Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Current Attempt in Progress Larkspur Limited purchased a patent for $86,400 on June 1, 2019. Larkspur has a calendar fiscal year end. Straight-line amortization is

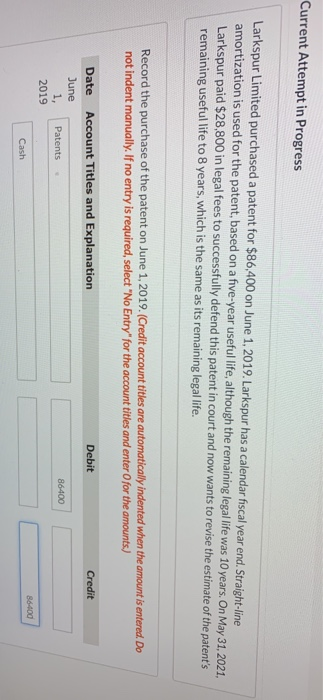

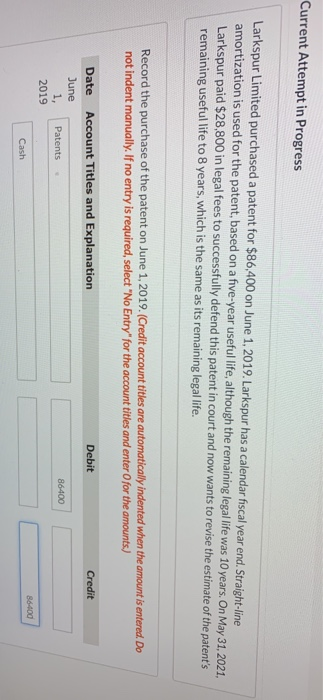

Current Attempt in Progress Larkspur Limited purchased a patent for $86,400 on June 1, 2019. Larkspur has a calendar fiscal year end. Straight-line amortization is used for the patent, based on a five-year useful life, although the remaining legal life was 10 years. On May 31, 2021. Larkspur paid $28,800 in legal fees to successfully defend this patent in court and now wants to revise the estimate of the patent's remaining useful life to 8 years, which is the same as its remaining legal life. Record the purchase of the patent on June 1, 2019. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts.) Debit Credit Date Account Titles and Explanation June 1, Patents 2019 86400 86-400 Cash

Current Attempt in Progress Larkspur Limited purchased a patent for $86,400 on June 1, 2019. Larkspur has a calendar fiscal year end. Straight-line amortization is used for the patent, based on a five-year useful life, although the remaining legal life was 10 years. On May 31, 2021. Larkspur paid $28,800 in legal fees to successfully defend this patent in court and now wants to revise the estimate of the patent's remaining useful life to 8 years, which is the same as its remaining legal life. Record the purchase of the patent on June 1, 2019. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts.) Debit Credit Date Account Titles and Explanation June 1, Patents 2019 86400 86-400 Cash

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started