Answered step by step

Verified Expert Solution

Question

1 Approved Answer

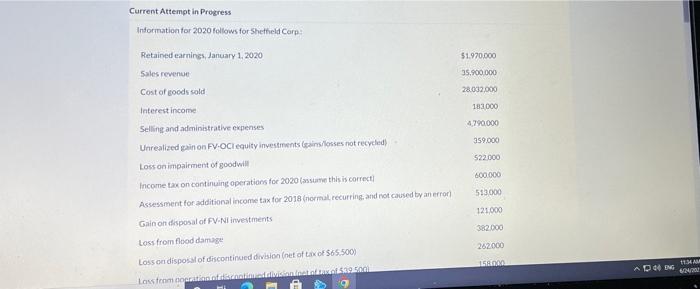

Current Attempt in Progress Information for 2020 follows for Sheffield Corp: Retained earnings, January 1, 2020 Sales revenue Cost of goods sold Interest income

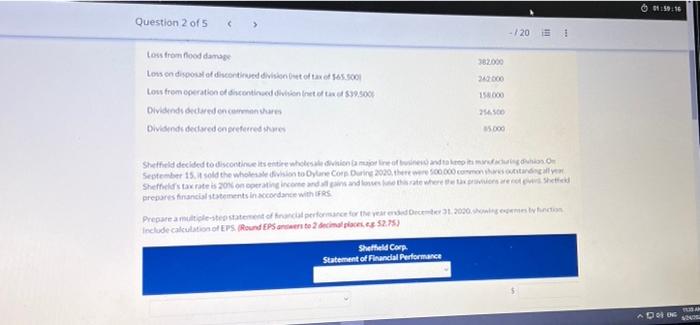

Current Attempt in Progress Information for 2020 follows for Sheffield Corp: Retained earnings, January 1, 2020 Sales revenue Cost of goods sold Interest income $1,970,000 35,900.000 28.032,000 183,000 Selling and administrative expenses 4,790,000 Unrealized gain on FV-OCI equity investments (gains/losses not recycled) 359,000 Loss on impairment of goodwill $22,000 Income tax on continuing operations for 2020 (assume this is correct) 600.000 Assessment for additional income tax for 2018 (normal, recurring, and not caused by an error) 513,000 Gain on disposal of FV-NI investments 121,000 Loss from flood damage 382.000 Loss on disposal of discontinued division (net of tax of $65.500) 262000 Loss from noeration of discontinued division inet of tax of $39.5001 158.000 ADING 1134 AM 6/24/201

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started