Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Current assets Cash and cash equivalents Accounts receivable (net) Inventory Prepaid expenses CARLA VISTA CO. Balance Sheets December 31 Total current assets Investments 2022 $330

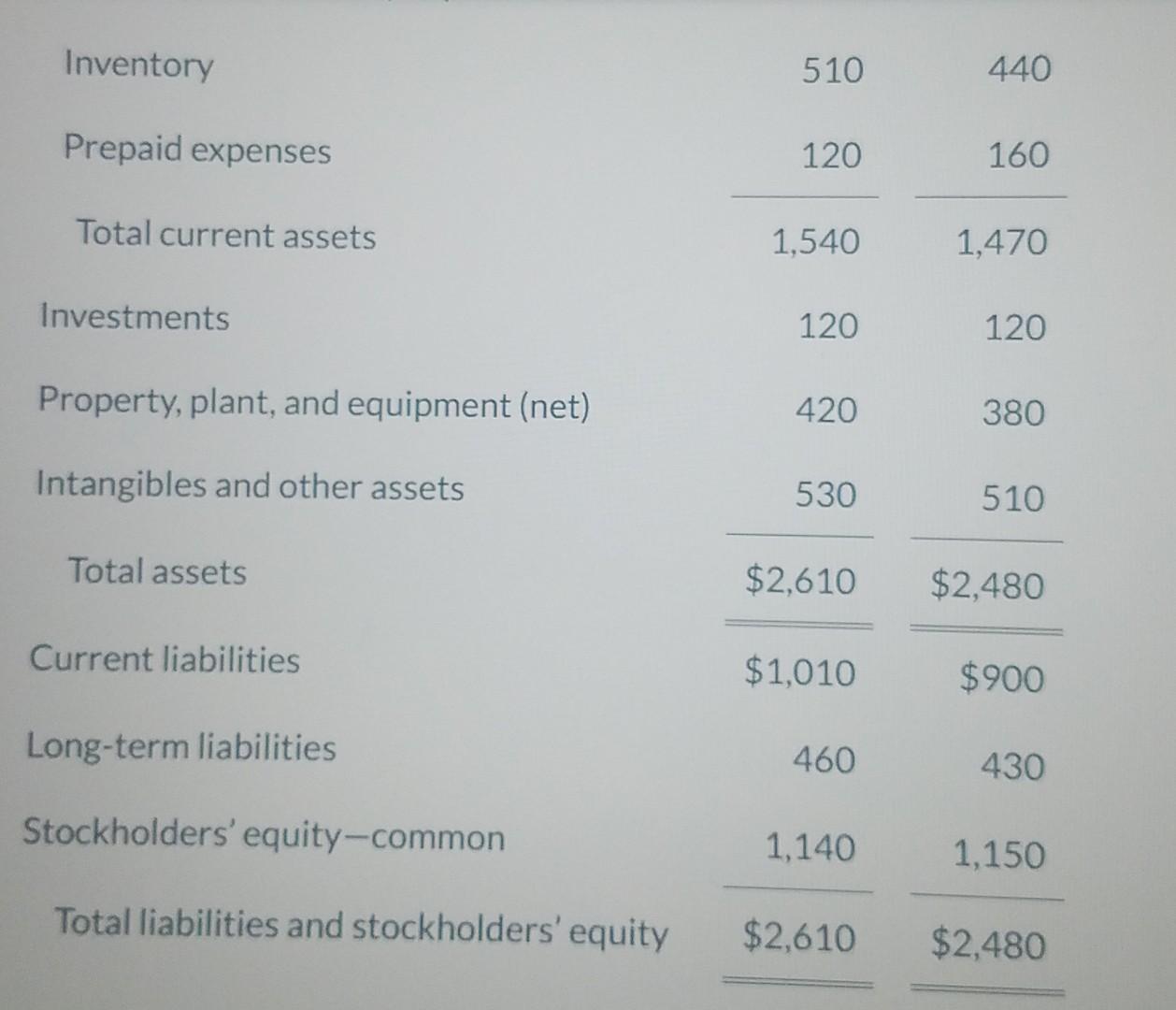

Current assets Cash and cash equivalents Accounts receivable (net) Inventory Prepaid expenses CARLA VISTA CO. Balance Sheets December 31 Total current assets Investments 2022 $330 580 510 120 1,540 120 2021 $360 510 440 160 1,470 120

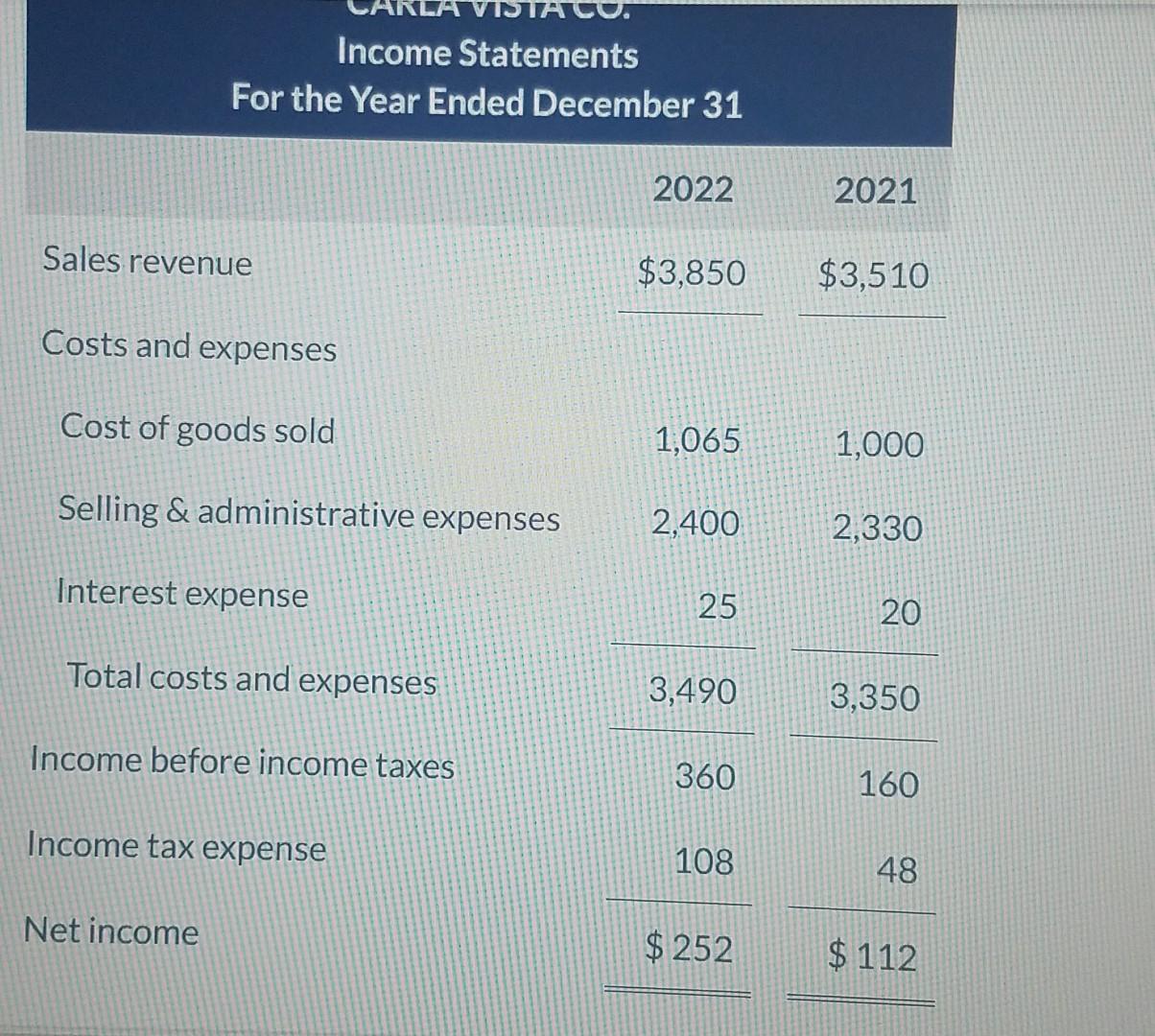

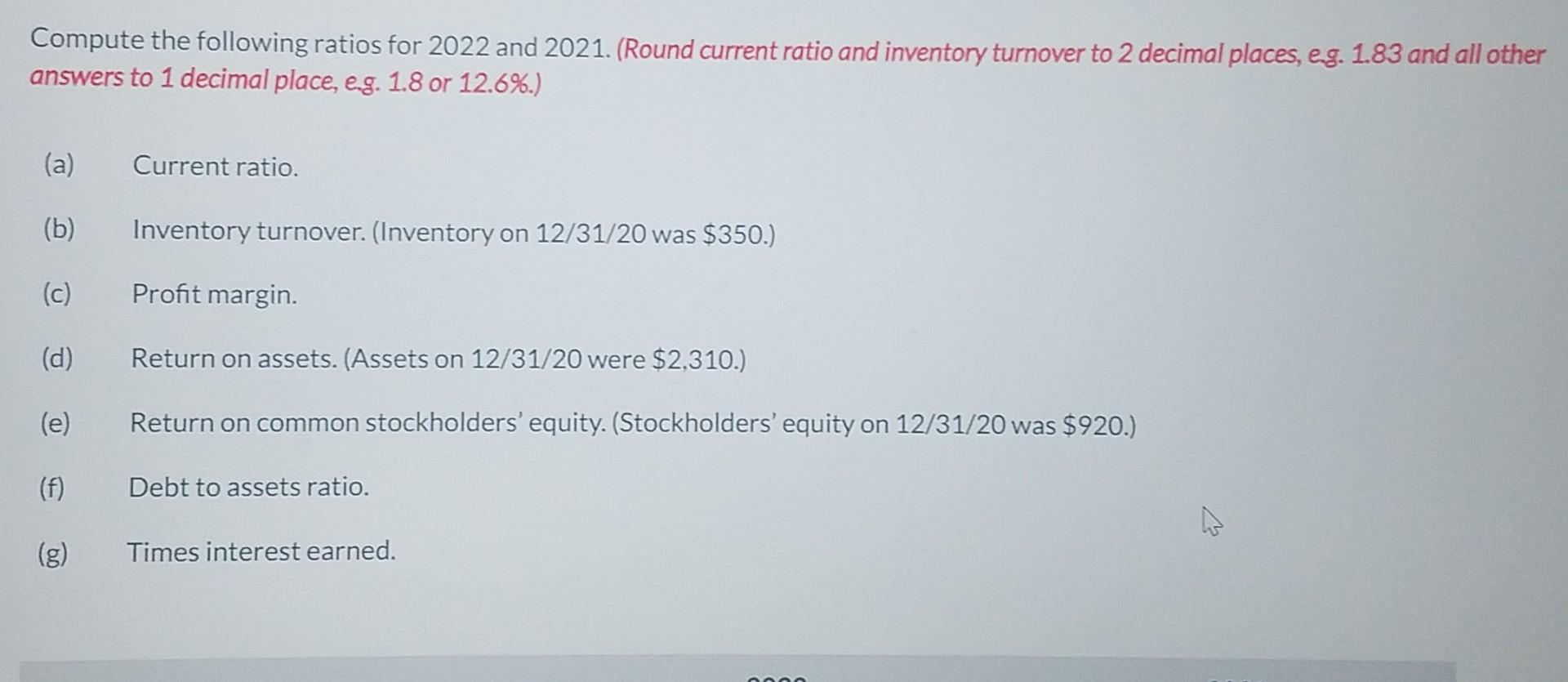

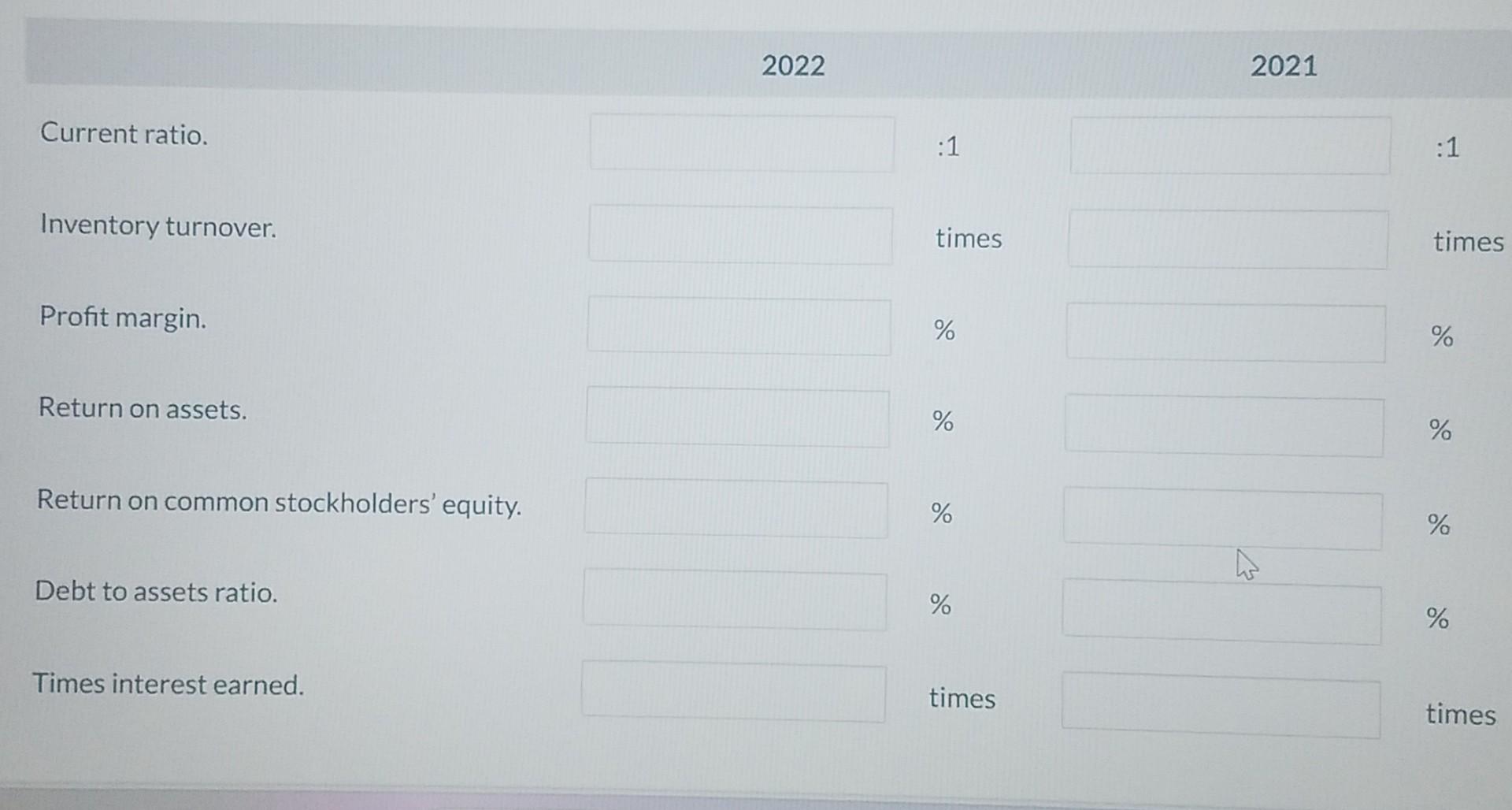

Income Statements For the Year Ended December 31 \begin{tabular}{lrrr} & 2022 & & 2021 \\ Sales revenue & $3,850 & & $3,510 \\ \cline { 2 - 2 } Costs and expenses & & & \\ Cost of goods sold & 1,065 & & 1,000 \\ \hline Selling \& administrative expenses & 2,400 & & 2,330 \\ \hline Interest expense & 25 & & 20 \\ \hline Total costs and expenses & 3,490 & & 3,350 \\ \hline Income before income taxes & 360 & & 160 \\ \hline Income tax expense & 108 & 48 \\ \hline Net income & $252 & $112 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|} \hline Inventory & 510 & 440 \\ \hline Prepaid expenses & 120 & 160 \\ \hline Total current assets & 1,540 & 1,470 \\ \hline Investments & 120 & 120 \\ \hline Property, plant, and equipment (net) & 420 & 380 \\ \hline Intangibles and other assets & 530 & 510 \\ \hline Total assets & $2,610 & $2,480 \\ \hline Current liabilities & $1,010 & $900 \\ \hline Long-term liabilities & 460 & 430 \\ \hline Stockholders' equity-common & 1,140 & 1,150 \\ \hline Total liabilities and stockholders' equity & $2,610 & $2,480 \\ \hline \end{tabular} 2022 2021 Current ratio. :1 :1 Inventory turnover. times times Profit margin. % % Return on assets. % % Return on common stockholders' equity. % % Debt to assets ratio. % % Times interest earned. times Compute the following ratios for 2022 and 2021. (Round current ratio and inventory turnover to 2 decimal places, e.g. 1.83 and all other answers to 1 decimal place, e.g. 1.8 or 12.6%.) (a) Current ratio. (b) Inventory turnover. (Inventory on 12/31/20 was $350.) (c) Profit margin. (d) Return on assets. (Assets on 12/31/20 were $2,310.) (e) Return on common stockholders' equity. (Stockholders' equity on 12/31/20 was $920.) (f) Debt to assets ratio. (g) Times interest earned

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started