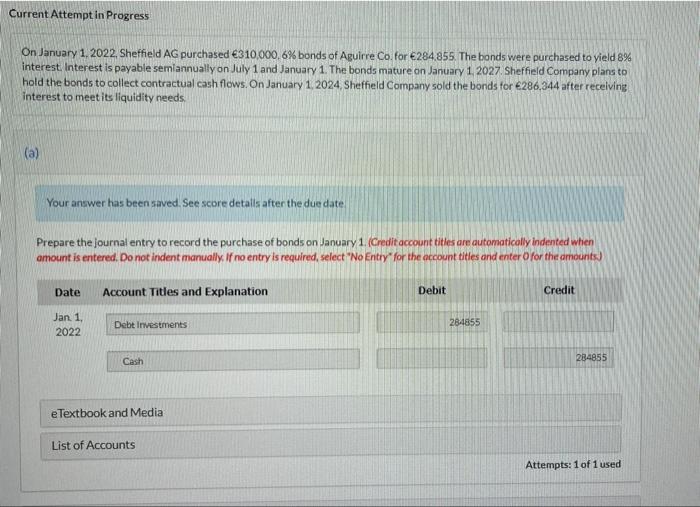

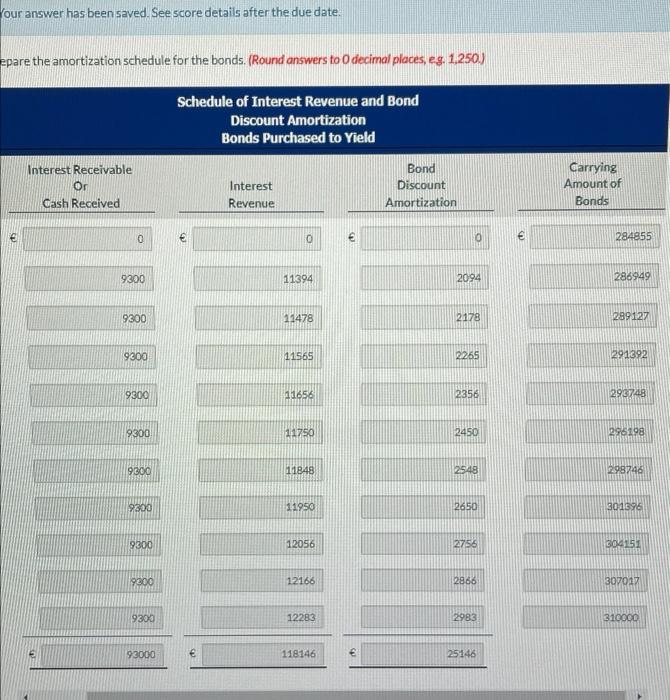

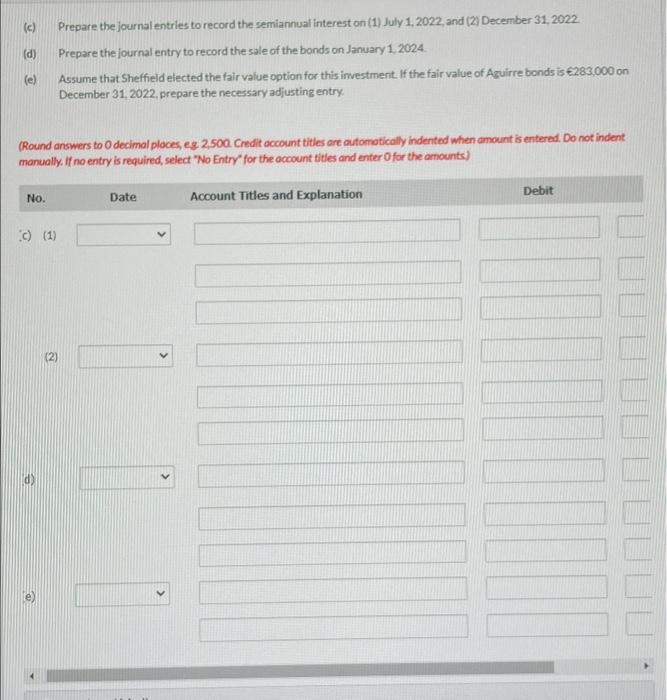

Current Attempt in Progress On January 1, 2022, Sheffield AG purchased 310,000,6% bonds of Aguirre Co.for 284.855. The bonds were purchased to yield 8% interest. Interest is payable semiannually on July 1 and January 1. The bonds mature on January 1, 2027. Sheffield Company plans to hold the bonds to collect contractual cash flows. On January 1, 2024, Sheffield Company sold the bonds for 286,344 after receiving interest to meet its liquidity needs (a) Your answer has been saved. See score details after the due date Prepare the journal entry to record the purchase of bonds on January 1. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter for the amounts.) Date Account Titles and Explanation Debit Credit Jan 1, 2022 Debt Investments 284855 Cash 284855 e Textbook and Media List of Accounts Attempts: 1 of 1 used our answer has been saved. See score details after the due date. epare the amortization schedule for the bonds. (Round answers to decimal places, eg. 1.250.) Schedule of Interest Revenue and Bond Discount Amortization Bonds Purchased to Yield Interest Receivable Or Cash Received Interest Revenue Bond Discount Amortization Carrying Amount of Bonds e 0 O 0 284855 9300 11394 2094 286949 9300 11478 2178 289127 9300 11565 2255 291392 9300 11656 2356 2931748 9300 11750 2450 296198 9300 111848 2548 298746 9300 11950 2650 301696 9300 12056 2756 CO251 9300 12166 2866 307017 9300 12283 2983 310000 93000 118146 25146 (c) (d) Prepare the journal entries to record the semiannual interest on (1) July 1, 2022, and (2) December 31, 2022 Prepare the journal entry to record the sale of the bonds on January 1, 2024 Assume that Sheffield elected the fair value option for this investment. If the fair value of Aguirre bonds is 283,000 on December 31, 2022, prepare the necessary adjusting entry (e) (Round answers to decimal places, es 2,500. Credit occount titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter for the amounts) No. Debit Date Account Titles and Explanation (1) (2)