Question

Sunshine Beach Ltd has five employees. According to their particular employment award, long-service leave can be taken after 15 years, at which time the employee

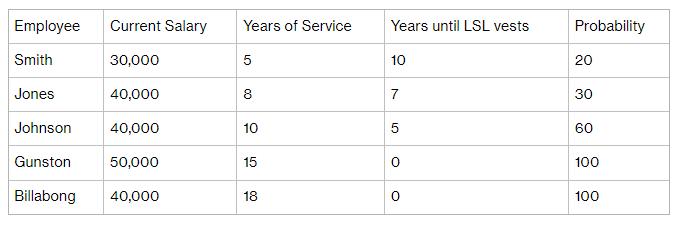

Sunshine Beach Ltd has five employees. According to their particular employment award, long-service leave can be taken after 15 years, at which time the employee is entitled to 13 weeks' leave. If the employee leaves before completing the 15 years' service, there will be no entitlement to leave, or to a cash payment in lieu of leave. The names of the employees, their current salaries and their years of service as at the end of the reporting period are as follows:

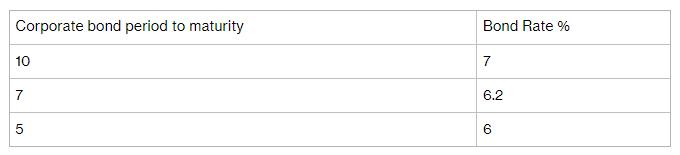

The provision for long-service leave as at the beginning of the reporting period is $20 900. High-quality corporate bonds exist with periods to maturity that exactly match the various periods that must still be served by the employees before LSL entitlements vest with them. These bond rates are as follows:

REQUIRED

Calculate the long-service leave obligation for Sunshine Beach Ltd as at the end of the reporting period.

Provide the necessary accounting entry to recognise the long-service leave expense for the year

Employee Current Salary Smith 30,000 Jones Johnson Gunston 40,000 40,000 50,000 Billabong 40,000 Years of Service 5 8 10 15 18 Years until LSL vests 10 7 5 0 Probability 20 30 60 100 100

Step by Step Solution

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Calculation Smith Probability of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started