Answered step by step

Verified Expert Solution

Question

1 Approved Answer

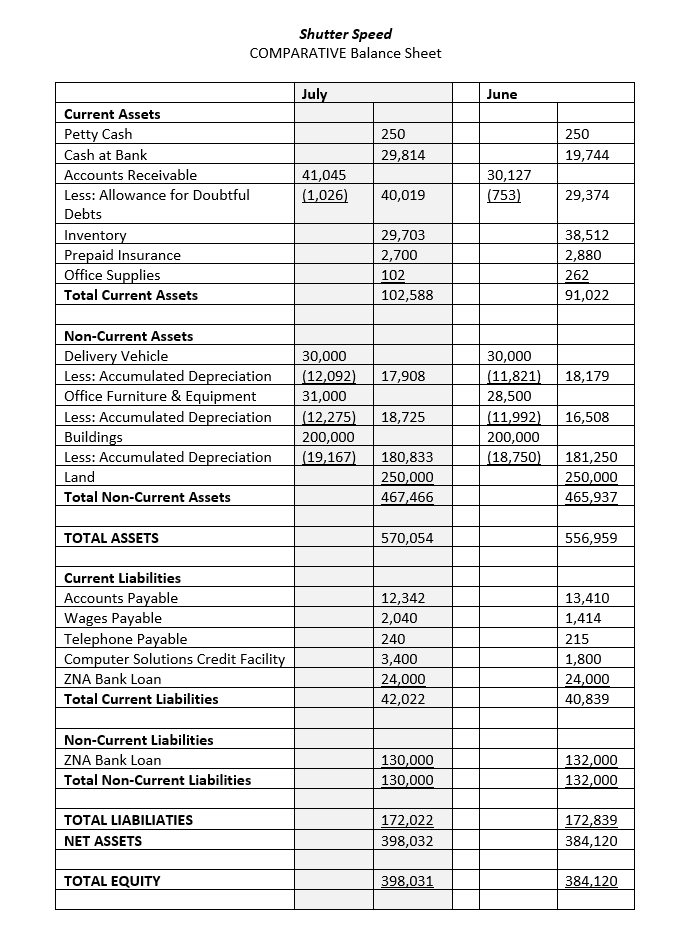

Current Assets Petty Cash Cash at Bank Accounts Receivable Less: Allowance for Doubtful Debts Inventory Prepaid Insurance Office Supplies Total Current Assets Non-Current Assets

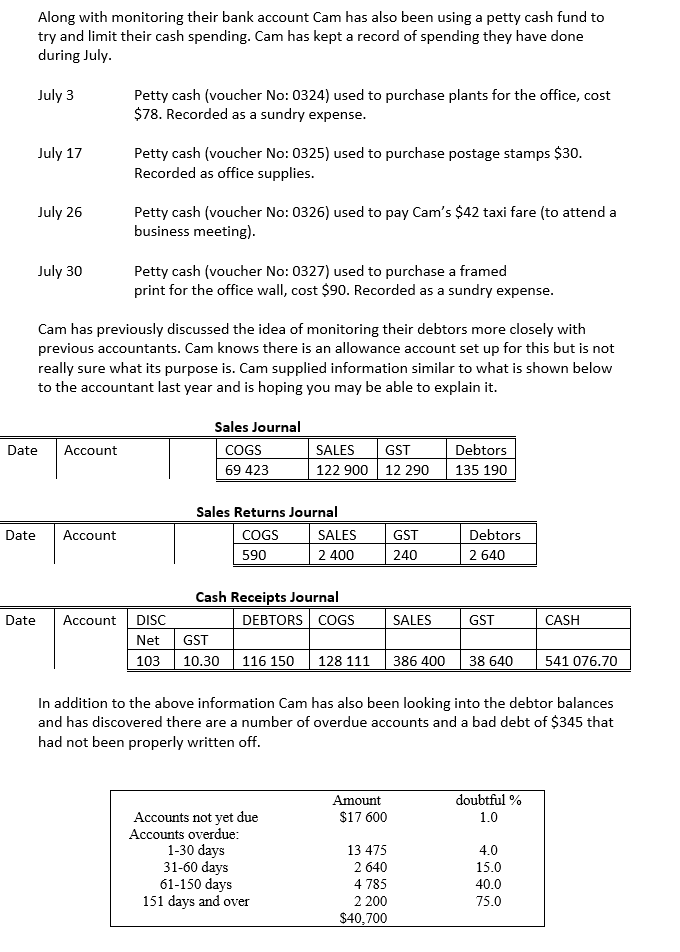

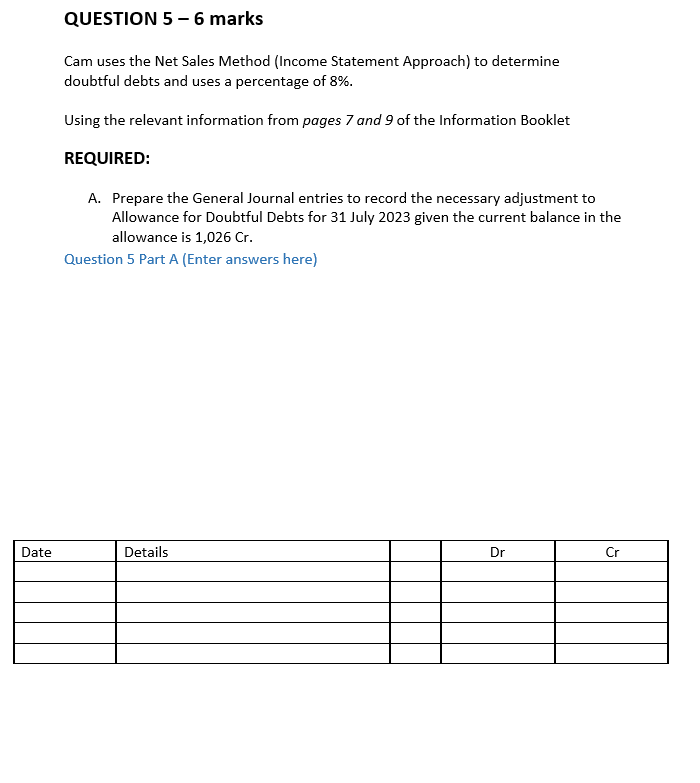

Current Assets Petty Cash Cash at Bank Accounts Receivable Less: Allowance for Doubtful Debts Inventory Prepaid Insurance Office Supplies Total Current Assets Non-Current Assets Delivery Vehicle Less: Accumulated Depreciation Office Furniture & Equipment Less: Accumulated Depreciation Buildings Less: Accumulated Depreciation Land Total Non-Current Assets TOTAL ASSETS Current Liabilities Accounts Payable Wages Payable Shutter Speed COMPARATIVE Balance Sheet Telephone Payable Computer Solutions Credit Facility ZNA Bank Loan Total Current Liabilities Non-Current Liabilities ZNA Bank Loan Total Non-Current Liabilities TOTAL LIABILIATIES NET ASSETS TOTAL EQUITY July 41,045 (1,026) 250 29,814 40,019 29,703 2,700 102 102,588 30,000 (12,092) 17,908 31,000 (12,275) 18,725 200,000 (19,167) 180,833 250,000 467,466 570,054 12,342 2,040 240 3,400 24,000 42,022 130,000 130,000 172,022 398,032 398,031 June 30,127 (753) 250 19,744 29,374 38,512 2,880 262 91,022 30,000 (11,821) 18,179 28,500 (11,992) 16,508 200,000 (18,750) 181,250 250,000 465,937 556,959 13,410 1,414 215 1,800 24,000 40,839 132,000 132,000 172,839 384,120 384,120 Along with monitoring their bank account Cam has also been using a petty cash fund to try and limit their cash spending. Cam has kept a record of spending they have done during July. July 3 Date July 17 Date July 26 July 30 Date Account Petty cash (voucher No: 0324) used to purchase plants for the office, cost $78. Recorded as a sundry expense. Account Petty cash (voucher No: 0325) used to purchase postage stamps $30. Recorded as office supplies. Cam has previously discussed the idea of monitoring their debtors more closely with previous accountants. Cam knows there is an allowance account set up for this but is not really sure what its purpose is. Cam supplied information similar to what is shown below to the accountant last year and is hoping you may be able to explain it. Petty cash (voucher No: 0326) used to pay Cam's $42 taxi fare (to attend a business meeting). Petty cash (voucher No: 0327) used to purchase a framed print for the office wall, cost $90. Recorded as a sundry expense. Account DISC Sales Journal COGS 69 423 SALES 122 900 Sales Returns Journal COGS 590 SALES 2 400 Cash Receipts Journal DEBTORS COGS Net GST 103 10.30 116 150 128 111 Accounts not yet due Accounts overdue: 1-30 days 31-60 days 61-150 days 151 days and over GST 12 290 Amount $17 600 GST 240 13 475 2 640 4 785 2 200 $40,700 SALES Debtors 135 190 Debtors 2 640 GST 386 400 38 640 In addition to the above information Cam has also been looking into the debtor balances and has discovered there are a number of overdue accounts and a bad debt of $345 that had not been properly written off. doubtful % 1.0 CASH 4.0 15.0 40.0 75.0 541 076.70 Date QUESTION 5-6 marks Cam uses the Net Sales Method (Income Statement Approach) to determine doubtful debts and uses a percentage of 8%. Using the relevant information from pages 7 and 9 of the Information Booklet REQUIRED: A. Prepare the General Journal entries to record the necessary adjustment to Allowance for Doubtful Debts for 31 July 2023 given the current balance in the allowance is 1,026 Cr. Question 5 Part A (Enter answers here) Details Dr Cr

Step by Step Solution

★★★★★

3.50 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Based on the provided information here is a breakdown of the relevant details 1 Current Assets Petty Cash 250 Cash at Bank 29814 Accounts Receivable 4...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started