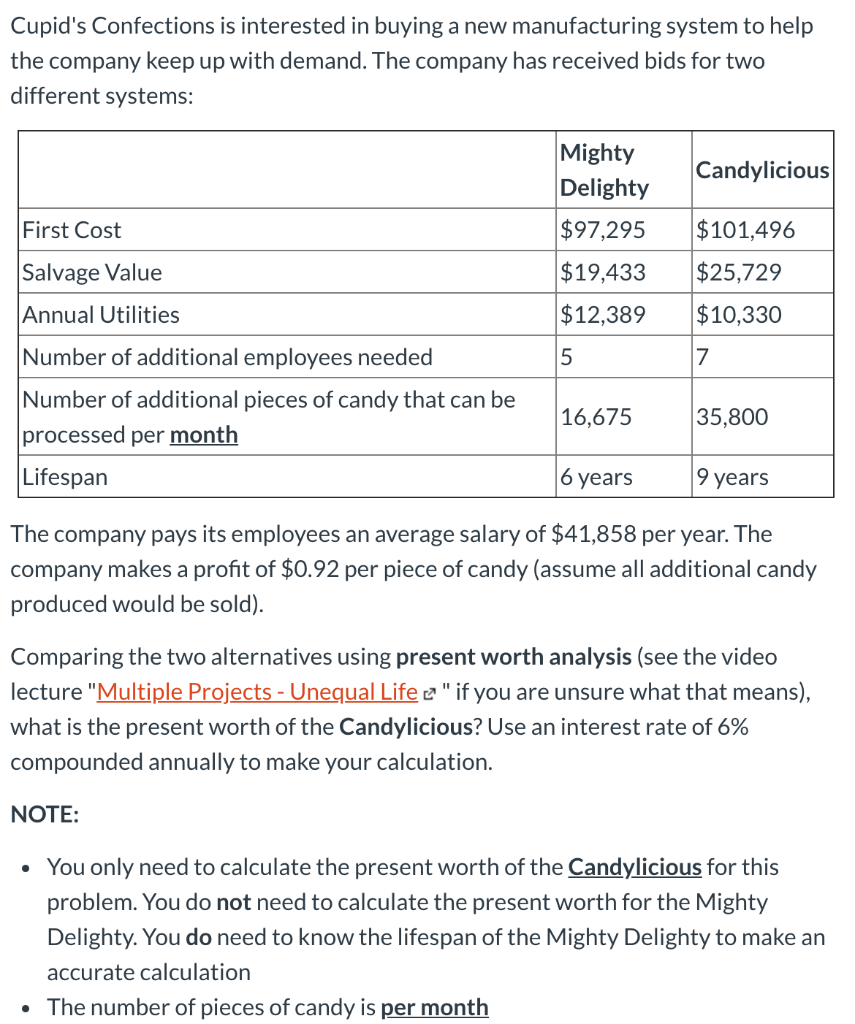

Cupid's Confections is interested in buying a new manufacturing system to help the company keep up with demand. The company has received bids for two different systems: Mighty Delighty Candylicious First Cost $97,295 $101,496 Salvage Value $19,433 $12,389 $25,729 $10,330 Annual Utilities 7 Number of additional employees needed Number of additional pieces of candy that can be processed per month 16,675 35,800 Lifespan 6 years 9 years The company pays its employees an average salary of $41,858 per year. The company makes a profit of $0.92 per piece of candy (assume all additional candy produced would be sold). Comparing the two alternatives using present worth analysis (see the video lecture "Multiple Projects - Unequal Life "if you are unsure what that means), what is the present worth of the Candylicious? Use an interest rate of 6% compounded annually to make your calculation. NOTE: You only need to calculate the present worth of the Candylicious for this problem. You do not need to calculate the present worth for the Mighty Delighty. You do need to know the lifespan of the Mighty Delighty to make an accurate calculation The number of pieces of candy is per month Cupid's Confections is interested in buying a new manufacturing system to help the company keep up with demand. The company has received bids for two different systems: Mighty Delighty Candylicious First Cost $97,295 $101,496 Salvage Value $19,433 $12,389 $25,729 $10,330 Annual Utilities 7 Number of additional employees needed Number of additional pieces of candy that can be processed per month 16,675 35,800 Lifespan 6 years 9 years The company pays its employees an average salary of $41,858 per year. The company makes a profit of $0.92 per piece of candy (assume all additional candy produced would be sold). Comparing the two alternatives using present worth analysis (see the video lecture "Multiple Projects - Unequal Life "if you are unsure what that means), what is the present worth of the Candylicious? Use an interest rate of 6% compounded annually to make your calculation. NOTE: You only need to calculate the present worth of the Candylicious for this problem. You do not need to calculate the present worth for the Mighty Delighty. You do need to know the lifespan of the Mighty Delighty to make an accurate calculation The number of pieces of candy is per month