Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Current Attempt in Progress During 2 0 1 3 , Blue Inc., a furniture store, issued two different series of bonds, details of which follow:

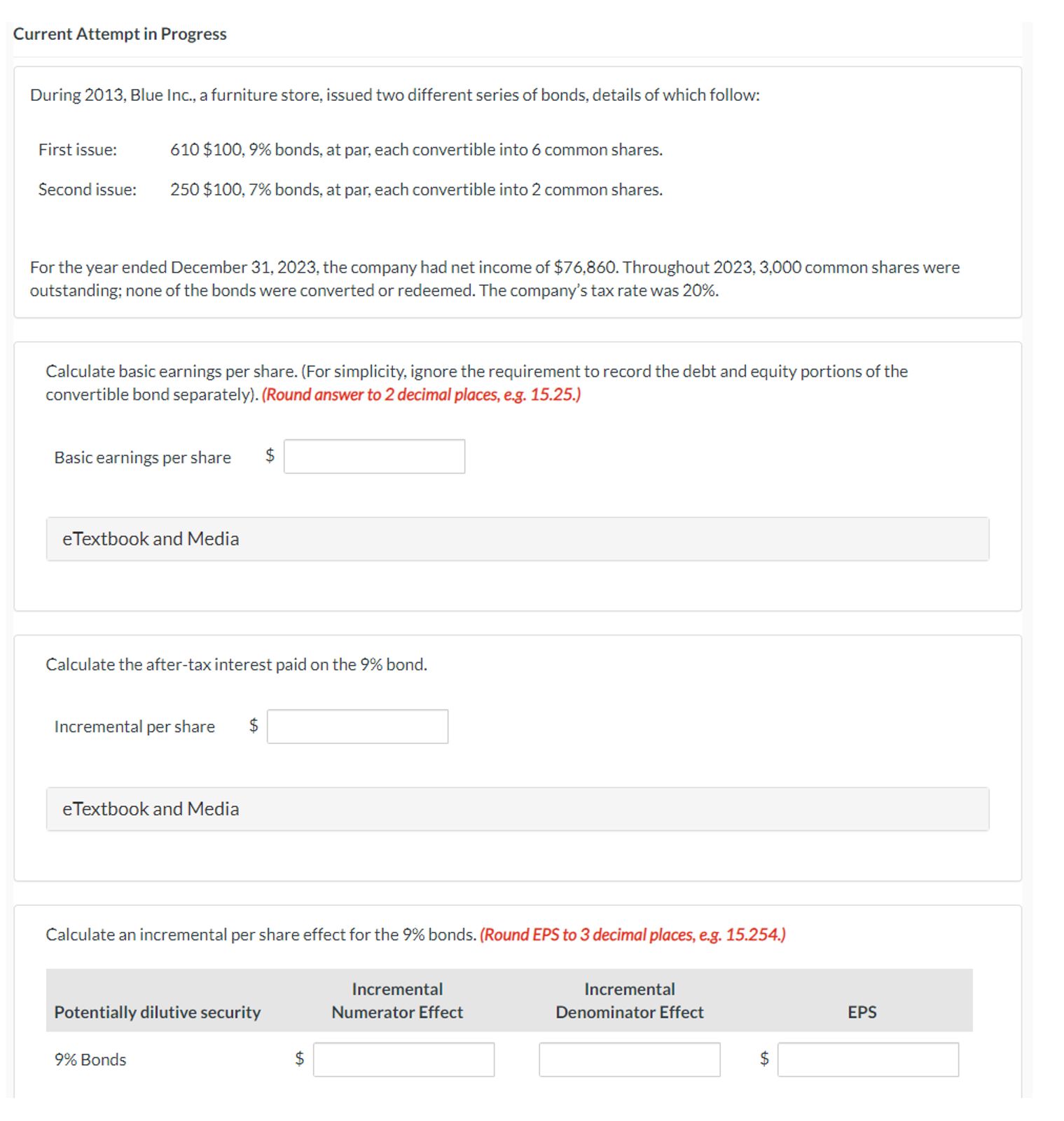

Current Attempt in Progress

During Blue Inc., a furniture store, issued two different series of bonds, details of which follow:

First issue: $ bonds, at par, each convertible into common shares.

Second issue: $ bonds, at par, each convertible into common shares.

For the year ended December the company had net income of $ Throughout common shares were

outstanding; none of the bonds were converted or redeemed. The company's tax rate was

Calculate basic earnings per share. For simplicity, ignore the requirement to record the debt and equity portions of the

convertible bond separatelyRound answer to decimal places, eg

Basic earnings per share $

eTextbook and Media

Calculate the aftertax interest paid on the bond.

Incremental per share $

eTextbook and Media

Calculate an incremental per share effect for the bonds. Round EPS to decimal places, eg

Potentially dilutive security

Incremental

Numerator Effect

Incremental

Denominator Effect

EPS

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started