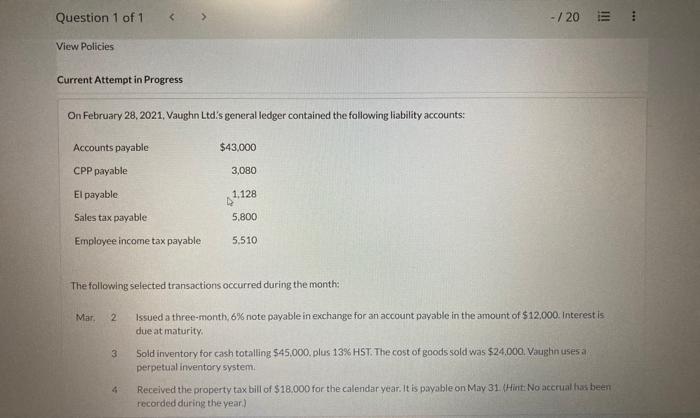

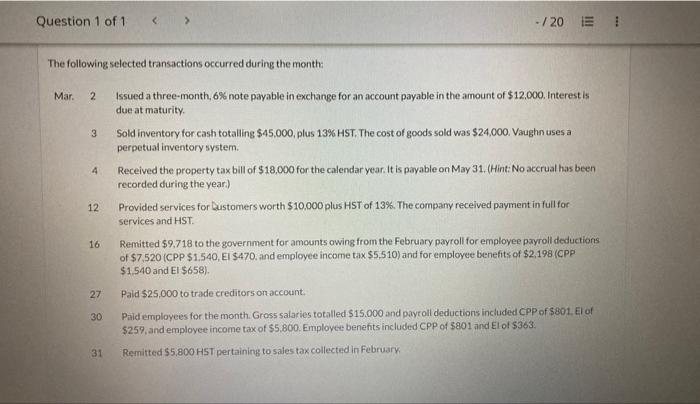

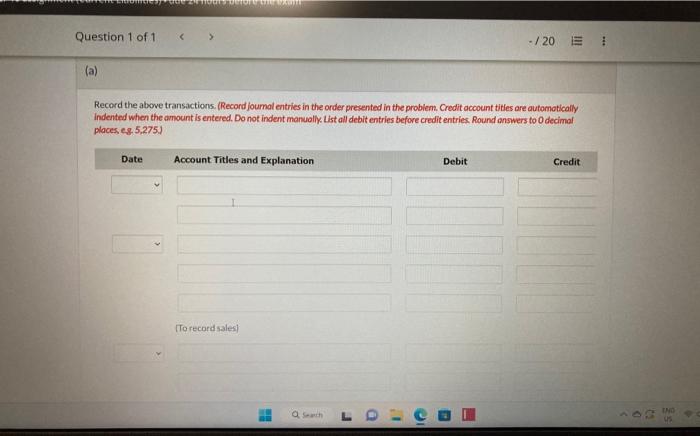

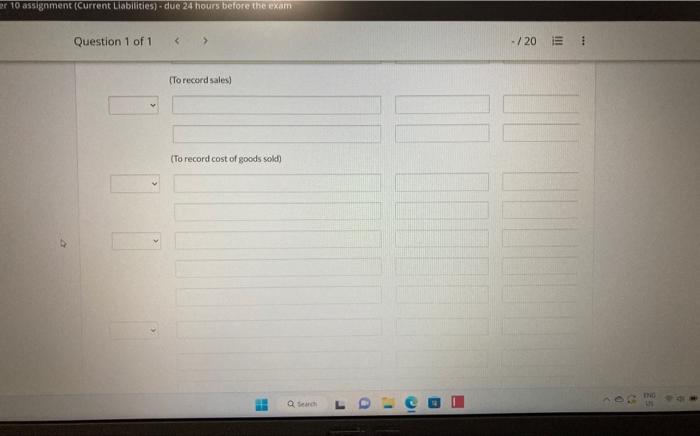

Current Attempt in Progress On February 28, 2021, Vaughn Ltdis general ledger contained the following liability accounts: The following selected transactions occurred during the month: Mar. 2. Issued a three-month, 6% note payable in exchange for an account payable in the amount of $12,000. Interest is due at maturity. 3. Sold inventory for cash totalling $45,000. plus 13% HST. The cost of goods sold was $24,000. Vaughn usesa perpetual inventory system. 4. Received the property tax bill of $18.000 for the calendar year. It is payable on May 31 . HinitiNo accrual has been recorded during the year.) The following selected transactions occurred during the month: Mar. 2 Issued a three-month, 6\% note payable in exchange for an account payable in the amount of $12,000. Interest is due at maturity. 3. Sold inventory for cash totalling $45.000, plus 13% HST. The cost of goods sold was $24,000. Vaughn uses a perpetual inventory system. 4. Received the property tax bill of $18,000 for the calendar year it is payable on May 31. (Hint: No accrual has been recorded during the year.) 12. Provided services for Lustomers worth $10,000 plus HST of 13%. The company received payment in full for services and HST. 16 Remitted $9,718 to the government for amounts owing from the February payroll for employee payroll deductions of \$7,520 (CPP \$1.540, El \$470, and employee income tax \$5.510) and for employee benefits of \$2,198 (CPP $1.540 and El$658). 27 Paid $25,000 to trade creditors onaccount. 30 Paid employees for the month. Gros5 salaries totalled $15,000 and payroll deductions included CPP of \$ $01. El of $257, and employee income tax of \$5,800. Employer benefits included CPP of $801 and El of $363. 31 Remitted 55,800 H5T pertaining to sales tax collected in February, Record the above transactions. (Recond joumal entries in the order presented in the problen. Credit account titles are automotically indented when the amount is entered. Do not indent manuolly List all debit entries before credit entries. Round answers to O decimal places, eg 5,275) at 10 assignment (Current Liabilities) - due 24 hours before the exam Question 1 of 1 120i (To recond sales) (To record cost of godds sald) Thapter 10 assignment (Current Liabilities) - due 24 hours before the exam Question 1 of 1 -120 E 1 Eld record payroil and emglowe deductiamin) Question 1 of 1 120 (To record payroll and employee deductions) (To record employee benefits) efextbook and Media List of Accounts