Answered step by step

Verified Expert Solution

Question

1 Approved Answer

currency) will play a dominant role in the world and will - possibly - replace some previously established businesses (if not the whole markets). But

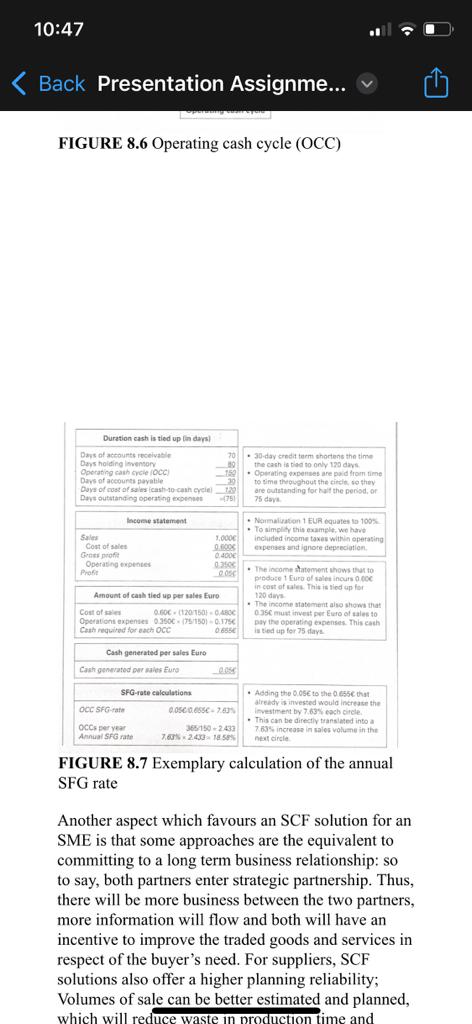

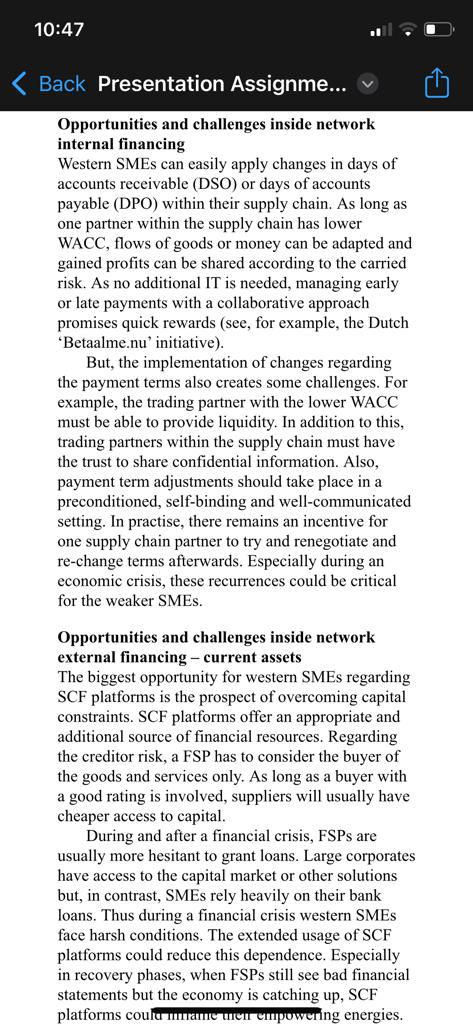

currency) will play a dominant role in the world and will - possibly - replace some previously established businesses (if not the whole markets). But - to achieve such a supremacy - changes are necessary to rebuild the Chinese banking system. Consequently, an alternative supply of capital is needed to keep the economic system afloat. SCF solutions might be a promising way to provide liquidity to the economy; the question is whether the Chinese government will allow SCF solutions at high volumes. Currently, the Chinese capital market is more or less isolated, something which tempered the effects of the financial crisis. Such isolation is also easier to monitor and regulate due to a lower degree of complexity. In China the government heavily influences lending behaviour and therefore promotes and subsidise certain industries. SCF solutions, which probably would be offered by international and non-Chinese players, would increase independence from Chinese banks and consequently the Chinese government. But, in contrast to loans, SCF solutions are more complex and they are 'the new kid on the block'. In order to push SCF solutions into the Chinese market, there would be the need for a lobby promoting these Concepts. In addition, general improvements in the financial infrastructure would enhance the chance of successful implementation of SCF solutions. For example, approximation to or harmonisation of international standards like accounting and auditing standards, credit reporting systems, collateral and insolvency regimes as well as payment and settlement systems will be beneficial (World Bank, 2010) Furthermore, the 'shadow banking' market in China has become too big to fail. A catchy example is the rapidly increased popularity of P2P lending. The Chinese government recently started to regulate these P2P systems. Ongoing volume growth and the impact in case of default to the system created a pitfall. Even for this reason, it would make sense to establish alternative sources of capital for the economy. Here, SCF could also played a vital role to foster business growth in China. The key is having the right levels of support from the government (especially legal, tax and regulatory amonorues as wel as urisdiction) to Opportunities and challenges external network external financing AR are usually a big element of a balance sheet. Trade receivable securitization (TRS) helps SMEs to turn their AR into quick cash. As long as the AR relates to a customer with a higher credit rating, that is lower cost of capital than the SME, an optimisation opportunity exists. An opportunity can also arise due to the flexibility of TRS. In case a SME has not sufficient AR to achieve the necessary limit of $50 million, An issuer could set up a pool with AR from other companies. An example might be that only AR are used from one buyer but from several suppliers, or AR from companies within a region, or within the same industry, are included. In addition, to increase marketability, over-collateralisation or insurance can be included. Western SMEs wishing to conduct a TRS transaction will have a limited choice when considering the acting financial intermediary, that is investment bank, due to their size. It is obvious that a smaller seller is with high probability less connected in the financial markets and potential investors would be more sceptical. Another challenge is that Western SMEs must have access to AR from companies with a good credit rating. Credit arbitrage is possible only if the customer of the suppliers has a higher credit rating. Added to this the SME must have qualified staff who can support the issuer setting up the transaction. 8.5 Summary From the discussion in this chapter, we can take out some useful rsum when acting in China with Chinese firms or while making business in Islamicoriented countries. Furthermore, some important issues for SCF regarding SMEs were tackled. To sum up, socio-cultural aspects will become increasingly significant in the near future. Corporates need to account for distinctive SCF features against this backdrop of 'regional' specialties (especially legislations), values and behaviour patterns. Recap on Chinese financing and SCF In the long run, the Chinese market (including How to on-board SME-suppliers efficiently There are seven principles for onboarding SME suppliers on a reverse factoring platform: 77. Be proactive: corporates should address supplier onboarding proactively rather than reactively. They should make the process seamless from the beginning so that suppliers have no cause to push back. 78. Prioritise suppliers to on-board: based on the Pareto principle, 20% of the suppliers will typically account for 80% of the total spend. By focusing on that 20%, the corporates will get more of their spend into the system even while onboarding a smaller number of suppliers. Then, once the top vendors are on-board, the focus can be expanded to the next tier. 79. Plan how do suppliers will connect: corporates have to determine whether the suppliers already use a defined EDI format because SMEs would easily buy into a system that they are already using. Between these suppliers it is important to prioritise the onboarding of those suppliers which use supported browsers - changing browsers is easier and more cost effective than developing support for a new browser. 80. Make registration of individual suppliers and users as easy as possible: automatic onboarding of 80% of the suppliers will allow corporates to focus on the 20% that run into issues. It should be possible to send suppliers email invitation with a link, username and password, and to allow suppliers to submit various documents and required certificates online so they can be tracked efficiently. 81. Plan for future growth: a merger or acquisition can increase the number of suppliers to be onboarded. If a corporate is currently in an expansion phase, numerous connectivity and management options into the collaboration platform should be considered, in order to retain scalability. but, in contrast, SMEs rely heavily on their bank loans. Thus during a financial crisis western SMEs face harsh conditions. The extended usage of SCF platforms could reduce this dependence. Especially in recovery phases, when FSPs still see bad financial statements but the economy is catching up, SCF platforms could inflame their empowering energies. Entering an SCF platform project helps create a strong bond between supply chain partners. For an SME in particular this has several advantages. The depreciation and operating costs are high, but are taken from the initiating corporate. Furthermore, the buyer has an incentive to stay with the chosen suppliers. So SMEs have a higher planning reliability and an advantage against competitors (positive lockin effect). As a result a, the supplier can also tackle projects with a longer time horizon regarding the demanded products or goods. In contrast, there are also challenges. SMEsuppliers must be able to provide a certain production capacity to achieve a certain turnover and frequency regarding deals with the supplier to offset the costs for the SCF platform. At the same time, these ties with the buyer will create a certain negative look-in effect. The buyer will make sure that the supplier stays, which potentially blocks other business opportunities. At the same time an unpleasant development for the buyer will directly influence the supplier, which creates a dependency risk. And additional challenge is that the buyer carefully reflects which supplier will be picked for the SCF platform. SMEs face disadvantages according to their size. For example, small SMEs will have a lower production capacity and their dependence on key persons will be higher. Also, due to lower output, costs for products or services will be probably higher due to higher costs for pre-products. While using an SCF platform, one of the major problems is, therefore, the rapid and efficient onboarding of suppliers - independently of their size and the corresponding trade volume (respectively customers on an account receivable solution). The success of this form of inside network external financing is directly tied to supplier willingness to use the system. So the only way to get return on encourage the SCF approach. There are definitely signs that support exists in China. Recap on Islamic financing and SCF Supply chain finance provides some halalconforming opportunities for policymakers in countries where Islam is the state religion. It should be noted that Islamic banking is a complement rather than a substitute. However, even as a complement it might stabilise a financial sector in a country. This is similar to SCF solutions. In most cases it will be an additional capital source but it could also help to reduce risk. Furthermore, this year solutions could pay a positive role in continuous development of these markets. To date, Islamic banks appear more protected against risk than large conventional banks. One reason is that they are financed primarily from deposit accounts, which grants stability. Islamic banks also did not engage in the secondary market, for example in the subprime mortgage market. This means that Islamic financing can help to diversify systematic risk due to their different exposure (Imam and Kpodad, 2013). Unfortunately, as soon as the real economy was hit in 2008/2009, Islamic banks perform as badly as their conventional competitors (Hasan and Dridi, 2011). Some SCF solutions could support the economic stability of a country due to the link between flow of goods or services and money. As demand increases, capital is available. Overall, promoting SCF solutions could benefit the reputations of politicians in a Muslim society, as SCF can provide several opportunities and in addition it can be totally in line with the requirements of shariah and other Islamic principles. The heterogeneity of Islamic financing is - and will remain - one of the major challenges to introducing SCF in such regions and cultural context in the future. Excursus: Elaborating the internal financing capability of a firm For the determination of the self-financeable growth (SFG) rate, three factors are essential: 71. A company's operating cash cycle (OCC), which is the amount of time that company's money is tied up in inventory and other current assets before the company is paid for the goods and services it produces (figure 8.6). 72. The amount of cash needed to finance each dollar of sales, including working capital and operating expenses. 73. The amount of cash generated by each dollar of sales. The length of the OCC depends on a lot of different factors. For example service firm with little inventory and quick payments in cash from its customers has typically a shorter OCC than a company which has to tie up funds, has a large inventory and has to wait long term until it can collect its accounts receivables. Before the SFG-rate can be calculated each of the three factors has to be determined (figure 8.7). In the given example the annual SFG-rate is 18.58%. If the firm grows more slowly than this, it will produce more cash than it needs to support its business expansion. But if it attempts to grow faster than 18.58% per year, it must either free up more cash from its operations or find additional funding externally. Otherwise, it could unexpectedly find itself strapped for cash. It is possible to increase the SFG-rate by affecting any of the three levers that determine the SFG-rate: 74. Shortening the OCC, example by lowering the period of inventory lock up, lowering the accounts receivable payment terms or increasing the account payable payment terms. 75. Reducing cost of goods sold and other expenses, example realisation of discounts. 76. Increasing net sales, example through lower sales prices because of reduced purchase price is. of their suppliers quickly. After that suppliers are able to get their invoices paid by financial service provider FSP. The financing depends on the credit rating of the business partners, which leads to low interest rates. This alleviates the need for suppliers to obtain outside financing, providing them with fast and easy access to cash - regardless of industry, size or financial strength. TABLE 8.3 National initiatives to strengthen SMEs by encouraging supplier financing solutions FIGURE 8.5 faster navment with Betaalme.nu FIGURE 8.6 Operating cash cycle (OCC) FIGURE 8.7 Exemplary calculation of the annual SFG rate Another aspect which favours an SCF solution for an SME is that some approaches are the equivalent to committing to a long term business relationship: so to say, both partners enter strategic partnership. Thus, there will be more business between the two partners, more information will flow and both will have an incentive to improve the traded goods and services in respect of the buyer's need. For suppliers, SCF solutions also offer a higher planning reliability; Volumes of sale can be better estimated and planned, Opportunities and challenges inside network internal financing Western SMEs can easily apply changes in days of accounts receivable (DSO) or days of accounts payable (DPO) within their supply chain. As long as one partner within the supply chain has lower WACC, flows of goods or money can be adapted and gained profits can be shared according to the carried risk. As no additional IT is needed, managing early or late payments with a collaborative approach promises quick rewards (see, for example, the Dutch 'Betaalme.nu' initiative). But, the implementation of changes regarding the payment terms also creates some challenges. For example, the trading partner with the lower WACC must be able to provide liquidity. In addition to this, trading partners within the supply chain must have the trust to share confidential information. Also, payment term adjustments should take place in a preconditioned, self-binding and well-communicated setting. In practise, there remains an incentive for one supply chain partner to try and renegotiate and re-change terms afterwards. Especially during an economic crisis, these recurrences could be critical for the weaker SMEs. Opportunities and challenges inside network external financing - current assets The biggest opportunity for western SMEs regarding SCF platforms is the prospect of overcoming capital constraints. SCF platforms offer an appropriate and additional source of financial resources. Regarding the creditor risk, a FSP has to consider the buyer of the goods and services only. As long as a buyer with a good rating is involved, suppliers will usually have cheaper access to capital. During and after a financial crisis, FSPs are usually more hesitant to grant loans. Large corporates have access to the capital market or other solutions but, in contrast, SMEs rely heavily on their bank loans. Thus during a financial crisis western SMEs face harsh conditions. The extended usage of SCF platforms could reduce this dependence. Especially in recovery phases, when FSPs still see bad financial statements but the economy is catching up, SCF The Dutch 'pay me now' initiative targets the following specific advantages: 65. Better insight into the cash flows; 66. Possibility to harmonise the payment terms between SME suppliers and their customers; 67. Easier growth for activated SME-suppliers; 68. Strengthening of the supply chain stability; 69. Lower costs because of improved efficiency for all of the supply chain members; And 70. fewer mistakes because of electronic invoicing Betaalme.nu seeks to unlock 2.5 billion in liquidity for Dutch SMEs in the next five years. It aims to do this by mobilising 50% of the top 1000 corporates to offer their suppliers the opportunity of faster payment, or fast financing of their invoices. These ambitious goals will financially strengthen the SMEs and give them more opportunity for investment (Betaalme.nu, 2016). Opportunities and challenges for corporates A big opportunity for companies is the fact that SCF solutions enabled them to diversify their capital sources and therefore reduce their dependence on bank loans. In the early stages, firms often depend on informal funding. If firms start to expand, formal sources become more and more important and their availability can terminate the growth rate. In the western world it is banks that are the major providers of financing working capital. SMEs typically need a wide range of services that only banks are able to provide, but traditional banking models typically target the largest firms. Microfinance companies have developed specific skills and business models to provide small loans to the informal sector, but they have limited ability to accompany client firms as they grow. SMEs usually start with short-term lending until there is sufficient credit history (World Bank, 2010). As already mentioned, SMEs are more likely to be constrained than large firms, which mainly affects their specific growth rate. Companies can reach their growth limits in different ways. External business factors, such as the saturation of sales markets or scarcity of a skilled, experienced workforce, but also internal business aspects, such as capacity limits, Considering a strict application of the principles of Islamic financing, any form of trade receivable securitisation cannot be offered by any Islamic bank. Selling commercial papers on the financial market is a way to mitigate risk and stands in contrast to the idea of risk sharing. As a result, it involves uncertainty and in some cases also gambling. Moreover, the flows of goods and money have no connection. There is no transaction of goods or services involved. Added to this, interest is involved. In conclusion, the opportunities of external network external financing in Islamic dominated economies is rather limited. 8.4 Western SME financing and supply chain finance Introduction to Western SME financing The European union defines SME on the basis of three facts: employees, turnover and total assets. To be regarded as an SME the number of employees must be fewer than 250 and the company should generate up to 50 million per year. Furthermore, the total balance sheet should be smaller or equal to approximately 40 million. The European Union also defines micro companies with the following characteristics: fewer than 10 Employees, 2 million or less turnover and 2 million or fewer total assets. Therefore, any company between these two defined boundaries can be subsumed as small- and mediumsize enterprise (SME). SMEs are very heterogeneous. There are big differences regarding firm productivity and growth between them. In general, they can be divided into three groups: 62. The first group are small companies. Usually they were founded to provide labour for the owner, and usually remain small in regard to staff strength and sales revenues. 63. The second group has moderate growth. Usually they enter an existing market with an existing product. 64. The third group are high-growth firms. They have tremendous expansion in the first years and they usually become medium- to large-sized enterprises. external financing - current assets SCF platforms can be fully in line with Islamic financing. Interest can be avoided. Also a FSP can be used for financing purposes. To meet the regulations of Islamic banking the supplier sells the product or services via the SCF platform to the FSP, which immediately resells it to the buyer. The FSP can use the concept of a Mudaraba transaction and charge a markup instead of interest. Herewith, risk sharing, the connection of flows of goods and money and the ethical requirements like fairness can be fulfilled. Corporate entities which fully comply with Islamic financing could receive, via SCF platforms, an additional source of capital. Typically one partner has to provide the capital alone. Thus, reducing the needed capital with an SCF platform could enhance the number of newly founded companies. At the same time using an SCF platform can help corporate entities to standardise their processes. This helps to improve reliability of financial flows and also efficiency. Islamic banks should also apply moral values. This could help in case of disagreements between the trading partners. A challenge arises due to the fact that each component of the supply chain should be halal. As a result the operation of is FSP should be run according to the principles of Islamic financing. Due to this, conventional banks may have to step up a separate entity in order to fulfil these requirement. Taxes pose a threat to the implementation of SCF platforms within Islamic financing. In contrast to conventional banking, goods and services go through an additional sale. Consequently, taxes like VAT must be paid one more time, and the impact is negative on the margins. As a result, companies must find a way to solve this problem or this would be a competitive disadvantage. Especially considering international trade, to deal with different tax and legal authorities to lift this handicap could be complex. External network external financing Considering a strict application of the principles of Islamic financing. any form of trade receivable 64. The third group are high-growth firms. They have tremendous expansion in the first years and they usually become medium- to large-sized enterprises. All SME-groups share some characteristics. Often SMEs do not have a good financial record - they have insufficient assets usable as collateral, and need only small loans, so contract-making is labour intensive. Added to this, SMEs commonly have a less professional management and are mostly family owned (Munro, 2018). So we have to consider that, for financial service providers FSPs, giving loans to SME is more difficult. Even estimating credit risk is harder than for one big corporate and - typically the cost-to-earnings ratio is higher. Added to this, most large companies have know-how about how to deal with capital markets or with FSPs. This might not be the case for SMEs: 43% of small enterprises and 38% of medium size companies report that access to finance is a major obstacle (World Bank, 2010). Small enterprises face proportionally greater financial obstacles. So size matters. In contrast to large companies, SMEs are more affected by collateral requirements, bank bureaucracy and connection to legal and tax authorities. Financial obstacles have an impact on operation and growth of SME (Beck et al, 2005). So the smallest firms are consistently the most adversely affected by all obstacles. In contrast to size, age does not matter; Firm age has no correlation to financial constraint state (Kuntchev et al, 2013). Besides the similarities, we have to distinguish whether a SME operates in the formal or informal economy. The latter - also known as black market is hard to define. Typically an informal economy illegally produces goods and services deliberately concealed from public authorities to avoid paying taxes and Social Security contributions and legal obligations or requirements and market standards (Schneider et al, 2010). In emerging countries around 4050% of the GDP is produced by informal companies (Martinez Peria and Singh, 2014). Formal companies are - in contrast - establishments and businesses that are formally registered, example in the register of compaines. somics970 of all informal rationing affects them as well (Tewari et al, 2013). Despite their relevance, SMEs were too often overlooked by policymakers in the past. Fortunately,more and more countries realise the value of SMEs. The Netherlands, the United States and the United Kingdom - beside other countries have launched initiatives between them to strengthen small- and medium-sized enterprises by encouraging supplier financing solutions (table 8.3). All of these initiatives aim to improve the financing options smaller companies and give them access to working capital they need for growth. SMEs are a crucial component of the western oriented economies. Healthy SMEs invest and expand, which generates employment and stimulates broad economic growth. As suppliers of goods and services to large corporations, SMEs are also a vital link in many supply chains. Therefore, it is important to keep the SMEs flourishing to get stable supply chains and, as a result, an efficient working Capital Management. In order to grow, SMEs need sufficient liquidity. Yet many of them struggle with this, largely because much of their cash is tide up in invoices for their products and services, awaiting payment. This lack of liquidity makes them vulnerable and hinders their growth. This is exactly the point where their national initiatives - like the Dutch 'pay me now' programme - come in place. CASE STUDY: Betaalme.nu ('pay me now') initiative in the Netherlands Betaalme.nu ('pay me now') Is s not-for-profit initiative that aims to ease SME suppliers' access to reasonable priced liquidity. This can support their growth ambitions and their ability to create jobs and strengthen the stability of supply chains - benefiting the Dutch economy as a whole. The initiative works together with a pledge of large corporates to ensure that the Dutch SMEs received payment on early terms and at attractive financing rates (figure 8.5). These corporates decide if they want to pay their suppliers faster or to offer an SCF solution to their partners at the supply side. SCF is an appropriate solution to support suppliers with liquidity. The crucial point is that companies approve the invoices the register of companies. Some 53% of all informal firms have a bank account compared to 86% of all firms in the formal sector but only 12% of all firms in the informal sector have bank loans. By contrast 47% of all firms in their formal sector have them. If we look at financing of working capital, the situation is even more severe. Only 7% of all informal enterprises have received external finance for their working capital; 47% of all formal companies have access to the bank finance for their working capital. This is due to the fact that informal companies often have no credit record (Tewari et al, 2013). The main reasons for informal enterprises not to apply for bank loans are complex application procedures, high interest rates and high guarantees or collateral requirements. Therefore these firms must rely even more on internal funds, families and peer groups to receive capital (Martinez Peria and Singh, 2014). The debt crisis which started in 2009/10 made the fragile banking sector more risk-averse, and also discourage bank lending (OECD, 2013). The resulting consequences were even more severe for SMEs. Turnover and profit of many companies dropped, which negatively affected creditworthiness. Therefore most banks reduce the financial access available to SMEs and have tightened credit conditions (World Bank, 2010). This had a deep impact. It is well recognised that SMEs are more dependent on debt financing than are larger enterprises (Which can turn to other types of finance such as public offering for debts and equity). As a result, a large number of SMEs had serious liquidity problems. The most vulnerable did not survive an went bankrupt. Even worse, the implementation of Basel III in 2014 may have a significant impact on SME lending and credit conditions. A probable scenario is that banks will reduce their balance sheets accordingly instead of raising capital. A reduction of loans would hit again the SME segment (OECD, 2013) However, some SMEs are favourable candidates for bank loans compared to their peer group: they are competitive and fast growing and therefore contribute disproportionately more to the overall economic performance. Unfortunately, credit financing are not measured by commercial success only Alljifri and Khandelwal, 2013). As a result, a borrower can expect that Islamic banks will not exclusively follow a shareholder maximisation approach, but also act according to Islamic principles. Especially for borrowers in a weak position, this might be an argument to apply for a loan at an Islamic bank. Also, entrepreneurial believers might prefer Islamic banking, although it might have some drawbacks. A further opportunity for any company is that Islamic financing does not distinguish between equity and debt. In conventional banking the capital lender, who provides the company's debt, has an advantage over the equity holder. If the company defaults or is liquidated, the capital lender has the first draw. In Islamic banking, debt is abandoned, and this causes a specific principal-agent constellation. If the business is not running well, the capital provider is affected immediately even though there might be an information asymmetry in disadvantage of the capital lender. As a logical consequence, the KYC (know your customer) costs for financial service providers (FSP) are much higher. In fact the company must be monitored and also expertise regarding the business area must be available for the FSP. As a result, companies have the advantage that they typically work more closely with their investors. Those investors who also be interested in providing business contacts and know how to the company, comparable to a venture capital fund. Considering an economic standpoint for an enterprise, depending on the customer base, it might be an important differentiation that the company is financed according to Islamic principles. If one element in a supply chain is not halal, the whole supply chain is not halal. This is also true for supply chain finance. Nevertheless, the Islamic world is not homogeneous. Muslim countries are widespread around the globe and can differ widely considering cultural aspects. Currently, numerous Islamic countries have an emerging economy, with less developed financial infrastructures and non western oriented legal systems. In such an environment it is hard for an investor to estimate credit risk and, in Back Presentation Assignme... by specification cannot be sold through the contract of Salam. 60. Quantity, quality, maturity date and place of delivery must be specified clearly in the contract. It is necessary that the quality of the object of sale is fully specified leaving no ambiguity which may lead to a dispute. 61. The buyer (the bank) is allowed to require security from the seller, in the form of a guarantee or mortgage. In case of a default in delivery, the borrower his guarantor may be asked to deliver the same commodity by purchasing it from the market, or to reimburse the sum advanced to him. Besides the different formats of Islamic financing, it has to be noted that in most Muslim countries, there are a halal-conform and a traditional (western shaped) banking system. Only banks in Pakistan, Sudan and Iran exclusively offer Shariah- compatible products (Simader, 2013). This parallelism reflexes the customer behaviour. Most wealthy customers from Muslim countries have two accounts: one account is for Islamic banking and one account is for conventional banking. To sum up: Islamic banking transactions are in most cases virtually identical to traditional banking. Conventional banking is largely debt-based and allows risk transfer and Islamic intermediation is asset-based and centred on risk sharing (Hassan and Dridi, 2011). In contrast, Islamic transactions often mimic the financial results of an interest rate comparable to conventional products (Hunt-Ahmed, 2013). A comparison can be found in table 8.2. Opportunities and challenges for corporates SCF can be totally in line with the principles of Islamic financing. The Islamic banking system offers an additional chance for the design of specific SCFinstruments as borrowers can view the bank also as a trustee. Moreover, there is a Shariah board in the bank, which protects the interests of all stakeholders and sets boundaries according to halal. So an Islamic financial contract includes moral and ethical elements. Added to this, decision makers in Islamic financing are case of default, recover debts. And, in case of default, recover debts. Consequently, investors will demand a premium for the risk. Depending on the specific situations the premium can be very high, so we have usually a credit spread between Western countries and emerging economies. These credit spreads might be exploited by SCF. If a company from an emerging economy can use an SCF solution in such a constellation, it has cheaper access to capital and usually a strategic business relationship with its supply chain partners. SCF in Islamic banking systems also faces some challenges. It can only provide a partial solution for the capital needs. A major challenge in Islamic financing is asymmetric information. Entrepreneurs know more about their companies and projects than banks too, and they know the markets better than an investor providing capital. Therefore investors use signals to estimate efforts and credibility of customers. Pledged collateral, debt guarantee and acceptance TABLE 8.2 Comparison between conventional (Western) and Islamic banking Conventional banking Islamic banking internal financing Companies can easily manage days of accounts receivable (DSO) or days of accounts payable (DPO): meaning, they can adapt payment terms, which allows companies with a lower WACC within to supply chain to carry more cash-to-cash (C2C) days. All requirements for Islamic financing can be fulfilled. Interest must not be used due to adaptation of the price for the goods or services. Furthermore, there is no gambling due to additional uncertainty or risk involved. At the same time, both parties still share risks due to their business transaction while there is a connection between the flow goods and services. A big challenge arises when payment terms are not met. First, penalties due to delayed payments are not in line with the principles of Islamic financing or should at least be given to charity. Second, the legal system comes into play to enforce payments. Most countries with Islam as a state religion have emerging economies with a less efficient legal system compared to developing countries. third, the enforceability of Islamic finance transaction is of pressing legal concern (Hunt-Ahmed, 2013 ). Borrowers might doubt the underlying legal contract due to questions arising in regard to the morality of the contract. Moreover, trading partners with access to disposable liquidity are needed within their supply chain. Even if such a partner is available, one potential restriction is that, in the case of an economic downturn, the cash-rich partner may renegotiate the payment terms and cause a liquidity shortage for the other trading partner. Finally, a challenge arises due to the ban of interest. Due to the adaptation of payment terms both companies should be able to make profit. The involve companies have to calculate the total gain without using the concept of interest. The concept of Mudaraba with its strong profit-loss-sharing approach seems to be a good starting point to solve this challenge in practise. Opportunities and challenges inside network external financing - current assets SCF platforms can be fully in line with Islamic Debis tinancing has the advantage of Sharing prouts in case of Mudaraba from taxable profits. This causes huge minimisation of the tax burden over burden of taxes on salaries person. salaried persona. This increases the Thus the saving and disposable income savings and disposable income of the of the people is badly affected. Thus people, which increases the real GDP decreases the real gross domestic product of financial covenants, all are commonly used signals which help to overcome asymmetric information. For example, Mudaraba impedes an entrepreneur to give such signals. The capital lender is not allowed to demand collateral or a stake from his partner. Added to this, motivation and efforts of the entrepreneur might change overtime, which will have an impact on profit and earnings. Unfortunately, the capital provider bears the losses alone. Also, there exists an immanent incentive for a partner to hide earnings from his or her capital provider. Tax issues might also be a hurdle for Islamic banking and SCF. In Islamic banking, financial flows depend on the flow of goods or services. This causes some fundamental drawbacks. First of all, the purchase and sale of goods requires value added taxes (VAT). Second, tax law often allows interest to be deductible, whereas markups or cost-ups are not (Visser, 2013). To overcome these hints, countries such as the United Kingdom and the United states have defined criteria for Islamic financial products regarding tax law. The profit element of deferred purchase price, lease arrangements and investor arrangements are treated for tax purposes as payment and receipt of interest subject (Conway and Feese, 2007). In the United Kingdom, for instance, Islamic banks works closely with tax advisers and treasury to guarantee that new Islamic financial products fall under tax legislation. Murabaha transactions should have as a zero rating for VAT. Therefore, Islamic banking depends heavily on goodwill of the government and multilateral organisations (Williams, 2010). So if SCF and trade finance comes into play, all possible products must be negotiated with each country separately to provide an even playing field. Opportunities and challenges inside network internal financing life. Muslims are supposed to live their lives by this concept, with its connotations of cleanliness, integrity and self-restraint. Shariah: Shariah is the fundamental religious concept of Islam and derives from the religious percepts of Islam, particularly the Quran. At the most basic level, Sharia is the Muslim universe of ideals. It is the result of the collective effort to understand and apply the Quran and supplementary teachings of the Prophet Muhammad. It is the basic Islamic legal system and provides the legal framework for the foundation and functioning of society; It also details moral, ethical, social and political codes of conduct for Muslims at an individual and collective level, including many topics like crime, politics, marriage contracts, trade regulations, religious prescriptions and economics. It is a significant source of legislation in many Muslim countries. The starting point of the Shariah-confirming banking system we know today was India. This may be surprising, but it was due to the separation of the Muslim minority from the Hindus by the British colonial administration. On one hand, ideas about geographical separation were pushed, which ended in a split into the three states: India, Pakistan and Bangladesh. On the other hand, efforts regarding cultural and economic independence, respectively segregation, were intended. For these reasons, the system of Islamic banking was developed. From then on Muslim countries had the possibility to differentiate themselves from the West also in terms of banking services. Islamic banking must fulfil three elementary rules. This must be free from: 51. Interest (riba) 52. Uncertainty (gharar) 53. Gambling (Maisir) or anything that is banned by the Quran or Sunna (non-halal) This is set in the trade laws as fiqh al-mu'amalat (Ariss, 2010). Futher principles must be fulfilled for Islamic banking (El Hawary et al, 2004): 54. The risk must be borne by both parties 55. Financial flows must be linked with a business transaction. There for a good must be sold. 56. Exploiting a contract partner is not allowed. The most important point regarding Islamic finance is the ban of interest (riba). Scholars, however, see it as unfair that the lender receives a fixed amount of money without entrepreneurial risk. Added to this, many Muslim authors see money only as a means of exchange and numeric, not as an asset in its own right (Visser, 2013). A general deficiency is that riba is not defined universally in the Islamic economy, which causes an ongoing debate. The orthodox interpretation, for instance, equates riba with all types of interest. In this direction, some modern scholars accept interest if it is not exorbitant and if the loan is used for an investment and not for consumption (Akram and Khan, 2013). Not for riba only, but for other economic principles too, it has to be mentioned that Islam has different schools of thought (Simader, 2013). As a result, a range of opinions and operationalisations are possible. The result is a heterogeneity of configurations and established practises of Islamic financing. To be conform to halal and replace interest in Islamic finance, the methods using profit-losssharing (PLS) were developed. A differentiation is made between strong and weak forms of PLS products. An example for a strong PLS product is Mudaraba. Two partners found an enterprise together. One partner provides the capital and the other partner provides the labour force and runs the company. Profits are shared according to a split agreed at founding. If the company makes a loss, the capital provider bears the risk alone (figure 8.2). Strong PLS products may be the ideal of Islamic financing, but in practise the only play a secondary role (Visser, 2013). In contrast, murabaha is a weak PLS form. In Islamic finance it is the dominant form of financing. It can be described a 'cost-up transaction'. A customer wants the goods of a supplier - for example, raw materials for his own production - but cannot afford the purchase price. Therefore the supplier and th A third popular form of Islamic finance is Salam financing. This is a kind of prepaid forward sale. Mostly the supplier uses the money made available to buy raw materials, which they need to produce a good. While the supplier gets paid in advance, the bank or the customer will not get the good until a settled date in the future. Additionally, the seller need not to be the manufacturer or producer. It is possible that they are just an agent who organises the transaction. In this case the client requests a quotation for commodity prices on specified future dates and the commodity supplier makes a quotation and undertakes to provide the commodities on specified dates at specified prices (figure 8.4). Indeed, a good must be sold to fulfil the principles of Islamic banking. But there is consensus among Muslim jurists on the permissibility of Salam because the object of the contract is that the goods are a recompense for the price paid in advance, just as the price is recompensed paid for getting the goods in advance. The idea of Salam is to provide a mechanism that ensures that the seller has the liquidity they expected from entering into the transaction in the first place (financial Islam, 2015). The Salam contract must be conformed to several conditions in order to be valid (United Nations conference on trade and development, 2006): FIGURE 8.4 Concept of Salam financing 57. The commodity should not exist when the finance is provided. 58. The full purchase price is paid at or near to the moment that the contract is signed. 59. The underlying asset is standardisable, easy quantifiable and of determinate quality. Assets where quality or quantity cannot be determined by specification cannot be sold through the Back Presentation Assignment.docx supplier and the customer go to a bank and make a property purchase contract. The bank buys the good from the supplier and immediately resells it to the customer. The customer has to repay the money including and mark up in the future figure 8.3. The pearls to interest based financing are obvious. Similar to FIGURE 8.2 Concepts of Mudaraba financing with profit-loss-sharing FIGURE 8.3 Concept of Murahaba financing Conventional lending, the bank assesses the creditworthiness of the client, the underlying asset serves as collateral and the bank and client enter a debtor-creditor relationship. The bank bears the risks relating to the underlying good but usually the bank owns it only for minutes, if not seconds. The contract for buying and the contract for selling the good are signed at the same time at the same place. Therefore, the Islamic bank carries a similar risk as a conventional bank, which provides a loan covered with collateral. As a result, murabaha is a clear deviation from strict interpretation of the Islamic finance rules (Al-Bashir Muhammad Al-Amine, 2013). Sometimes, mark-ups for murabaha products are even linked LIBOR (Visser, 2013). A third popular form of Islamic finance is Salam Back Presentation Assignment.docx 8.3 Islamic financing and supply chain finance Introduction to Islamic financing Islam is - in the broadest sense - not only a religion but a more social idea. Islam has a universal claim on nearly every aspect of life (Black, 2008). According to the Quran, this social idea was implemented in Medina by Prophet Muhammad - he called it Ummah, as a description for collective community of Islamic people (Simader, 2013). An interface between Islam and economics is Islamic financing. Especially, services for Muslims who want to invest their funds according to the Shariah without interest are part of this banking system. In 2010 over 300 Islamic financial Service providers were operating in more than 50 countries worldwide (Volk, 2010). The idea of banking services without interest it relatively new. It came up after the Second World War. Before that time, in the Ottoman empire interest rates up to 20% were customary and accepted by religious society as conforming to Shariah. In those days, it was also normal to deposit collateral for loans (Khan, 2010). Definition of important Islamic financing principles Quran: the current literally means 'the recitation' and is the central religious texts of Islam. It is the last revealed word of God and is the primary source of every Muslim's faith and practise. It deals with all subjects and provide guidelines and detailed teachings for society, proper human conduct and an equitable economic system. The Quran comprehends the complete code for Muslims to live a good, chaste, abundant and rewarding life in obedience to the commandments of Allah, in this life, and to gain salvation in the next. Halal: in Islamic dominated economies the whole financial system and the underlying supply chains must be halal. Halal is an Arabic word which means permissible or lawful. All objects or actions permissible to use or engage in (goods or acts) according to Islamic law are halal. The term covers not only food and drink but also all matters of daily With relevant examples, assess the merits and demerits of the main public procurement methods applicable in Ghana. currency) will play a dominant role in the world and will - possibly - replace some previously established businesses (if not the whole markets). But - to achieve such a supremacy - changes are necessary to rebuild the Chinese banking system. Consequently, an alternative supply of capital is needed to keep the economic system afloat. SCF solutions might be a promising way to provide liquidity to the economy; the question is whether the Chinese government will allow SCF solutions at high volumes. Currently, the Chinese capital market is more or less isolated, something which tempered the effects of the financial crisis. Such isolation is also easier to monitor and regulate due to a lower degree of complexity. In China the government heavily influences lending behaviour and therefore promotes and subsidise certain industries. SCF solutions, which probably would be offered by international and non-Chinese players, would increase independence from Chinese banks and consequently the Chinese government. But, in contrast to loans, SCF solutions are more complex and they are 'the new kid on the block'. In order to push SCF solutions into the Chinese market, there would be the need for a lobby promoting these Concepts. In addition, general improvements in the financial infrastructure would enhance the chance of successful implementation of SCF solutions. For example, approximation to or harmonisation of international standards like accounting and auditing standards, credit reporting systems, collateral and insolvency regimes as well as payment and settlement systems will be beneficial (World Bank, 2010) Furthermore, the 'shadow banking' market in China has become too big to fail. A catchy example is the rapidly increased popularity of P2P lending. The Chinese government recently started to regulate these P2P systems. Ongoing volume growth and the impact in case of default to the system created a pitfall. Even for this reason, it would make sense to establish alternative sources of capital for the economy. Here, SCF could also played a vital role to foster business growth in China. The key is having the right levels of support from the government (especially legal, tax and regulatory amonorues as wel as urisdiction) to Opportunities and challenges external network external financing AR are usually a big element of a balance sheet. Trade receivable securitization (TRS) helps SMEs to turn their AR into quick cash. As long as the AR relates to a customer with a higher credit rating, that is lower cost of capital than the SME, an optimisation opportunity exists. An opportunity can also arise due to the flexibility of TRS. In case a SME has not sufficient AR to achieve the necessary limit of $50 million, An issuer could set up a pool with AR from other companies. An example might be that only AR are used from one buyer but from several suppliers, or AR from companies within a region, or within the same industry, are included. In addition, to increase marketability, over-collateralisation or insurance can be included. Western SMEs wishing to conduct a TRS transaction will have a limited choice when considering the acting financial intermediary, that is investment bank, due to their size. It is obvious that a smaller seller is with high probability less connected in the financial markets and potential investors would be more sceptical. Another challenge is that Western SMEs must have access to AR from companies with a good credit rating. Credit arbitrage is possible only if the customer of the suppliers has a higher credit rating. Added to this the SME must have qualified staff who can support the issuer setting up the transaction. 8.5 Summary From the discussion in this chapter, we can take out some useful rsum when acting in China with Chinese firms or while making business in Islamicoriented countries. Furthermore, some important issues for SCF regarding SMEs were tackled. To sum up, socio-cultural aspects will become increasingly significant in the near future. Corporates need to account for distinctive SCF features against this backdrop of 'regional' specialties (especially legislations), values and behaviour patterns. Recap on Chinese financing and SCF In the long run, the Chinese market (including How to on-board SME-suppliers efficiently There are seven principles for onboarding SME suppliers on a reverse factoring platform: 77. Be proactive: corporates should address supplier onboarding proactively rather than reactively. They should make the process seamless from the beginning so that suppliers have no cause to push back. 78. Prioritise suppliers to on-board: based on the Pareto principle, 20% of the suppliers will typically account for 80% of the total spend. By focusing on that 20%, the corporates will get more of their spend into the system even while onboarding a smaller number of suppliers. Then, once the top vendors are on-board, the focus can be expanded to the next tier. 79. Plan how do suppliers will connect: corporates have to determine whether the suppliers already use a defined EDI format because SMEs would easily buy into a system that they are already using. Between these suppliers it is important to prioritise the onboarding of those suppliers which use supported browsers - changing browsers is easier and more cost effective than developing support for a new browser. 80. Make registration of individual suppliers and users as easy as possible: automatic onboarding of 80% of the suppliers will allow corporates to focus on the 20% that run into issues. It should be possible to send suppliers email invitation with a link, username and password, and to allow suppliers to submit various documents and required certificates online so they can be tracked efficiently. 81. Plan for future growth: a merger or acquisition can increase the number of suppliers to be onboarded. If a corporate is currently in an expansion phase, numerous connectivity and management options into the collaboration platform should be considered, in order to retain scalability. but, in contrast, SMEs rely heavily on their bank loans. Thus during a financial crisis western SMEs face harsh conditions. The extended usage of SCF platforms could reduce this dependence. Especially in recovery phases, when FSPs still see bad financial statements but the economy is catching up, SCF platforms could inflame their empowering energies. Entering an SCF platform project helps create a strong bond between supply chain partners. For an SME in particular this has several advantages. The depreciation and operating costs are high, but are taken from the initiating corporate. Furthermore, the buyer has an incentive to stay with the chosen suppliers. So SMEs have a higher planning reliability and an advantage against competitors (positive lockin effect). As a result a, the supplier can also tackle projects with a longer time horizon regarding the demanded products or goods. In contrast, there are also challenges. SMEsuppliers must be able to provide a certain production capacity to achieve a certain turnover and frequency regarding deals with the supplier to offset the costs for the SCF platform. At the same time, these ties with the buyer will create a certain negative look-in effect. The buyer will make sure that the supplier stays, which potentially blocks other business opportunities. At the same time an unpleasant development for the buyer will directly influence the supplier, which creates a dependency risk. And additional challenge is that the buyer carefully reflects which supplier will be picked for the SCF platform. SMEs face disadvantages according to their size. For example, small SMEs will have a lower production capacity and their dependence on key persons will be higher. Also, due to lower output, costs for products or services will be probably higher due to higher costs for pre-products. While using an SCF platform, one of the major problems is, therefore, the rapid and efficient onboarding of suppliers - independently of their size and the corresponding trade volume (respectively customers on an account receivable solution). The success of this form of inside network external financing is directly tied to supplier willingness to use the system. So the only way to get return on encourage the SCF approach. There are definitely signs that support exists in China. Recap on Islamic financing and SCF Supply chain finance provides some halalconforming opportunities for policymakers in countries where Islam is the state religion. It should be noted that Islamic banking is a complement rather than a substitute. However, even as a complement it might stabilise a financial sector in a country. This is similar to SCF solutions. In most cases it will be an additional capital source but it could also help to reduce risk. Furthermore, this year solutions could pay a positive role in continuous development of these markets. To date, Islamic banks appear more protected against risk than large conventional banks. One reason is that they are financed primarily from deposit accounts, which grants stability. Islamic banks also did not engage in the secondary market, for example in the subprime mortgage market. This means that Islamic financing can help to diversify systematic risk due to their different exposure (Imam and Kpodad, 2013). Unfortunately, as soon as the real economy was hit in 2008/2009, Islamic banks perform as badly as their conventional competitors (Hasan and Dridi, 2011). Some SCF solutions could support the economic stability of a country due to the link between flow of goods or services and money. As demand increases, capital is available. Overall, promoting SCF solutions could benefit the reputations of politicians in a Muslim society, as SCF can provide several opportunities and in addition it can be totally in line with the requirements of shariah and other Islamic principles. The heterogeneity of Islamic financing is - and will remain - one of the major challenges to introducing SCF in such regions and cultural context in the future. Excursus: Elaborating the internal financing capability of a firm For the determination of the self-financeable growth (SFG) rate, three factors are essential: 71. A company's operating cash cycle (OCC), which is the amount of time that company's money is tied up in inventory and other current assets before the company is paid for the goods and services it produces (figure 8.6). 72. The amount of cash needed to finance each dollar of sales, including working capital and operating expenses. 73. The amount of cash generated by each dollar of sales. The length of the OCC depends on a lot of different factors. For example service firm with little inventory and quick payments in cash from its customers has typically a shorter OCC than a company which has to tie up funds, has a large inventory and has to wait long term until it can collect its accounts receivables. Before the SFG-rate can be calculated each of the three factors has to be determined (figure 8.7). In the given example the annual SFG-rate is 18.58%. If the firm grows more slowly than this, it will produce more cash than it needs to support its business expansion. But if it attempts to grow faster than 18.58% per year, it must either free up more cash from its operations or find additional funding externally. Otherwise, it could unexpectedly find itself strapped for cash. It is possible to increase the SFG-rate by affecting any of the three levers that determine the SFG-rate: 74. Shortening the OCC, example by lowering the period of inventory lock up, lowering the accounts receivable payment terms or increasing the account payable payment terms. 75. Reducing cost of goods sold and other expenses, example realisation of discounts. 76. Increasing net sales, example through lower sales prices because of reduced purchase price is. of their suppliers quickly. After that suppliers are able to get their invoices paid by financial service provider FSP. The financing depends on the credit rating of the business partners, which leads to low interest rates. This alleviates the need for suppliers to obtain outside financing, providing them with fast and easy access to cash - regardless of industry, size or financial strength. TABLE 8.3 National initiatives to strengthen SMEs by encouraging supplier financing solutions FIGURE 8.5 faster navment with Betaalme.nu FIGURE 8.6 Operating cash cycle (OCC) FIGURE 8.7 Exemplary calculation of the annual SFG rate Another aspect which favours an SCF solution for an SME is that some approaches are the equivalent to committing to a long term business relationship: so to say, both partners enter strategic partnership. Thus, there will be more business between the two partners, more information will flow and both will have an incentive to improve the traded goods and services in respect of the buyer's need. For suppliers, SCF solutions also offer a higher planning reliability; Volumes of sale can be better estimated and planned, Opportunities and challenges inside network internal financing Western SMEs can easily apply changes in days of accounts receivable (DSO) or days of accounts payable (DPO) within their supply chain. As long as one partner within the supply chain has lower WACC, flows of goods or money can be adapted and gained profits can be shared according to the carried risk. As no additional IT is needed, managing early or late payments with a collaborative approach promises quick rewards (see, for example, the Dutch 'Betaalme.nu' initiative). But, the implementation of changes regarding the payment terms also creates some challenges. For example, the trading partner with the lower WACC must be able to provide liquidity. In addition to this, trading partners within the supply chain must have the trust to share confidential information. Also, payment term adjustments should take place in a preconditioned, self-binding and well-communicated setting. In practise, there remains an incentive for one supply chain partner to try and renegotiate and re-change terms afterwards. Especially during an economic crisis, these recurrences could be critical for the weaker SMEs. Opportunities and challenges inside network external financing - current assets The biggest opportunity for western SMEs regarding SCF platforms is the prospect of overcoming capital constraints. SCF platforms offer an appropriate and additional source of financial resources. Regarding the creditor risk, a FSP has to consider the buyer of the goods and services only. As long as a buyer with a good rating is involved, suppliers will usually have cheaper access to capital. D