Answered step by step

Verified Expert Solution

Question

1 Approved Answer

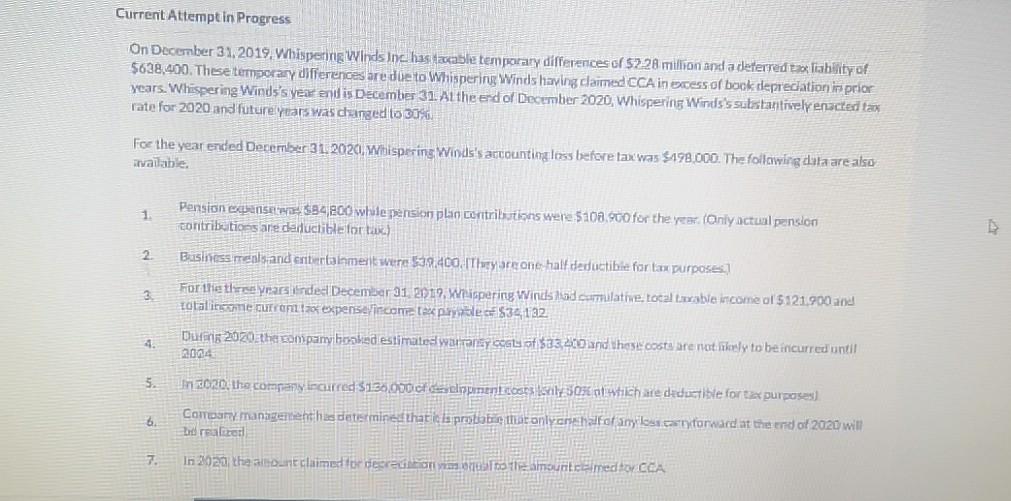

Current Attempt in Progress On December 31, 2019. Whispering Winds Inc. has taxable temporary differences of 52.28 million and a deterred tax liability of $638,400.

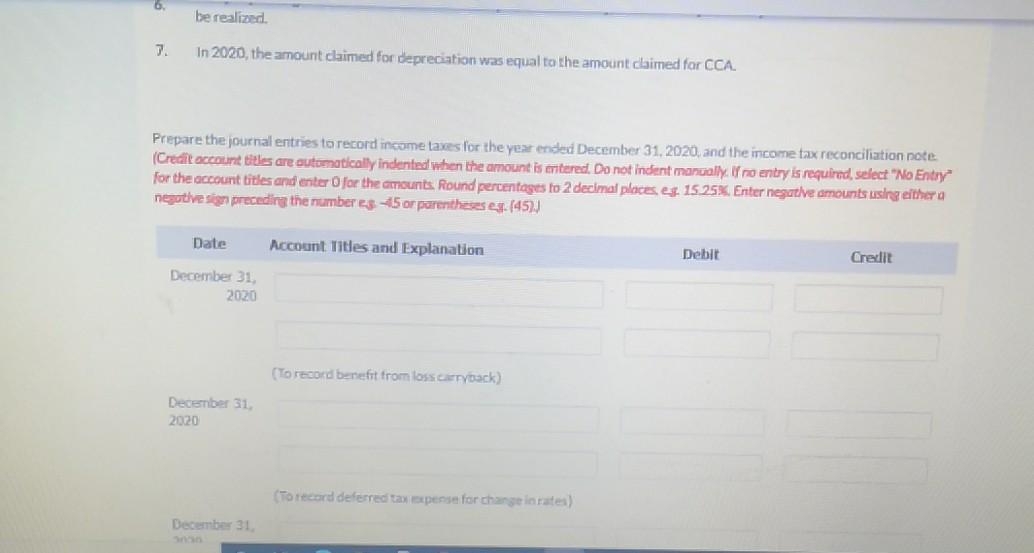

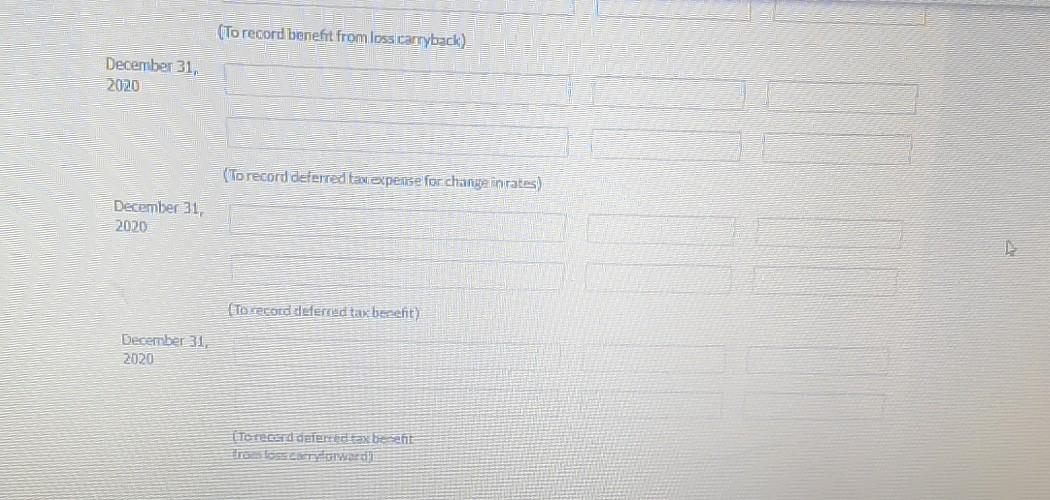

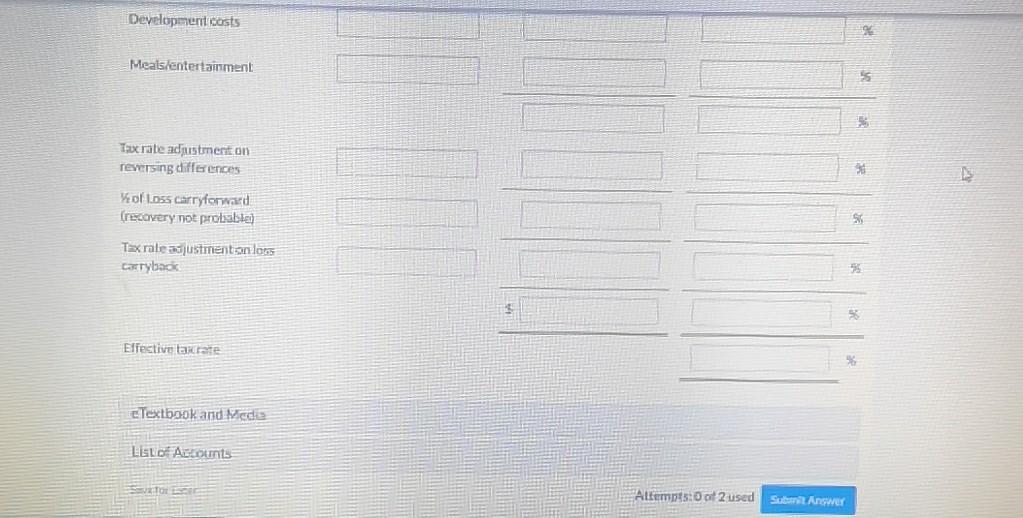

Current Attempt in Progress On December 31, 2019. Whispering Winds Inc. has taxable temporary differences of 52.28 million and a deterred tax liability of $638,400. These temporary differences are due to Whispering Winds having claimed CCA in Ecess of book depredation in prior years. Whispering Winds's year and is December 31 Altheard of December 2020, Whispering Winds's substantively enacted tax rate for 2020 and future years was changed to 30% For the year ended December 3 2020, Whispering Winds's accounting less before tax was $198.000. The following data are also available 1 Pension expense 584 800 while pension plan contributions were 5108.900 for the year. (Only actual pension contributions are daructible for tax.) D 2 Businessments and entertainment were $39.400. They are one half deductible for tax purposes 3 Forte the inded December 31, 2019, Whispering Windscamulative toca taxable income of $121.900 and totalisme curcaFlexpenselecomxpryles $34,192 Due 2020 the company booked estimated warranty cool of $33.2 and these costs are not thely to be incurred until 2004 4. 5. In the company incurred $136.000 clipurin oorly 33 which are deductible for tax purposes 6 Company management ha determined that i la prostate that onlyen hat any loss forward at the end of 2020 will 7. In 2020, the bount claimed to decrecionalnourite medto.CCA be realized 7. In 2020, the amount claimed for depreciation was equal to the amount aimed for CCA Prepare the journal entries to record income taxes for the year ended December 31, 2020, and the income tax reconciliation note (Creditoccountitles are automatically indented when the amount is mtered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter for the amounts Round percentages to 2 decimal places, es 15.25%. Enter negative amounts using either a negative sign preceding the numbers 45 or parentheses ex. (452) Date Account Titles and Explanation Debat Credit December 31 2020 (o record benefit from loss carrock) December 31 2020 (Torecard deferred tax expense for change intates) December 31 (To record benefit from loss.carnyback) December 31 2020 (To record deferred tax expense for change in rates) December 31 2020 To record deferred tax bezet) December 31 2020 LIOTECETI deler axent Whispering Winds Inc. Income Tax Reconciliation Statement + Accounting loss 30% Lists before the Non-detectible Development costs 33 Meals/entertainment Taxateusement on reversing citeren closs carryforward Trecovery reprobable) Theocrate adjustment loss Garryback Development costs Meals entertainment Taxrate adjustment on nexesing differences Vzof 1.055 Carryforward (recovery moe probable) Taxrale adjustmenton los taryback Effective tarate Textbook and Media Letof Accounts SOCIE Altmnts: Ootused Submit Answer Current Attempt in Progress On December 31, 2019. Whispering Winds Inc. has taxable temporary differences of 52.28 million and a deterred tax liability of $638,400. These temporary differences are due to Whispering Winds having claimed CCA in Ecess of book depredation in prior years. Whispering Winds's year and is December 31 Altheard of December 2020, Whispering Winds's substantively enacted tax rate for 2020 and future years was changed to 30% For the year ended December 3 2020, Whispering Winds's accounting less before tax was $198.000. The following data are also available 1 Pension expense 584 800 while pension plan contributions were 5108.900 for the year. (Only actual pension contributions are daructible for tax.) D 2 Businessments and entertainment were $39.400. They are one half deductible for tax purposes 3 Forte the inded December 31, 2019, Whispering Windscamulative toca taxable income of $121.900 and totalisme curcaFlexpenselecomxpryles $34,192 Due 2020 the company booked estimated warranty cool of $33.2 and these costs are not thely to be incurred until 2004 4. 5. In the company incurred $136.000 clipurin oorly 33 which are deductible for tax purposes 6 Company management ha determined that i la prostate that onlyen hat any loss forward at the end of 2020 will 7. In 2020, the bount claimed to decrecionalnourite medto.CCA be realized 7. In 2020, the amount claimed for depreciation was equal to the amount aimed for CCA Prepare the journal entries to record income taxes for the year ended December 31, 2020, and the income tax reconciliation note (Creditoccountitles are automatically indented when the amount is mtered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter for the amounts Round percentages to 2 decimal places, es 15.25%. Enter negative amounts using either a negative sign preceding the numbers 45 or parentheses ex. (452) Date Account Titles and Explanation Debat Credit December 31 2020 (o record benefit from loss carrock) December 31 2020 (Torecard deferred tax expense for change intates) December 31 (To record benefit from loss.carnyback) December 31 2020 (To record deferred tax expense for change in rates) December 31 2020 To record deferred tax bezet) December 31 2020 LIOTECETI deler axent Whispering Winds Inc. Income Tax Reconciliation Statement + Accounting loss 30% Lists before the Non-detectible Development costs 33 Meals/entertainment Taxateusement on reversing citeren closs carryforward Trecovery reprobable) Theocrate adjustment loss Garryback Development costs Meals entertainment Taxrate adjustment on nexesing differences Vzof 1.055 Carryforward (recovery moe probable) Taxrale adjustmenton los taryback Effective tarate Textbook and Media Letof Accounts SOCIE Altmnts: Ootused Submit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started