Answered step by step

Verified Expert Solution

Question

1 Approved Answer

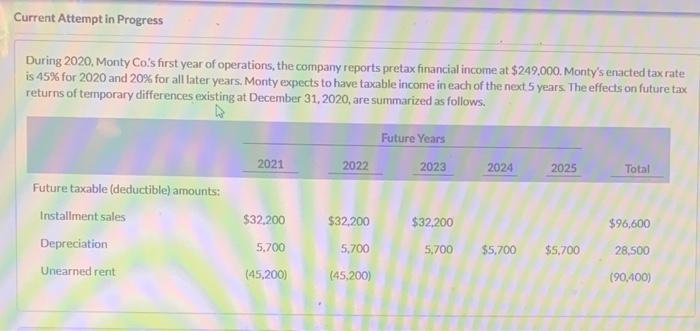

Current Attempt in Progress During 2020, Monty Co's first year of operations, the company reports pretax financial income at $249,000. Monty's enacted tax rate

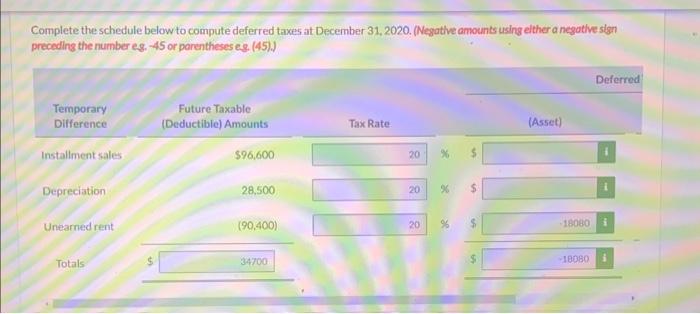

Current Attempt in Progress During 2020, Monty Co's first year of operations, the company reports pretax financial income at $249,000. Monty's enacted tax rate is 45% for 2020 and 20% for all later years. Monty expects to have taxable income in each of the next 5 years. The effects on future tax returns of temporary differences existing at December 31, 2020, are summarized as follows. Future taxable (deductible) amounts: Future Years 2021 2022 2023 2024 2025 Total Installment sales $32,200 $32,200 $32,200 $96,600 Depreciation 5,700 5,700 5,700 $5,700 $5,700 28,500 Unearned rent (45,200) (45,200) (90,400)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started