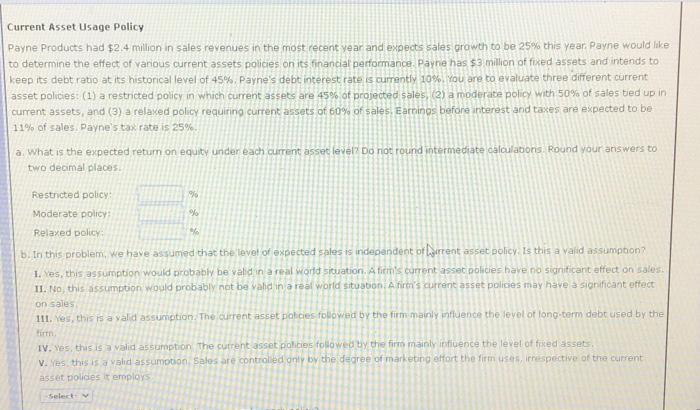

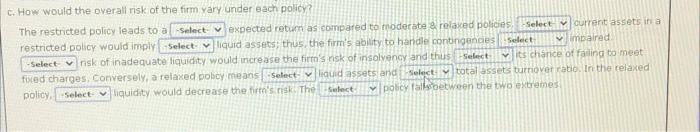

Current Asset Usage Policy Payne Products had $2.4 million in sales revenues in the most recent year and expects sales growth to be 25% this year. Payne would like to determine the effect of various current assets policies on its financial performance Payne has $3 million of fixed assets and intends to keep its debt ratio at its historical level of 45% Payne's debt interest rate is currently 10%. You are to evaluate three different current asset policies: (1) a restricted policy in which current assets are 45% of projected sales, (2) a moderate policy with 50% of sales tied up in current assets, and (3) a relaxed policy requiring current assets of 60% of sales, Earnings before interest and taxes are expected to be 11% of sales Payne's tax rates is 25% a What is the expected return on equity under each current asset level? Do not found intermediate calculations. Round your answers to two decimal places Restricted policy 9 Moderate policy 96 Relaxed policy b. In this problem. We have assumed that the level of expected sales is independent of rent asset policy. Is this a valid assumption 1. Yes, this assumption would probably be valid in a real world situation. A fim's current asset policies have no significant effect on Sales II. No, this assumption would probably not be valid in a real world situation Afirm's current asset policies may have a significant effect on sales 111. Yes, this is a valid assumption. The current asset policies followed by the firm mainly influence the level of long-term debt used by the SET IV. Yes, this is a valid assumption The current asset policies followed by the fire mainly influence the level officed assets V. Yes this is a valid assumption Sales are controlled only by the degree of marketing effort the firm uses irrespective of the current asset polides temploys Select C. How would the overall risk of the firm vary under each policy? The restricted policy leads to al Select expected return as compared to moderate & relaxed policies Select current assets in a restricted policy would imply select liquid assets; thus the firm's ability to handle contingences Select impaired -Select v risk of inadequate liquidity would increase the firm's nisk of insolvency and thus Select its chance of failing to meet fixed charges. Conversely, a relaxed policy means Select loud assets and Select total assets turnover ratio. In the relaxed policy. Select liquidity would decrease the firm's risk. The select policy falls between the two extremes