Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Current Attempt in Progress On November 1 , 2 0 2 3 , Flint Corp. purchased 1 0 - year, 8 % , bonds with

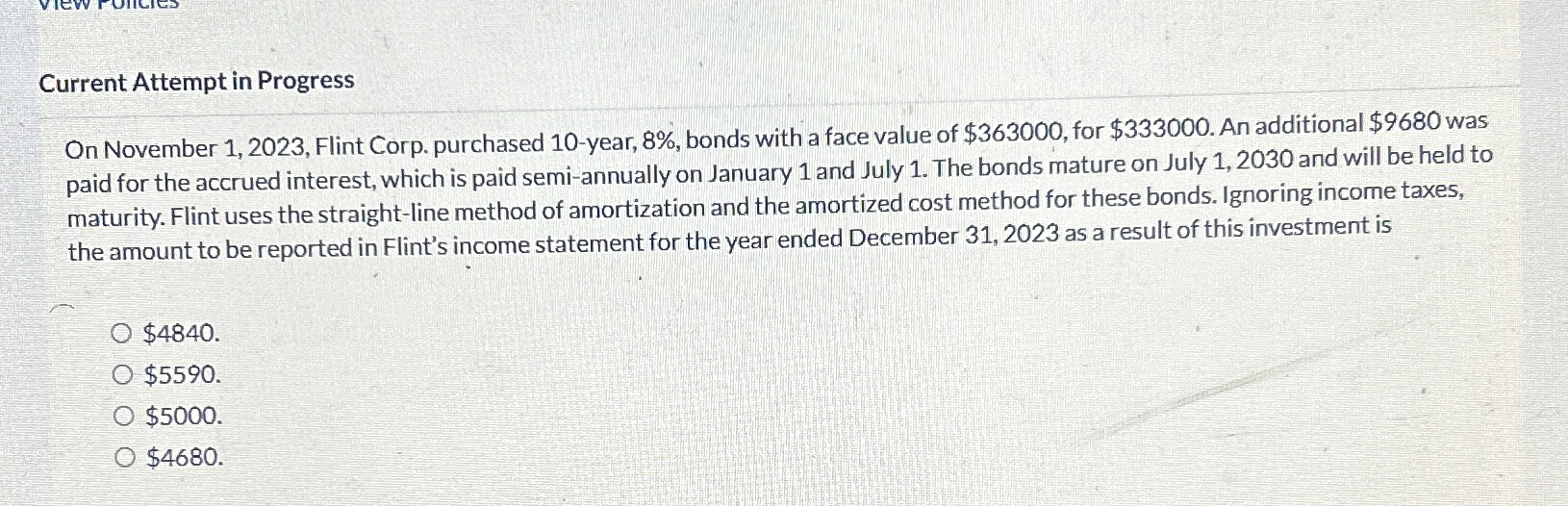

Current Attempt in Progress

On November Flint Corp. purchased year, bonds with a face value of $ for $ An additional $ was paid for the accrued interest, which is paid semiannually on January and July The bonds mature on July and will be held to maturity. Flint uses the straightline method of amortization and the amortized cost method for these bonds. Ignoring income taxes, the amount to be reported in Flint's income statement for the year ended December as a result of this investment is

$

$

$

$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started