Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Current Attempt in Progress Financial information for PINA Inc. follows. PINA INC. Statement of Financial Position December 31, 2023 Cash $49,000 Notes payable (short-term)

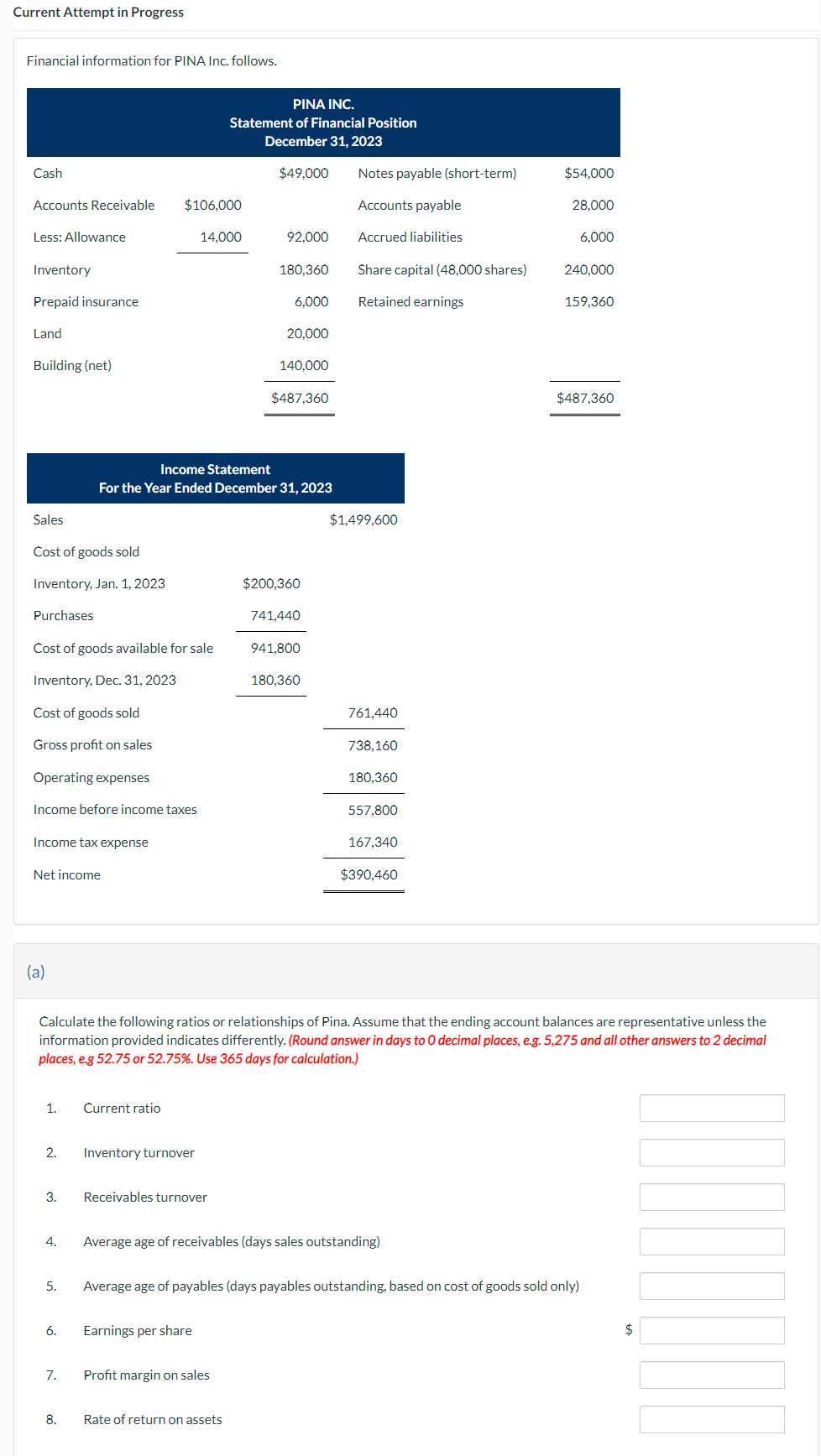

Current Attempt in Progress Financial information for PINA Inc. follows. PINA INC. Statement of Financial Position December 31, 2023 Cash $49,000 Notes payable (short-term) $54,000 Accounts Receivable $106,000 Accounts payable 28,000 Less: Allowance 14,000 92,000 Accrued liabilities 6,000 Inventory 180,360 Share capital (48,000 shares) 240,000 Prepaid insurance Land 6,000 Retained earnings 159,360 20,000 Building (net) 140,000 $487,360 $487,360 Income Statement For the Year Ended December 31, 2023 Sales $1,499,600 Cost of goods sold Inventory, Jan. 1, 2023 $200,360 Purchases 741,440 Cost of goods available for sale 941,800 Inventory, Dec. 31, 2023 180,360 Cost of goods sold 761,440 Gross profit on sales 738,160 Operating expenses 180,360 Income before income taxes 557,800 Income tax expense 167,340 Net income $390,460 (a) Calculate the following ratios or relationships of Pina. Assume that the ending account balances are representative unless the information provided indicates differently. (Round answer in days to O decimal places, e.g. 5,275 and all other answers to 2 decimal places, e.g 52.75 or 52.75%. Use 365 days for calculation.) 1. Current ratio 2. Inventory turnover 3. Receivables turnover 4. Average age of receivables (days sales outstanding) 5. Average age of payables (days payables outstanding, based on cost of goods sold only) 6. Earnings per share 7. Profit margin on sales 8. Rate of return on assets $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started