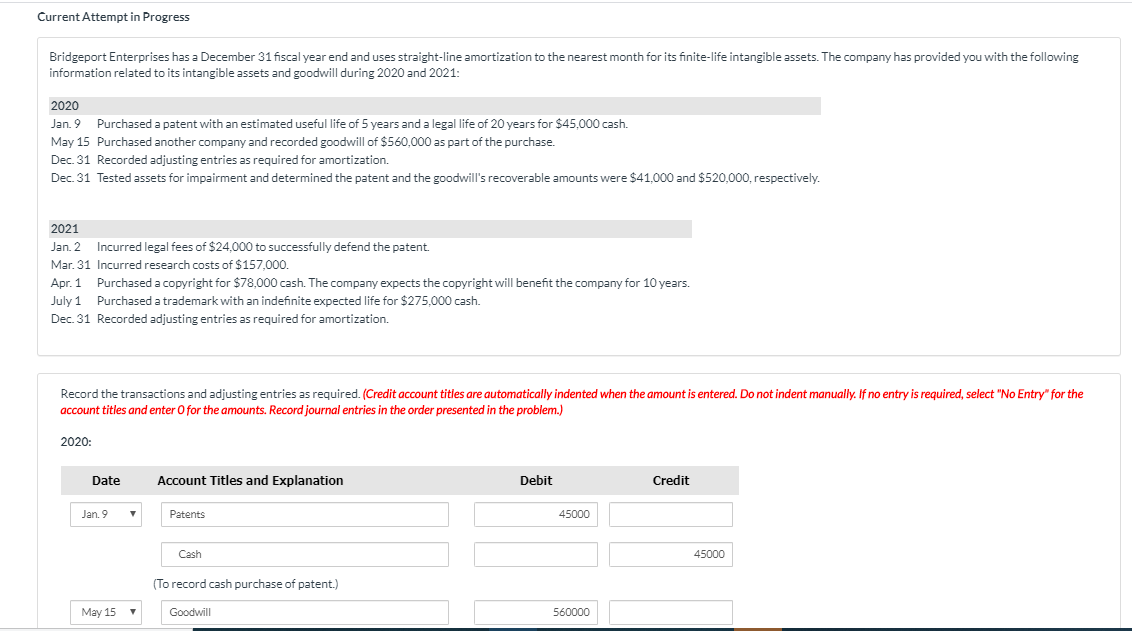

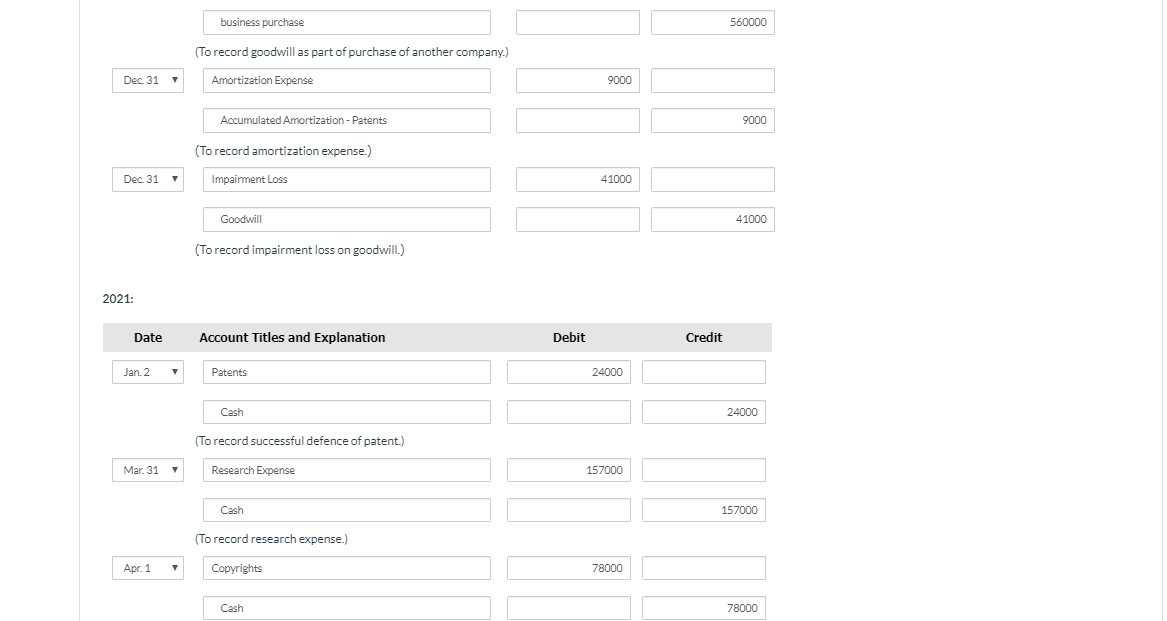

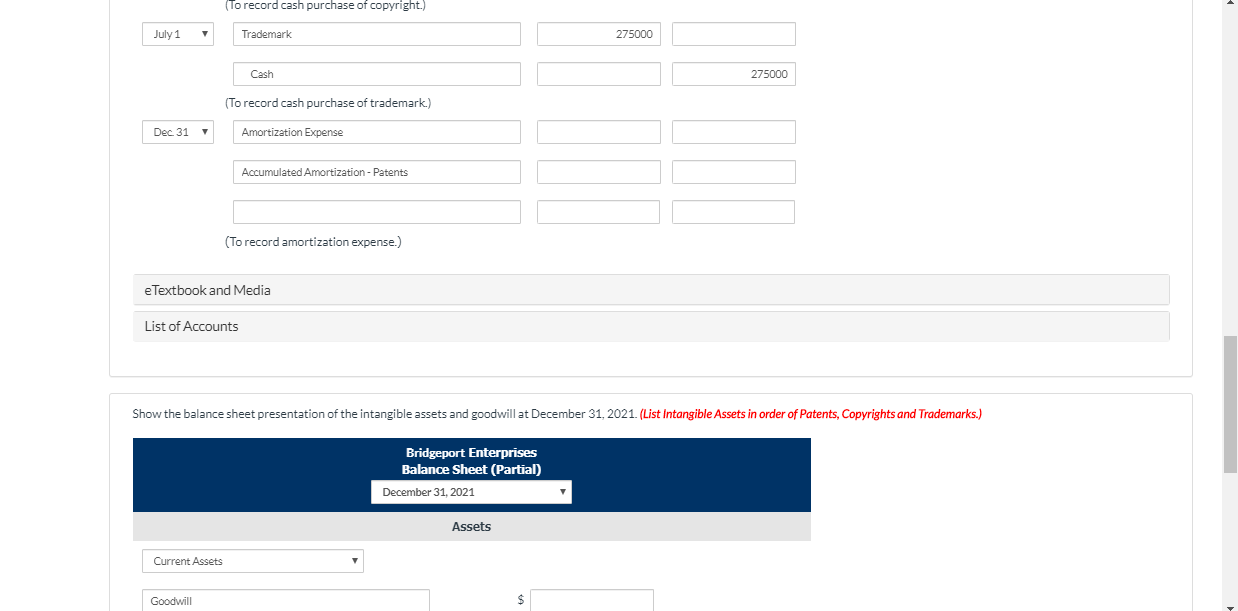

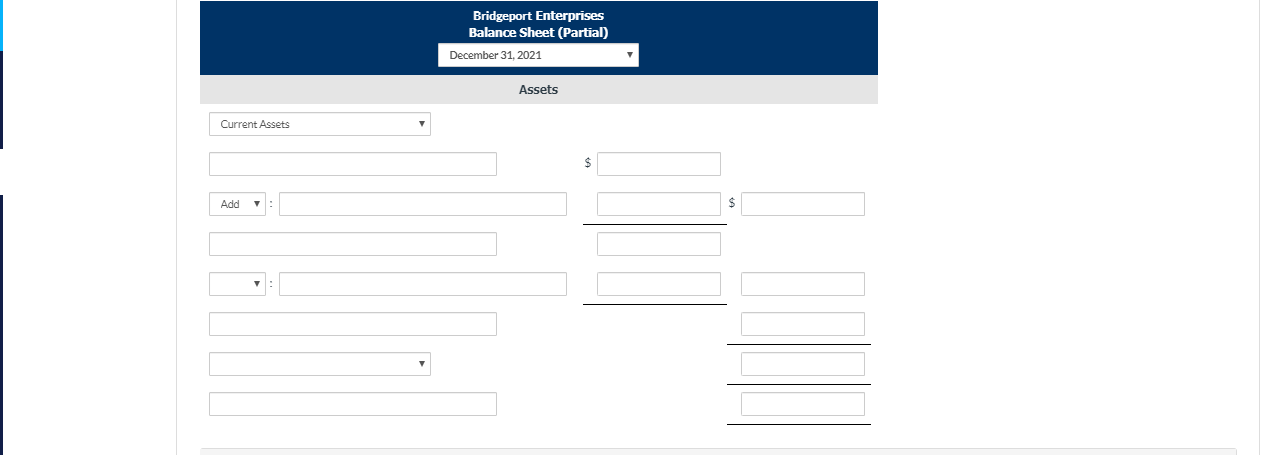

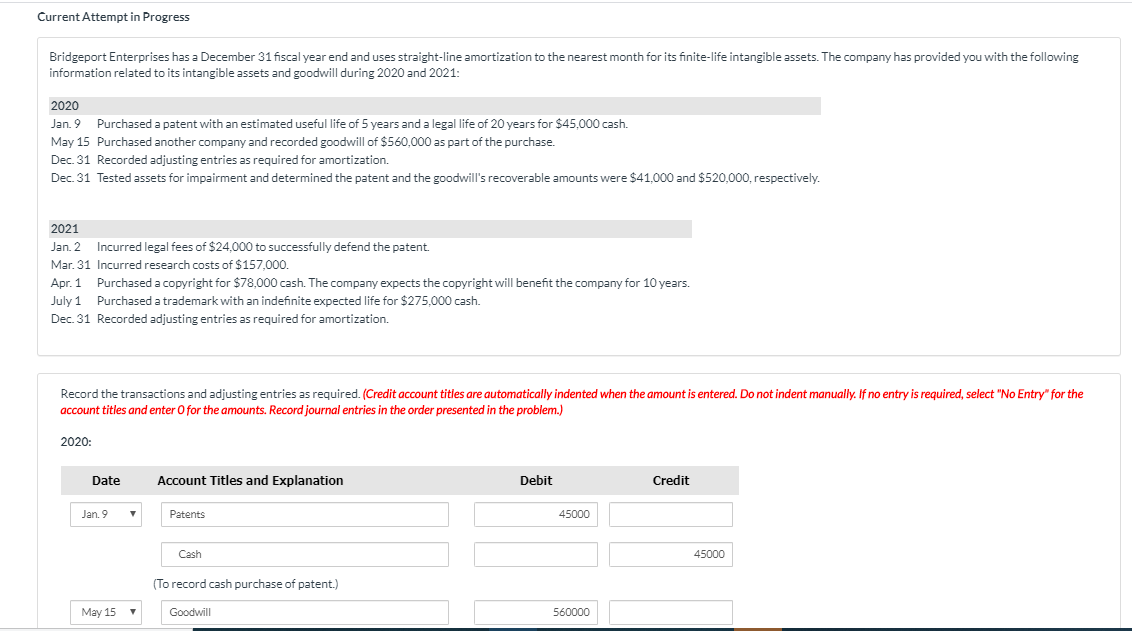

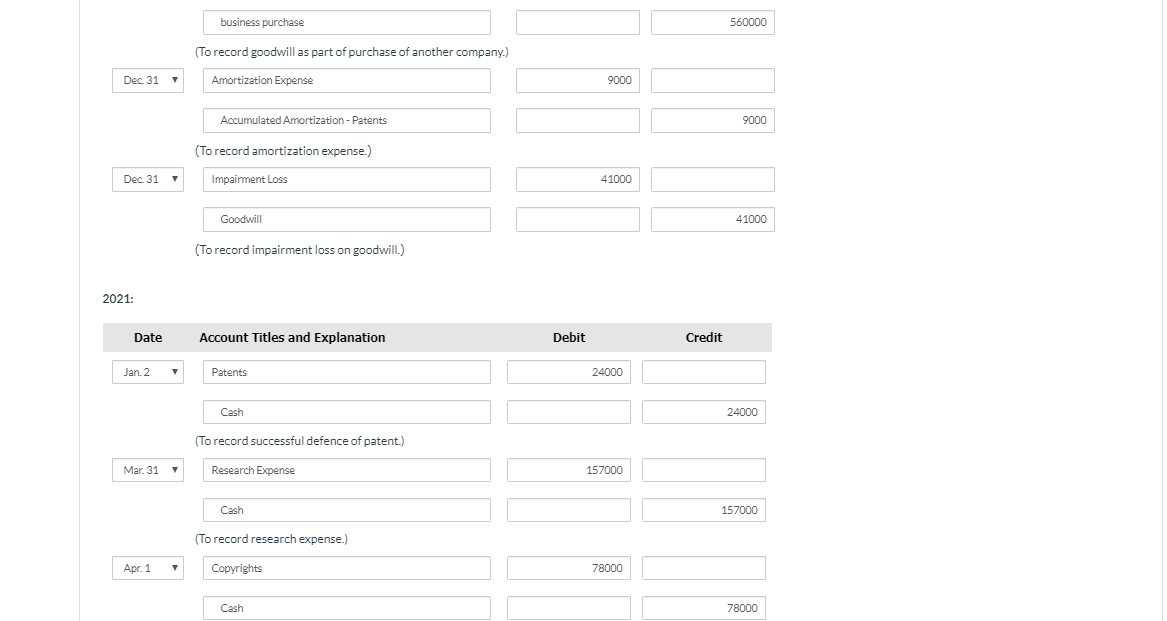

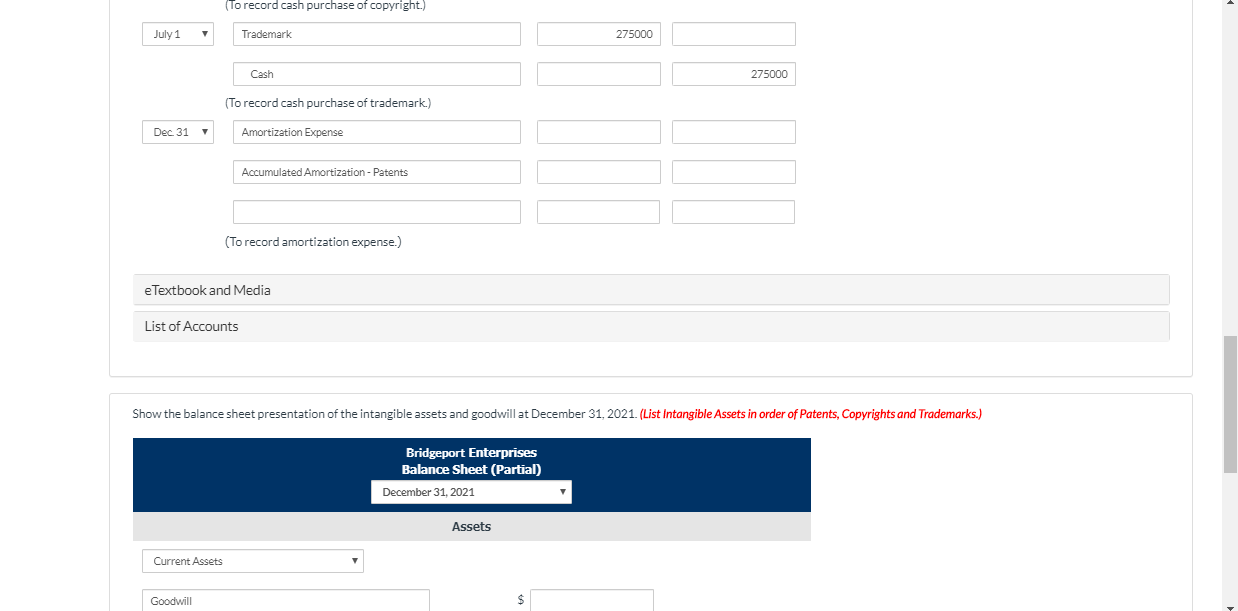

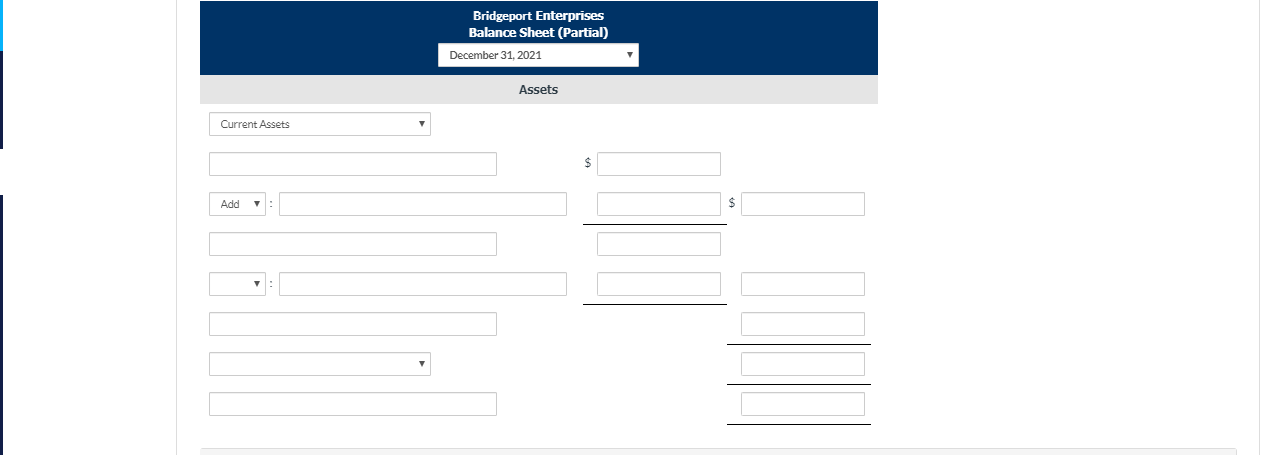

Current Attempt in Progress Bridgeport Enterprises has a December 31 fiscal year end and uses straight-line amortization to the nearest month for its finite-life intangible assets. The company has provided you with the following information related to its intangible assets and goodwill during 2020 and 2021 2020 Jan. 9 Purchased a patent with an estimated useful life of 5 years and a legal life of 20 years for $45,000 cash. May 15 Purchased another company and recorded goodwill of $560,000 as part of the purchase. Dec 31 Recorded adjusting entries as required for amortization. Dec 31 Tested assets for impairment and determined the patent and the goodwill's recoverable amounts were $41,000 and $520,000, respectively. 2021 Jan. 2 incurred legal fees of $24,000 to successfully defend the patent. Mar. 31 Incurred research costs of $157,000. Apr. 1 Purchased a copyright for $78,000 cash. The company expects the copyright will benefit the company for 10 years. July 1 Purchased a trademark with an indefinite expected life for $275,000 cash. Dec. 31 Recorded adjusting entries as required for amortization. Record the transactions and adjusting entries as required. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts. Record journal entries in the order presented in the problem.) 2020: Date Account Titles and Explanation Debit Credit Jan. 9 Patents 45000 Cash 45000 (To record cash purchase of patent.) May 15 Goodwill 560000 business purchase 560000 (To record goodwill as part of purchase of another company.) Dec 31 Amortization Expense 9000 Accumulated Amortization - Patents 9000 (To record amortization expense.) Dec 31 1 Impairment Loss 41000 Goodwill 41000 (To record impairment loss on goodwill.) 2021: Date Account Titles and Explanation Debit Credit Jan. 2 Patents 24000 Cash 24000 (To record successful defence of patent.) Mar. 31 Research Expense 157000 Cash 157000 (To record research expense.) Apr. 1 Copyrights 78000 Cash 78000 (To record cash purchase of copyright.) July 1 1 Trademark 275000 Cash 275000 (To record cash purchase of trademark) Dec 31 Amortization Expense Accumulated Amortization - Patents (To record amortization expense.) e Textbook and Media List of Accounts Show the balance sheet presentation of the intangible assets and goodwill at December 31, 2021. (List Intangible Assets in order of Patents, Copyrights and Trademarks.) Bridgeport Enterprises Balance Sheet (Partial) December 31, 2021 Assets Current Assets Goodwill Bridgeport Enterprises Balance Sheet (Partial) December 31, 2021 Assets Current Assets Add 1