Answered step by step

Verified Expert Solution

Question

1 Approved Answer

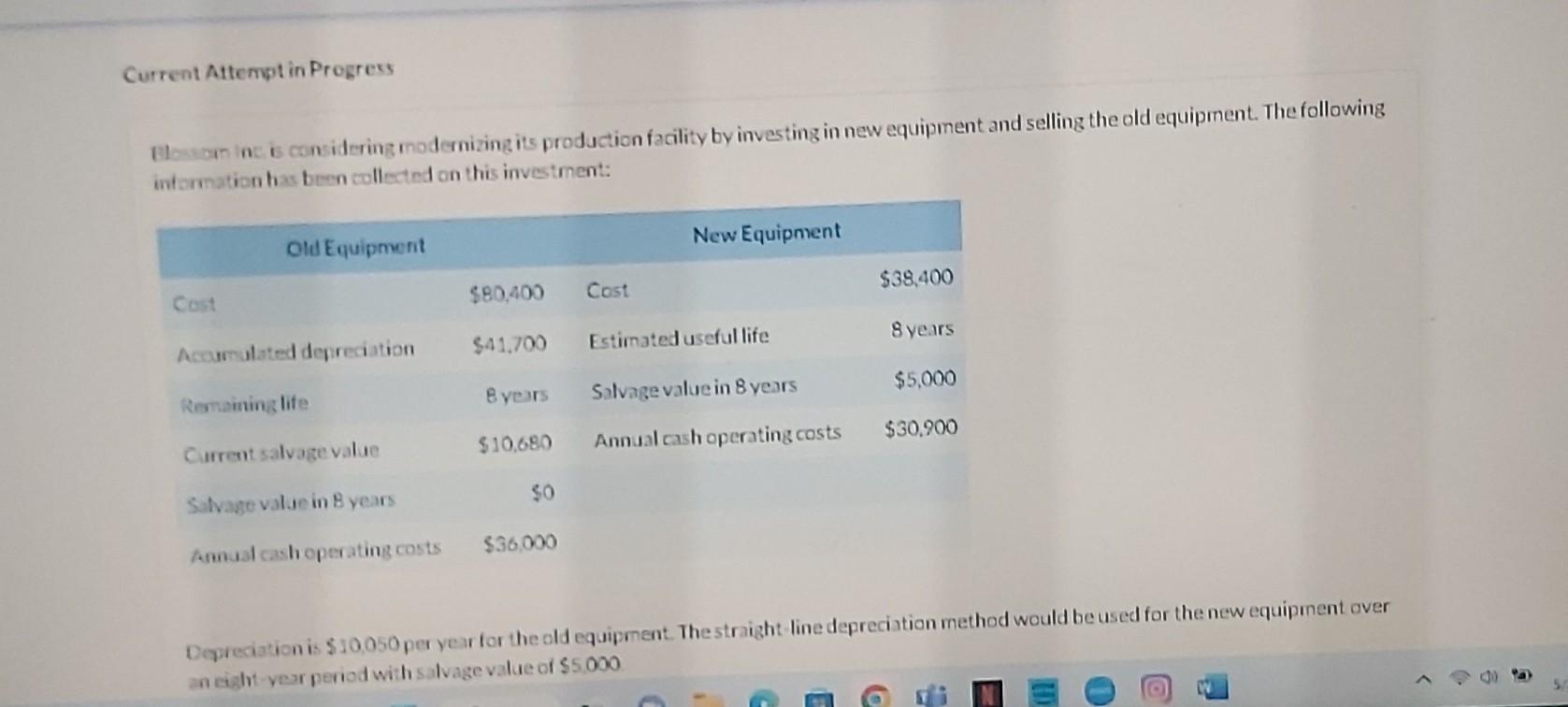

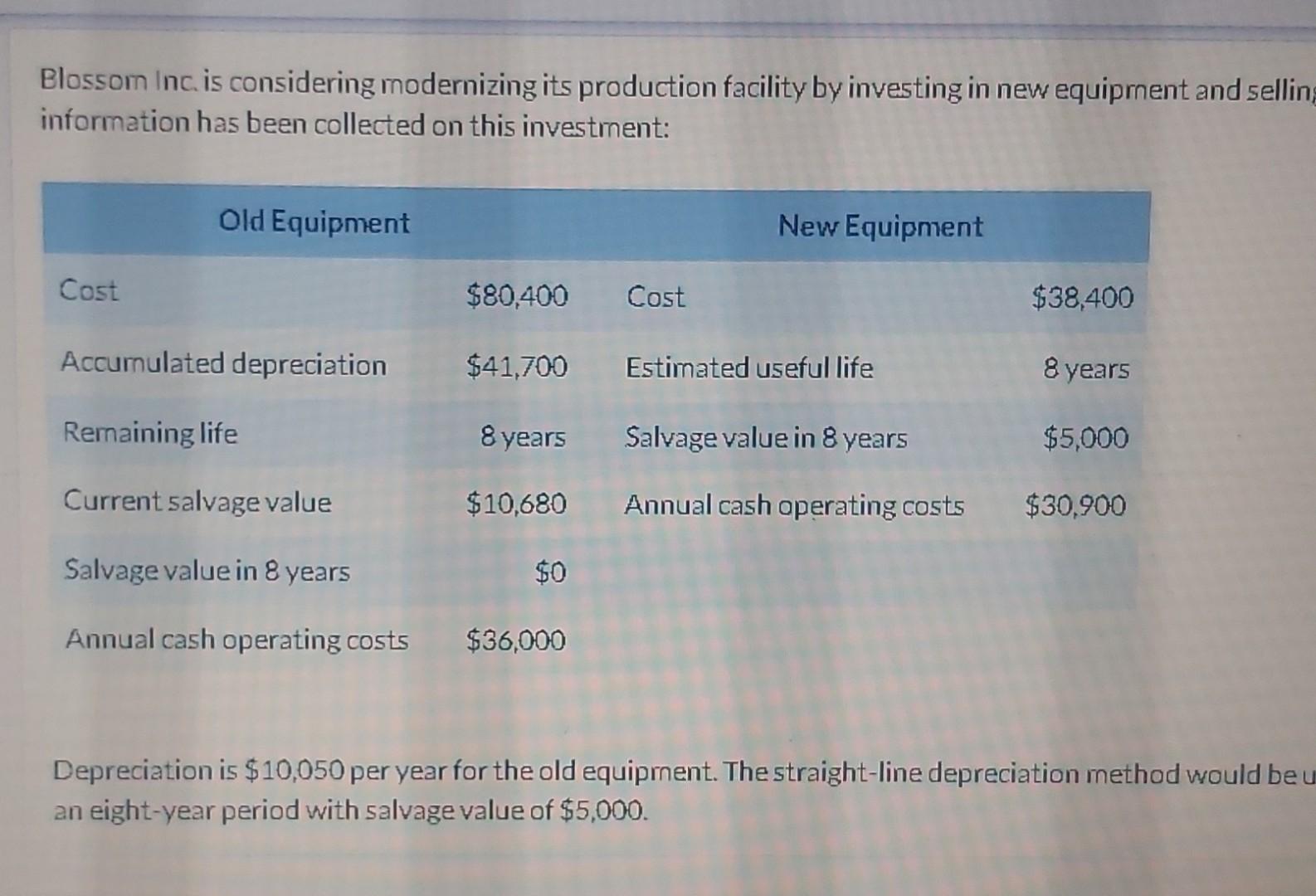

Current Attempt in Progress intermation has been collected on this investment: Deqrecistion is $10050 per year for the old equipment. Thestright line depreciation method would

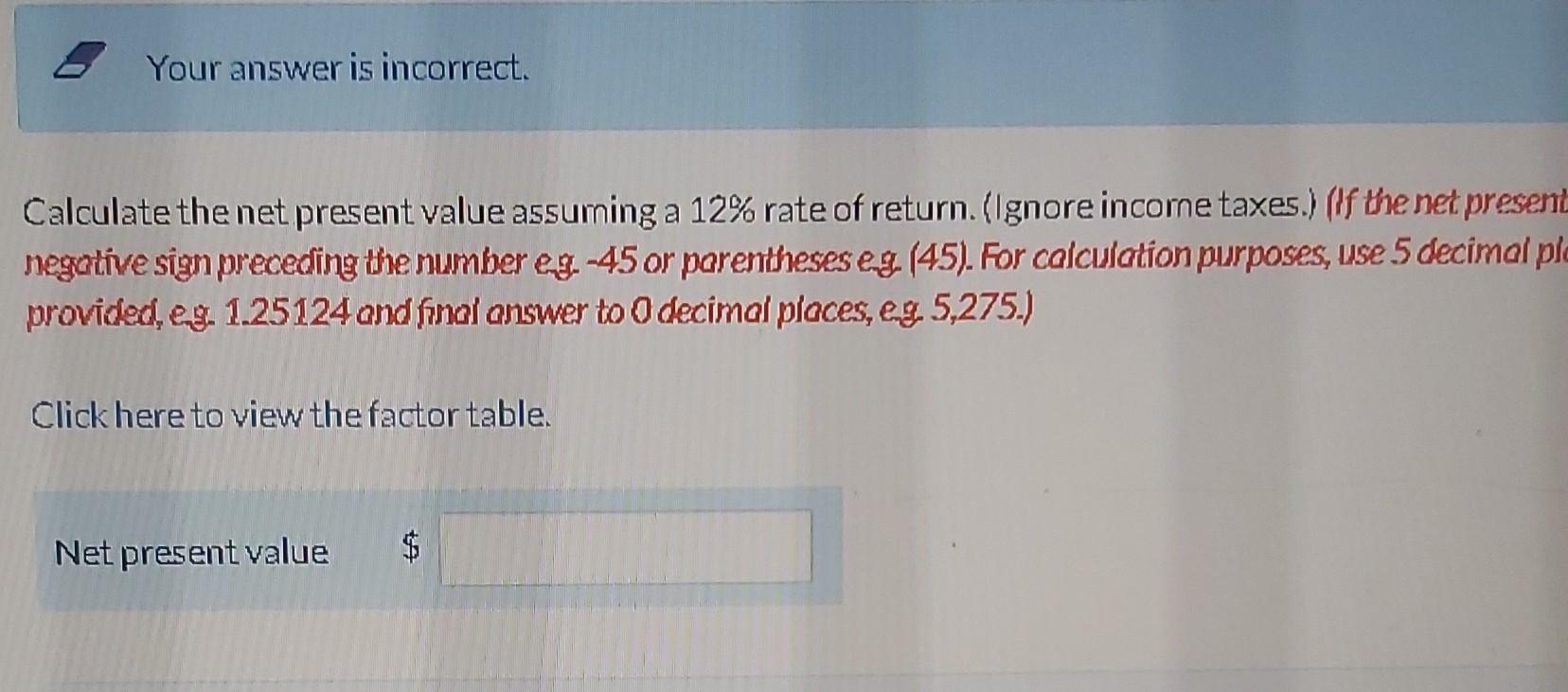

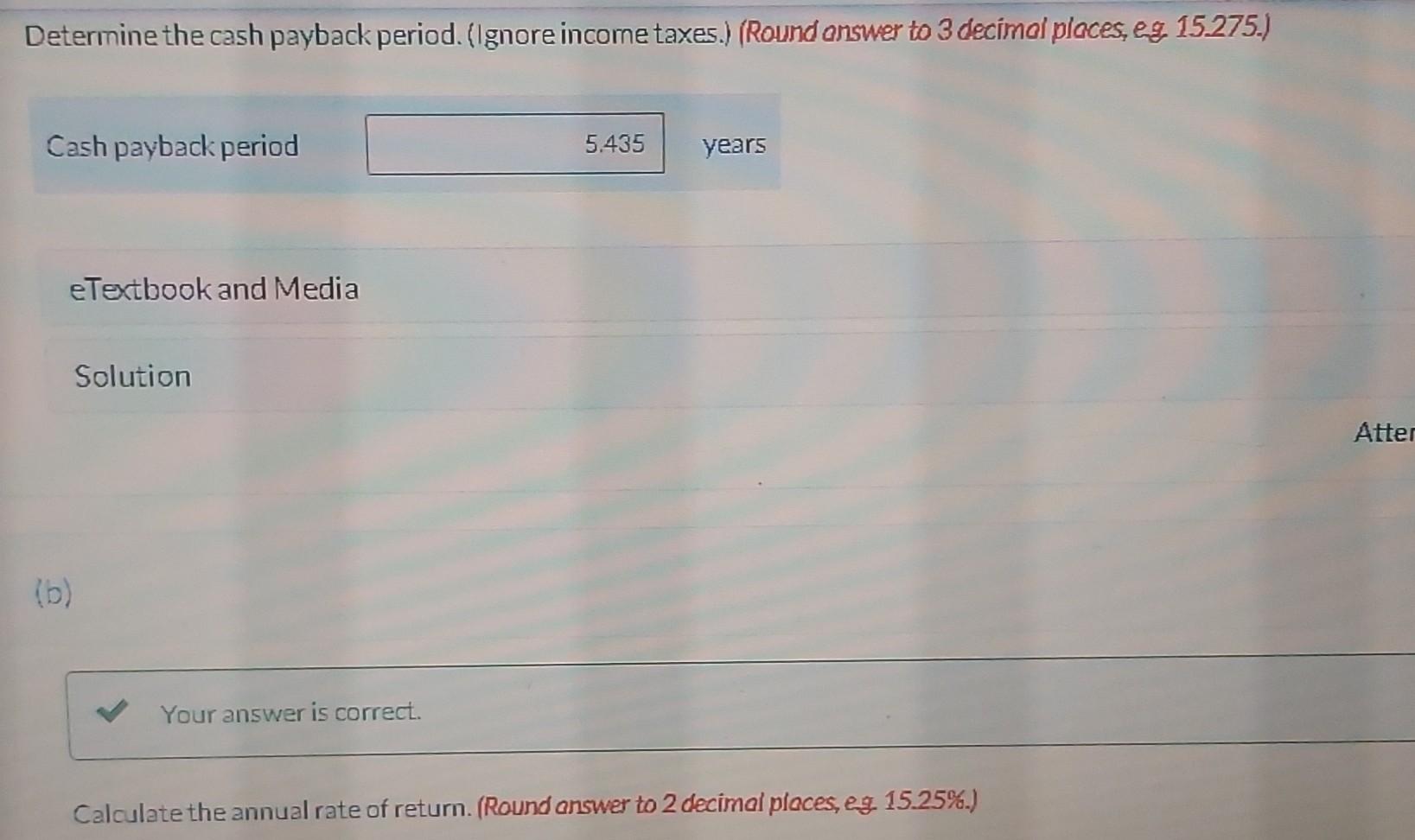

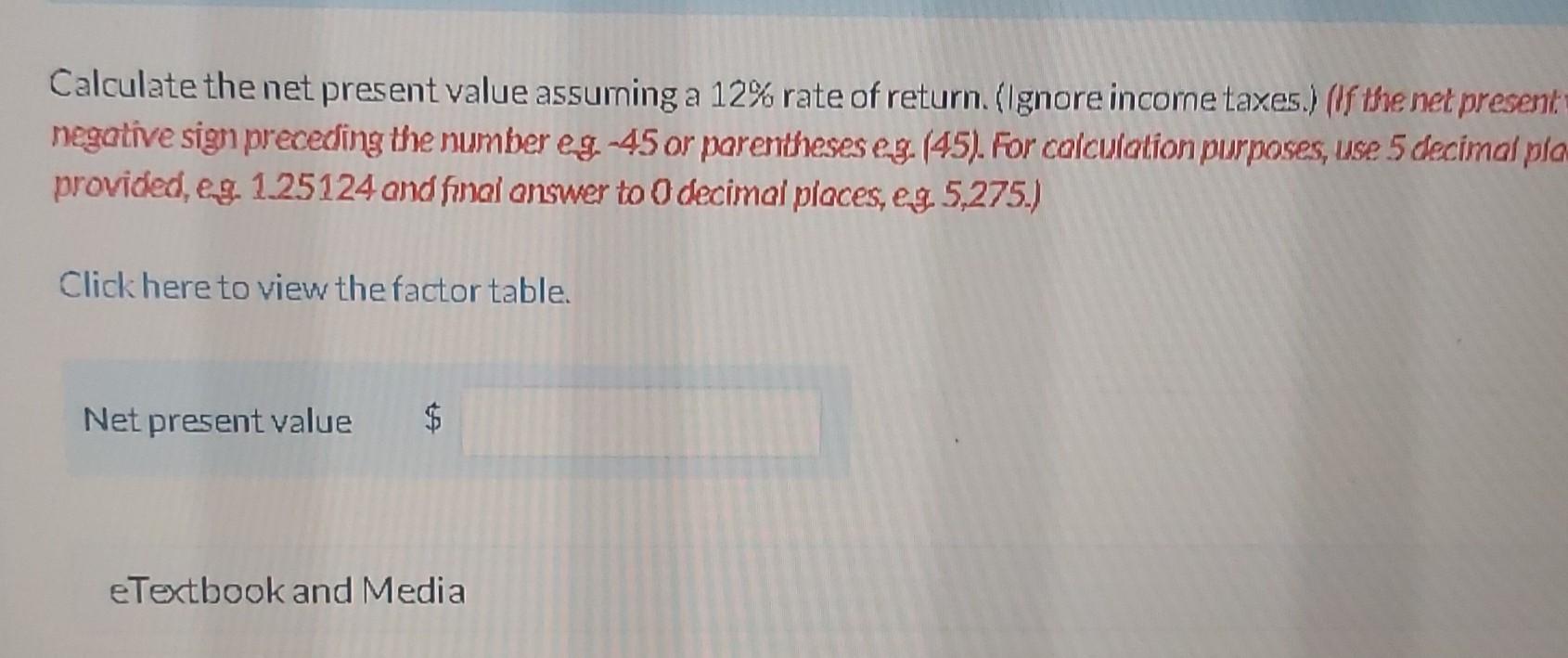

Current Attempt in Progress intermation has been collected on this investment: Deqrecistion is $10050 per year for the old equipment. Thestright line depreciation method would be used for the new equipment aver an eight-ver period with salvage value or $5,000 Determine the cash payback period. (|gnore incorne taxes.) (Round onswer to 3 decimal places, eg. 15.275.) years eTextbook and Media Calculate the annual rate of return. (Round answer to 2 decimol places, eg, 15.25\%.) Annual rate of return % eTextbook and Media Your answer is incorrect. Calculate the net present value assuming a 12% rate of return. (Ignore income taxes.) (If the net presen negotive sign preceding the number eg- 45 or porentheses eg, (45). For calculation purposes, use 5 decimal pl provided, eg. 1.25124 and final answer to 0 decimal places, eg, 5, 275.) Click here to view the factor table. Net present value $ Blossom Inc is considering modernizing its production facility by investing in new equiprnent and sellin information has been collected on this investrnent: Depreciation is $10,050 per year for the old equiprnent. The straight-line depreciation method would be an eight-year period with salvage value of $5,000. Determine the cash payback period. (Ignore income taxes.) (Round onswer to 3 decimol places, eg, 15.275.) years eTextbook and Media Solution (b) Your answer is correct. Calculate the annual rate of return. (Round answer to 2 decimal places, eg. 15.25\%.) Calculate the net present value assurning a 12% rate of return. (|gnore incorne taxes.) (If the net present: negative sign preceding the number eg -45 or parentheseseg. (45). For colculation purposes, use 5 decimal pla provided, eg. 125124 and final onswer to 0 decimal piaces, eq, 5,275 .) Click here to view the factor table. Net present value eTextbook and Media

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started