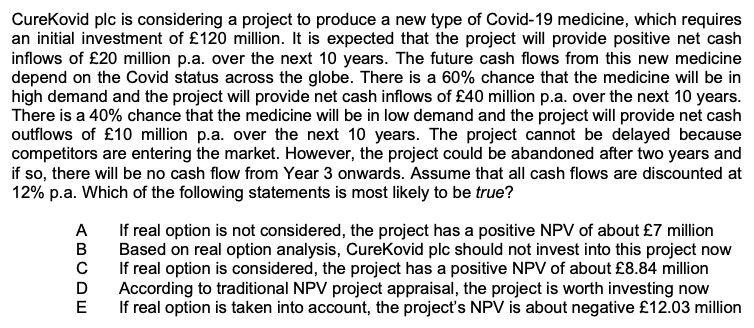

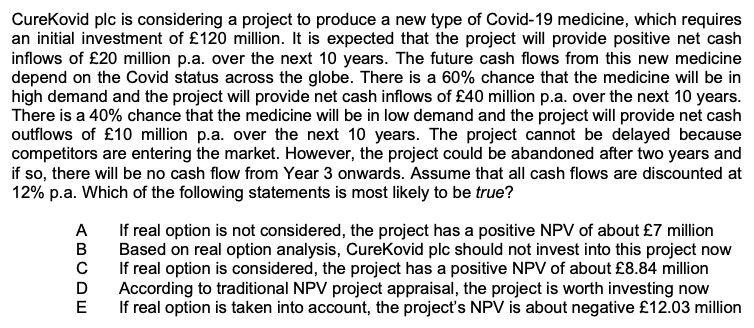

CureKovid plc is considering a project to produce a new type of Covid-19 medicine, which requires an initial investment of 120 million. It is expected that the project will provide positive net cash inflows of 20 million p.a. over the next 10 years. The future cash flows from this new medicine depend on the Covid status across the globe. There is a 60% chance that the medicine will be in high demand and the project will provide net cash inflows of 40 million p.a. over the next 10 years. There is a 40% chance that the medicine will be in low demand and the project will provide net cash outflows of 10 million p.a. over the next 10 years. The project cannot be delayed because competitors are entering the market. However, the project could be abandoned after two years and if so, there will be no cash flow from Year 3 onwards. Assume that all cash flows are discounted at 12% p.a. Which of the following statements is most likely to be true? A If real option is not considered, the project has a positive NPV of about 7 million B Based on real option analysis, CureKovid plc should not invest into this project now C If real option is considered, the project has a positive NPV of about 8.84 million D According to traditional NPV project appraisal, the project is worth investing now E If real option is taken into account, the project's NPV is about negative 12.03 million CureKovid plc is considering a project to produce a new type of Covid-19 medicine, which requires an initial investment of 120 million. It is expected that the project will provide positive net cash inflows of 20 million p.a. over the next 10 years. The future cash flows from this new medicine depend on the Covid status across the globe. There is a 60% chance that the medicine will be in high demand and the project will provide net cash inflows of 40 million p.a. over the next 10 years. There is a 40% chance that the medicine will be in low demand and the project will provide net cash outflows of 10 million p.a. over the next 10 years. The project cannot be delayed because competitors are entering the market. However, the project could be abandoned after two years and if so, there will be no cash flow from Year 3 onwards. Assume that all cash flows are discounted at 12% p.a. Which of the following statements is most likely to be true? A If real option is not considered, the project has a positive NPV of about 7 million B Based on real option analysis, CureKovid plc should not invest into this project now C If real option is considered, the project has a positive NPV of about 8.84 million D According to traditional NPV project appraisal, the project is worth investing now E If real option is taken into account, the project's NPV is about negative 12.03 million