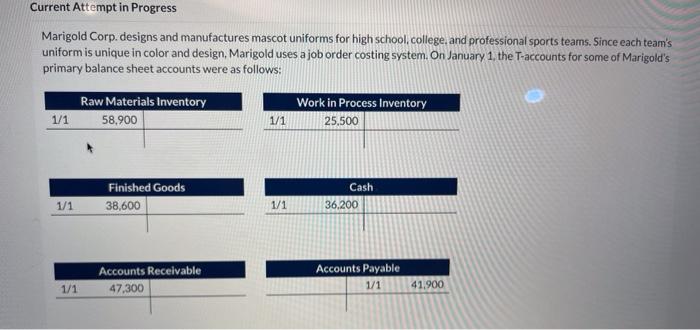

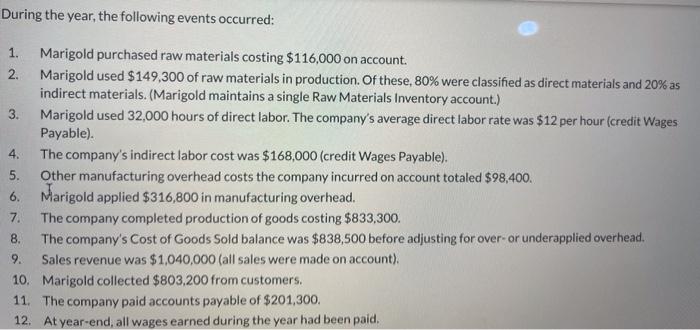

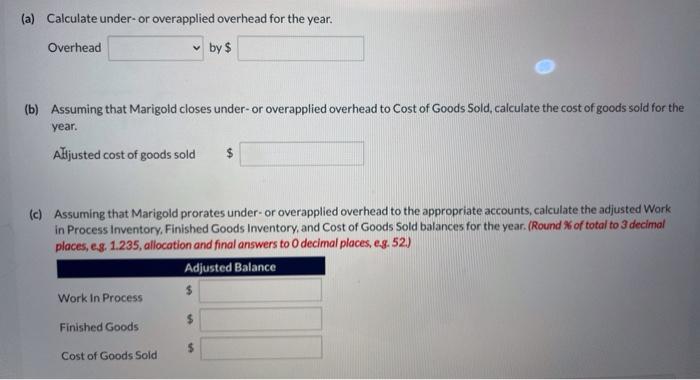

Current Attempt in Progress Marigold Corp.designs and manufactures mascot uniforms for high school, college and professional sports teams. Since each team's uniform is unique in color and design, Marigold uses a job order costing system. On January 1, the T-accounts for some of Marigold's primary balance sheet accounts were as follows: Raw Materials Inventory 58,900 Work in Process Inventory 25,500 1/1 1/1 Finished Goods 38,600 Cash 36.200 1/1 1/1 Accounts Receivable 47.300 Accounts Payable 1/1 1/1 41.900 During the year, the following events occurred: 1. Marigold purchased raw materials costing $116,000 on account. 2. Marigold used $149,300 of raw materials in production. Of these, 80% were classified as direct materials and 20% as indirect materials. (Marigold maintains a single Raw Materials Inventory account.) 3. Marigold used 32,000 hours of direct labor. The company's average direct labor rate was $12 per hour (credit Wages Payable). 4. The company's indirect labor cost was $168,000 (credit Wages Payable). 5. Other manufacturing overhead costs the company incurred on account totaled $98,400. 6. Marigold applied $316,800 in manufacturing overhead. The company completed production of goods costing $833,300. The company's Cost of Goods Sold balance was $838,500 before adjusting for over-or underapplied overhead. 9. Sales revenue was $1,040,000 (all sales were made on account), 10. Marigold collected $803,200 from customers. 11. The company paid accounts payable of $ 201,300. 12. At year-end, all wages earned during the year had been paid. 7. 8. (a) Calculate under or overapplied overhead for the year. Overhead by $ (b) Assuming that Marigold closes under-or overapplied overhead to Cost of Goods Sold, calculate the cost of goods sold for the year. Alljusted cost of goods sold $ (c) Assuming that Marigold prorates under or overapplied overhead to the appropriate accounts, calculate the adjusted Work in Process Inventory. Finished Goods Inventory, and Cost of Goods Sold balances for the year. (Round % of total to 3 decimal places, c.8. 1.235, allocation and final answers to decimal places, eg. 52) Adjusted Balance Work in Process Finished Goods $ Cost of Goods Sold